Yuya Shino/ReutersMasayoshi Son, the chief of SoftBank, the Japanese telecommunications company.

Yuya Shino/ReutersMasayoshi Son, the chief of SoftBank, the Japanese telecommunications company.

Earlier this month, Charles W. Ergen’s Dish Network made a bold bid to pre-empt Softbank’s $20 billion bid for Sprint Nextel with its own offer.

But SoftBank‘s outspoken chief executive, Masayoshi Son, said on Tuesday that his proposal would prevail — unmodified.

It is the first time that the Japanese telecommunications mogul has spoken out since Dish surprised many with a $25.5 billion offer for Sprint, the country’s third-biggest cellphone service provider.

Dish has said that its cash-and-stock bid for all of Sprint, valued at $7 a share, would create a new wireless titan whose phone, data and video services would rival those from Verizon Wireless and ATT.

For now, Mr. Son insists that his proposal, a two-step process that would leave 30 percent of Sprint publicly traded, is straightforward and can be closed by mid-July. (The first part of the process, in which SoftBank invested $3.1 billion in the American company to keep it afloat, has already been competed.)

“Charlie’s proposal does not provide any new cash into the company, and it provides heavy burden of debt,” Mr. Son said in a telephone interview. “I believe our deal will go through.”

Mr. Son insisted that he was not surprised by the arrival of Mr. Ergen, who has publicly amassed a cash hoard that many assumed would finance some sort of acquisition. Though Dish had already made a play for Clearwire, Mr. Son said he guessed that the satellite-TV company had even bigger ambitions.

“My guess was right,” he said.

He repeatedly attacked Dish’s bid as unworkable and his rival’s numbers as misleading. By his own reckoning, factoring in both cost savings and potential costs like delays, SoftBank’s offer was worth $7.65 a share, while Dish’s was valued at $6.31.

Chief among Mr. Son’s criticisms was the amount of debt that the interloping offer would pile on to Sprint, which he estimated at $50 billion. In a long presentation to SoftBank’s shareholders, Mr. Son argued that his proposal would increase Sprint’s debt by three times, while Dish’s would do so by nearly six times.

“It would be prohibitively high debt,” he said.

Dish has proudly trumpeted the amount of wireless spectrum the combined company would control, but Mr. Son said that the holdings would be wastefully excessive and expensive to maintain. And it would still require spending what he estimated was $6 billion to upgrade Sprint’s network.

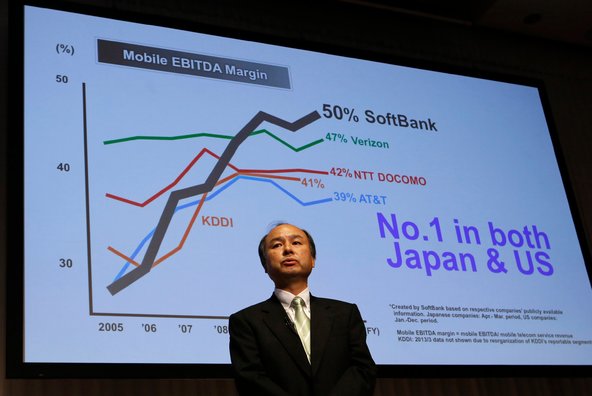

And Mr. Son contended that Mr. Ergen, a wily deal maker whose net worth Forbes estimates is more than $10 billion, is an amateur when it comes to the mobile industry. By contrast, he pointed repeatedly to SoftBank’s rise over the last seven years to become one of Japan’s three biggest wireless companies.

Still, much of SoftBank’s hopes are tied to Sprint’s bid to buy the remainder of Clearwire, an offer that has drawn significant shareholder opposition.

Mr. Son dismissed concerns about the proposal’s fate, saying that Sprint has not signaled any desire or need to raise its offer of $2.97 a share. The company can’t raise its bid without the blessing of its benefactor, SoftBank.

In the worst-case scenario, Sprint will raise its ownership in Clearwire to about 65 percent from 50 percent through agreements to buy out partners in the company, including Intel and Brighthouse.

Speaking of dissident investors who think Sprint’s offer is too low, Mr. Son said, “They can stay as shareholders for however long they want. We are happy with just 65 percent.”

Article source: http://dealbook.nytimes.com/2013/04/30/softbank-chief-is-defiant-as-dish-challenges-his-bid-for-sprint/?partner=rss&emc=rss