Think it’s expensive to buy a home in New York? Try moving to China.

Sources: International Monetary Fund, using CEIC Data; 8th Annual Demographia International Housing Affordability Survey; national statistical offices; and I.M.F. staff estimates. Note: Data for cities in mainland China (in red), Tokyo, and Singapore are calculated as the price of a 70-square-meter home divided by average annual pretax household income; data for other cities are the median house price divided by median pretax household income, as reported by Demographia.

Sources: International Monetary Fund, using CEIC Data; 8th Annual Demographia International Housing Affordability Survey; national statistical offices; and I.M.F. staff estimates. Note: Data for cities in mainland China (in red), Tokyo, and Singapore are calculated as the price of a 70-square-meter home divided by average annual pretax household income; data for other cities are the median house price divided by median pretax household income, as reported by Demographia.

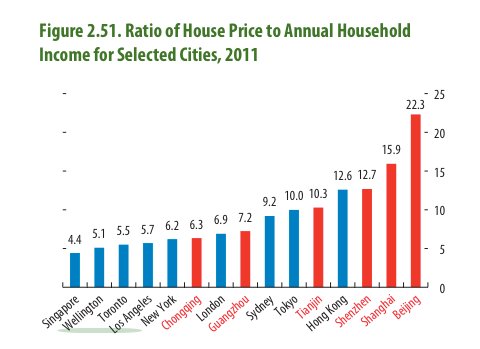

That chart comes from the International Monetary Fund (and was brought to my attention by Torsten Slok, the chief international economist at Deutsche Bank). It shows the ratio of house prices to annual household income: that is, how many years’ worth of income it would take to buy the typical house in a given city.

CATHERINE RAMPELL

Dollars to doughnuts.

As you can see, the median house price in New York was equal to 6.2 years’ worth of the median pretax household income in 2011. The most comparable data we have for an array of Chinese cities — shown in red above — suggests that homes in New York are a steal compared to those in urban parts of the Middle Kingdom.

The Chinese data (which use a slightly different metric: the price of a 70-square-meter home divided by average annual pretax household income) show that in Shanghai it would cost 15.9 times the typical household income to buy a standard home. In Beijing, the ratio is even higher, at 22.3.

Real estate prices are so high in China, Mr. Slok explains, because people have few options for parking their savings.

The savings rate is phenomenally high in China. The consumer banking sector, however, is not nearly as built out as those in most developed countries, partly because the Chinese government restricts entry of foreign service-providing companies like financial institutions. So people have been investing their savings in a local sector that has had big returns — real estate — chasing home prices ever higher.

I should note, by the way, that housing prices in China began to fall in 2011 as the government tried to curb speculative real estate investment. Home prices then picked up again in the middle of last year and continue to rise.

Article source: http://economix.blogs.nytimes.com/2013/01/25/a-place-that-makes-new-york-real-estate-look-cheap/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.