It is that time of the year again, when we award the Deal Professor A’s, the grade for the best deals and deal makers of 2011. Here are the highlights (with a few grades of F as well), in alphabetical order:

Attachmate Group/Novell. The $2.2 billion deal involved the innovative sale of certain Novell’s intellectual property assets to CPTN Holdings, a company organized by Microsoft and a number of other technology companies. The deal, along with Google’s $12.5 billion acquisition of Motorola Mobility, showed that technology companies were willing to pay dearly to acquire intellectual property assets. Deal makers were more than willing to leverage this desire.

Shuji Kajiyama/Associated PressWarren Buffett, chief of Berkshire Hathaway.

Shuji Kajiyama/Associated PressWarren Buffett, chief of Berkshire Hathaway.

Berkshire Hathaway/Lubrizol. Warren E. Buffett yet again shows that not only does he do deals fast, but that they usually fall into his lap like manna from heaven. Like Buffett targets of years past, Lubrizol seemed to be quite captivated by Mr. Buffett and willing to sell quickly. Mr. Buffett receives an A for showing not only his skill at capturing bargains, but navigating this deal through a scandal involving a former Berkshire executive, David Sokol.

Joshua Roberts/Bloomberg NewsDavid Rubenstein, co-founder of the Carlyle Group.

Joshua Roberts/Bloomberg NewsDavid Rubenstein, co-founder of the Carlyle Group.

Carlyle/Diversified Machine/Platinum Equity. The Carlyle Group bought this automotive supply manufacturer out of bankruptcy in 2005. During a six-year period, Carlyle increased the company’s revenue 4.5 times, and the company’s employee headcount went to more than 2,200 employees from about 525. Carlyle sold Diversified to Platinum for an undisclosed purchase price but was reportedly seeking about $400 million for the asset. Carlyle wins the inaugural Teddy Forstmann memorial private equity value creation award.

Caterpillar/Bucyrus International. Caterpillar wins a significant asset and just as important wins Chinese antitrust approval — after 143 days, almost two months after obtaining clearances from European Union and United States regulators. The deal underscores the increasing importance of Chinese antitrust clearance in global mergers and acquisitions.

Eric Piermont/Agence France-Presse — Getty ImagesRen Jianxin, chairman of China National Chemical Corporation.

Eric Piermont/Agence France-Presse — Getty ImagesRen Jianxin, chairman of China National Chemical Corporation.

ChemChina/Koors/Makhteshim. China National Chemical, or ChemChina, in partnership with Koor Industries of Israel buys 60 percent of an Israeli agricultural chemical company, Makhteshim. The deal valued at $2.4 billion was one of the largest outbound investments by China ever, and showed that the country was on the prowl internationally for crucial suppliers. In light of American efforts to block many Chinese deals on national security grounds, Chinese money is being directed elsewhere.

China Fire and Security/Bain; China Security and Surveillance/GuoshenTu; Funtalk China Holdings/Insider-Led Consortium; Harbin Electric/Tianfu Yang and Abax Global.

Many a Chinese deal was hit by short-sellers who sought to bet on uncertainty over China and the accounting of its companies. None of these deals were pretty, but they all managed to get completed despite this turbulence, beginning a mini-wave of Chinese companies reversing United States market listings to go private.

Exco/Management Buyout. The independent directors of Exco Resources get an A for standing up to the chief executive, Doug Miller, who proposed a management buyout at $20.50 a share, later lowering it to an $18.50 offer consisting of $13.50 in cash and $5 in “minority interests” equity. Mr. Miller had previously taken the company private once before, and the board decided in July to reject his second effort. The Exco independent directors stand in marked contrast to boards like J.Crew’s, which failed to stand up to a chief executive’s effort to buy the company. Mr. Miller gets an F for trying the same old trick twice.

Frontier Oil/Holly. If you terminate your deal in 2003 and each side ends up suing each other, try again in 2011, this time reversing buyer and seller. This one gets the Elizabeth Taylor/Richard Burton optimism award.

Fundtech/S-1/GTCR/ACI. S1 and Fundtech had agreed to combine in a stock-for-stock merger valued at about $318 million. Each soon received its own unsolicited offer to be acquired. S1 and Fundtech terminated their deal, with S1 being acquired by ACI and Fundtech going to GTCR. The deals showed the rare ability of a bidder to top a stock-for-stock deal and not only disrupt it but end up on the winning end.

Scott Eells/Bloomberg NewsJames Gorman, chief of Morgan Stanley.

Scott Eells/Bloomberg NewsJames Gorman, chief of Morgan Stanley.

Groupon I.P.O. It is all about perspective. The investment bankers, led by Morgan Stanley, get an A for pushing through an initial public offering at a high price despite all the turbulence. But F’s abound here also, including to Groupon itself for its iffy accounting and to its chief executive, Andrew Mason, for nearly torpedoing the I.P.O. by appearing to violate Securities and Exchange Commission rules requiring a company to be quiet just before its initial public offering.

