In my earlier post on the economics of the viral Princeton Mom letter, I didn’t address another assertion of the writer: the suggestion that women cannot (or at least do not) pair off with younger men.

She wrote:

Here is another truth that you know, but nobody is talking about. As freshman women, you have four classes of men to choose from. Every year, you lose the men in the senior class, and you become older than the class of incoming freshman men. So, by the time you are a senior, you basically have only the men in your own class to choose from, and frankly, they now have four classes of women to choose from. Maybe you should have been a little nicer to these guys when you were freshmen?

I don’t have data about whether Princeton men, per se, are willing to marry older women, but there are national figures on the age gaps between heterosexual spouses.

Source: U.S. Census Bureau, Current Population Survey, 2012 Annual Social and Economic Supplement.

Source: U.S. Census Bureau, Current Population Survey, 2012 Annual Social and Economic Supplement.

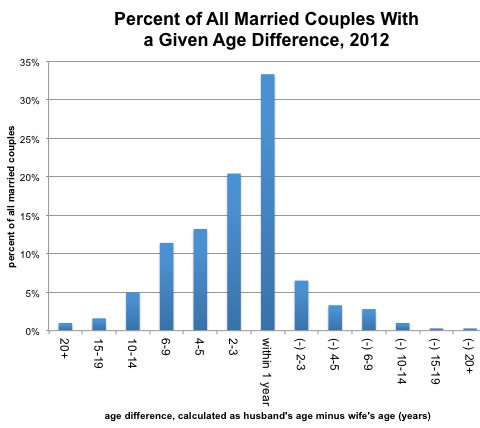

According to 2012 Census Bureau data, 85.9 percent of husbands are older than or about the same age as their wives. To break it down further, 52.6 percent of all husbands are at least two years older than their wives (based on their ages at the time of the survey, which could be less than a full 24-month difference).

Another 33.3 percent, a plurality, are within a year of the same age — meaning the wife could be older or the husband could be older, with that slim one-year margin of age difference. Assortative matching at work, once again.

That leaves 14.2 percent of all husbands who are at least two years younger than their wives.

At first blush, the distribution of those age gaps does not seem to have changed much since 1999, the earliest year for which I could find a directly comparable data table. (If you have access to earlier data, please let me know.) In 1999, 12.3 percent of husbands were at least two years younger than their wives.

If norms have changed sharply from then to now, of course, they probably still would not make a big dent in the overall age-gap numbers, since a lot of couples who would have been married before 1999 are still around. Indeed, as we’ve noted before, the annual new-marriage rate has been falling in that time period, meaning that any new preferences that are emerging for newly married couples would show up in a shrinking share of the total married population.

Article source: http://economix.blogs.nytimes.com/2013/04/01/on-whether-women-can-or-do-marry-younger-men/?partner=rss&emc=rss