“I don’t expect a comprehensive deal whatsoever,” said Ruan Zongze, the executive vice president of the China Institute of International Studies, which is the policy research arm of China’s Foreign Ministry. “I think there is a lot of game playing here.”

Beijing is frustrated with Mr. Trump’s threats to impose tariffs on $150 billion in Chinese goods and dismayed by suggestions in the West that China has a weak bargaining position. Chinese officials think the country’s one-party political system and President Xi Jinping’s enduring grip on power — particularly after the repeal of presidential term limits in March — mean that China can outlast the United States and Mr. Trump in any trade quarrel.

The Chinese government believes Mr. Trump’s background as a businessman means that at some point he will agree to a deal. Seminar participants also reaffirmed previous Chinese trade policy offers to further open the country’s financial and automotive sectors, though not in ways that would impact China’s industrial modernization program, called Made in China 2025. They also suggested that China would be willing to tighten its intellectual property rules so as to foster innovation within China as well as protect foreign technologies from counterfeiting and other illegal copying.

China is insisting that the parameters of any negotiations be limited, and that the tariff threat be removed before a final deal can be struck.

Chinese officials have reached out to Treasury Secretary Steven Mnuchin, who has reacted positively to China’s overtures in the auto and financial sectors. Mr. Mnuchin, a former Goldman Sachs executive who will be on the Trump administration’s team in Beijing later this week, has sought to calm investors worried that the rhetoric between Washington and Beijing could break out into a full-blown trade war.

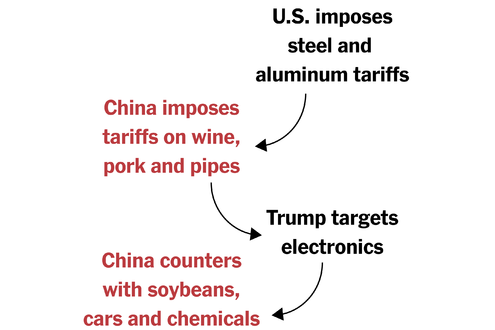

The U.S.-China Trade Conflict: How We Got to This Point

American companies want a level playing field with their Chinese counterparts. China wants to build its industries into sophisticated global competitors. This week, both countries demonstrated a willingness to escalate trade tensions to defend their positions.

China’s position is that the bilateral trade imbalance arises from differences in savings rates. Households in China save roughly two-fifths of their income. Americans, on average, save almost nothing. So money from China tends to flow to the United States, buying factories, technology companies, real estate and more, and Americans in turn spend much of that money to buy goods from China. Many economists in the United States, including some at the Treasury, share that view.

By contrast, many trade lawyers, lawmakers on both sides of the aisle and Mr. Trump contend that the trade deficit stems to a large extent from unfair practices, including cheap loans by state-controlled banks to exporters.

Advertisement

Continue reading the main story

China is ready to discuss shrinking the $375 billion annual trade deficit. But it wants to do so by buying more high-tech American goods. Washington has long blocked such deals because of concerns that they may have military value. China is also willing to buy more oil, natural gas, coal and other goods from the United States, and to help finance the extra pipelines and other infrastructure that would be needed to move them to China.

A senior Chinese government official said that Beijing is unwilling to negotiate with the United States on any curbs on Made in China 2025, which includes large-scale government assistance to favored industries in advanced-technology manufacturing. China perceives the American demands as an attempt to stop China’s economic development and technological progress, the senior Chinese official said.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

Germany and other countries also have industrial policies, and the United States has not objected to them, he added. American and European officials have argued that those policies elsewhere are much narrower and less ambitious.

Other advisers and officials said that the United States had misunderstood the Made in China 2025 industrial policy. They expressed hope that it might be possible to resolve differences by explaining the program better and making very small tweaks to it — a stance that still may not appease the Trump administration.

The Chinese government is not simply throwing money, land and other resources to favored industries like robotics, artificial intelligence, semiconductors and aircraft manufacturing, they said. China is engaged instead, they contended, in a carefully thought-out program that measures potential profits for each dollar of investment. So China’s program bears some resemblance, they said, to private sector investment programs in the West.

One subject was repeatedly and conspicuously avoided by all officials throughout the seminar, even when advisers occasionally speculated about it: whether China might someday try to link trade disputes to national security issues.

China has been deeply involved in international pressure on North Korea to give up its nuclear weapons and ballistic missiles, an issue of high importance to the Trump administration. Beijing also wants to someday assert control of Taiwan, a self-governing democracy that Beijing regards as a renegade territory.

Tsinghua University’s new Academic Center for Chinese Economic Practice and Thinking organized the seminar, which was held at Tsinghua and two other venues in western Beijing. President Xi graduated from Tsinghua, which is in Beijing and is China’s top university, and he has filled much of the senior ranks of his government with Tsinghua professors and graduates.

In some respects, the hard stance struck by Chinese officials reflects a hardening of public attitudes in China.

Advertisement

Continue reading the main story

In mid-April, the United States barred American companies from selling their wares to a Chinese telecom equipment maker, ZTE. The move is seen as potentially crippling to the Chinese company, which needs American chips and software to power the smartphones and equipment it sells around the world.

Washington officials cited ZTE’s repeated violations of sanctions against Iran and North Korea, but many in China saw it as a reminder by the United States that sizable sectors of the Chinese economy still rely on American-made goods. Much of the Made in China 2025 policy is aimed at reducing that dependence.

The ZTE case “has changed a lot of Chinese people’s opinion,” said Mr. Ruan, of the China Institute of International Studies. “In the past, people saw us as interdependent.”

Continue reading the main story

Article source: https://www.nytimes.com/2018/04/30/business/china-trump-trade-talks.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.