Tim Boyle/Bloomberg NewsScott L. Thompson, chief of Dollar Thrifty.

Tim Boyle/Bloomberg NewsScott L. Thompson, chief of Dollar Thrifty.

Hertz/Avis/Dollar Thrifty. In a deal hung over from 2010, Dollar Thrifty shareholders reaped the benefit of saying no to Hertz even after a second broken auction. Dollar Thrifty shares are now trading at about $69.86 after Hertz’s offer in the low $50s was voted down. Along with Airgas, whose shares are $79.65, well above the $70 a share offered by Air Products, these companies made the right decision compared with, say, Yahoo which spurned Microsoft’s advances in 2008. Avis, meanwhile, was able to scoop up Avis Europe at an attractive price by leveraging Avis Europe’s fears that if Avis completed a Dollar Thrifty deal, it would not have capacity or desire to do Avis Europe deal for a long time.

Lucas Jackson/ReutersJohn V. Faraci, chief of International Paper.

Lucas Jackson/ReutersJohn V. Faraci, chief of International Paper.

International Paper/Temple-Inland. International Paper shows that after Airgas, a hostile bid against a company with a staggered board and poison pill can succeed. You just need to act fast and pay a high price. It is just that easy.

iGate/Patni Computer Systems. iGate, an Indian-based outsourcing company, partnered with Apax Partners to acquire another Indian company, Patni, in a $1.2 billion deal. The acquisition was one of the largest leveraged buyouts in India ever, and one of the first to tap the high yield debt market in the United States.

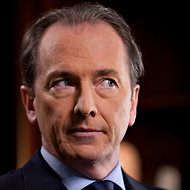

Andrew Harrer/Bloomberg NewsJim Davidson, co-chief of Silver Lake Partners.

Andrew Harrer/Bloomberg NewsJim Davidson, co-chief of Silver Lake Partners.

Microsoft/Silver Lake Partners/Skype. Silver Lake Partners turned an amazing profit by buying a 70 percent interest in Skype for $1.9 billion from eBay. Silver Lake flipped eBay’s orphan 18 months later to Microsoft for $8.5 billion. It remains to be seen if Microsoft will similarly profit, but the deal also allowed Microsoft to put its $42 billion foreign cash pile to work buying Skype, which is based in Luxembourg.

Jeff Chiu/Associated PressLarry Ellison, chief of Oracle.

Jeff Chiu/Associated PressLarry Ellison, chief of Oracle.

Oracle/Art Technology Group. Oracle wins the speed award for finishing this cash merger deal announced in 2010 in 63 days, a month earlier than usual. The deal would have closed even earlier but the Delaware Chancery Court enjoined the ART Technology special meeting for 14 days in order for ART Technologies to make additional disclosures. The deal shows that in some cases a merger can almost be as quick as a tender offer structure.

Ramius/Royalty Pharma/Cypress Bioscience. An activist hedge fund puts its money where its mouth is. Ramius Value Opportunity Advisors ends up teaming with Royal Pharma to buy Cypress for $255 million. The acquisition came after almost six months of back and forth started by Ramius making an offer to buy the entire company. The buyout group paid a 160 percent premium to Cyprus’s share price the day before Ramius first announced its offer.

Renaissance Learning/Permira. A private equity bidding war broke out between Permira and Plato Learning, a portfolio company of Thoma Bravo and HarbourVest, over Renaissance. But Renaissance’s co-founders, Terrance and Judith Paul, who owned 69 percent of Renaissance, refused to countenance a Plato bid. The result: Renaissance public shareholders lost out when Plato offered $18 a share to the public holders against a bid of $16.60 a share from Permira. The Pauls, in a rare case of charity by a controlling shareholders, took only $15 a share. The Pauls receive an A for their generosity in wanting to preserve Renaissance’s headquarters in Wisconsin. The lawyers on the deal (Godfrey Kahn and Sidley Austin for Renaissance and Skadden, Arps, Slate, Meagher Flom for Permira) also deserve an A for forcing through a clever structure intended to take advantage of Renaissance’s incorporation in Wisconsin and the unique laws there. For public shareholders however, this deal is an F.

Teva Pharmaceutical Industries/Cephalon. Teva made a quick strike to buy Cephalon for $6.8 billion after a hostile bidder, Valeant Pharmaceuticals, opened up the opportunity. Teva showed the value of opportunistic and quick action in deal-making, winning the Bruce Wasserstein “Dare to Be Great” award.

I wish you all the best in the new year. May it be a happy and healthy one.

Steven M. Davidoff, writing as The Deal Professor, is a commentator for DealBook on the world of mergers and acquisitions.

Article source: http://feeds.nytimes.com/click.phdo?i=d53aef55f1e764ebf999c6e485e75e6b

Speak Your Mind

You must be logged in to post a comment.