CATHERINE RAMPELL

Dollars to doughnuts.

Last week I wrote about a new Pew Research Center report on the ailing middle class. Today, Pew has come out with a comparable report about the wealthy and how Americans feel about this upper-income class.

When respondents were asked how much a family of four would need to earn to be considered wealthy “in your area,” the median response was $150,000. The responses varied by geographic region, though, with people in the Northeast (where the cost of living is higher) giving a median response of $200,000.

The survey also included a pointed question about whether upper-income people pay their “fair share” in taxes. About 26 percent of respondents said they did, with another 8 percent saying the rich paid too much in taxes and 58 percent saying the rich paid too little.

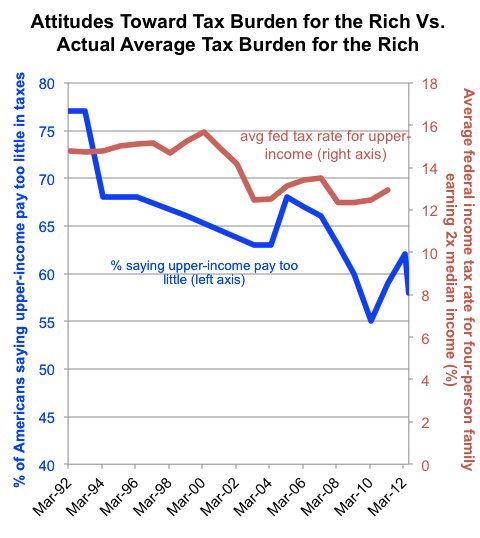

If that sounds like a lot of people complaining that the wealthy don’t contribute enough to Uncle Sam, note that Americans’ attitudes toward the tax obligation of the rich have become much less demanding over the last two decades.

When this question was first asked by Gallup, in March 1992, 77 percent of respondents said upper-income Americans paid too little in taxes. Yet the average income tax burden of the wealthy was actually higher then.

Sources: Pew Research Center, Tax Policy Center. The blue line, which shows the percent of Americans who say the upper-income pay too little in taxes, refers to the left-hand axis. Note that this axis does not start at zero to better show the change. The red line, which shows the average federal income tax rate for a family of four earning twice the median income, refers to the right-hand axis.

Sources: Pew Research Center, Tax Policy Center. The blue line, which shows the percent of Americans who say the upper-income pay too little in taxes, refers to the left-hand axis. Note that this axis does not start at zero to better show the change. The red line, which shows the average federal income tax rate for a family of four earning twice the median income, refers to the right-hand axis.

In 1992, when more than three-quarters of Americans said that rich people should be paying more, a family of four earning twice the median household income paid an average federal income tax rate of 14.79 percent, according to the Tax Policy Center.

As of 2011, the average tax burden for a family of four earning twice the median income (which came to $151,296) was 12.93 percent.

Over the same period, Americans have become much more demanding about how much the poor pay, however.

In 1992, 8 percent of Americans said lower-income people paid “too little” in taxes. Today that share has risen to 20 percent.

As with that of the wealthy, the tax burden of the poor has also fallen considerably in the last two decades; in 1992, a family earning half the median income paid an average tax rate of 4.55 percent, whereas last year a family in that position had a negative tax burden of 6.84 percent (that is, the family received money from the federal government equaling 6.84 percent of their income, thanks to refundable tax credits).

For whatever reason, Americans have become much less tolerant of lower tax rates for the poor than they have for the rich.

Addendum on methodology: Pew’s survey was done through telephone interviews conducted July 16-26, 2012, with a nationally representative sample of 2,508 adults ages 18 and older. The margin of sampling error is plus or minus 3 percentage points.

Article source: http://economix.blogs.nytimes.com/2012/08/27/wealth-taxes-and-public-opinion/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.