Casey B. Mulligan is an economics professor at the University of Chicago. He is the author of “The Redistribution Recession: How Labor Market Distortions Contracted the Economy.”

The “earned income tax credit” is, ironically, more likely to be received by unemployed people than by workers who do not spend any time unemployed.

Today’s Economist

Perspectives from expert contributors.

The credit was created years ago to reduce tax burdens on the poor and to “provide a genuine incentive for working;” a household must have some wage and salary income in order to receive the credit.

However, because the credit is administered on a calendar-year basis and is phased out with calendar-year wages and salaries, it is disproportionately received by people unemployed after a layoff.

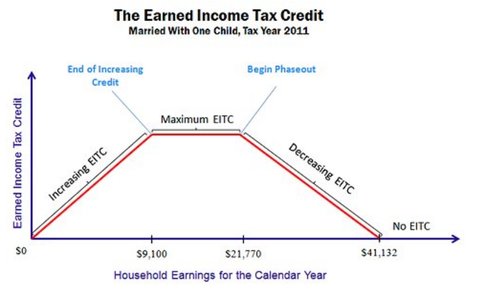

As I illustrated in an earlier post, the credit follows a mountain-plateau pattern: an increasing portion for the lowest calendar incomes, a flat portion, a decreasing portion and then a flat portion of zero.

Internal Revenue Service

Internal Revenue Service

You might think that unemployed people do not receive the credit because they do not have any wage or salary income, but typically people unemployed from layoff do have wages or salary income during the calendar year of their unemployment from their previous job. Their layoff might have occurred after the beginning of the calendar year. Even a layoff occurring in December of the previous year might generate wage and salary income in the current year because of a severance payment or accumulated sick and vacation pay.

Moreover, an unemployed person might have a spouse with wage and salary income, and the spouse’s income counts toward the credit.

Because unemployment compensation is supposed to be reported on the recipient’s federal individual income tax return, I was able to further investigate this issue by examining a large sample of individual income tax returns for the years 2000-07 provided by the Internal Revenue Service to the National Bureau of Economic Research and other institutions for research purposes.

In 2007, 97 percent of the 7.6 million returns showing unemployment-compensation income (that is, the taxpayer or spouse was unemployed and receiving benefits some time during the calendar year) also had wage and salary income during the year. That percentage was essentially the same in each of the years 2000-06.

Of the same 7.6 million returns with unemployment income in 2007, one quarter received the earned income tax credit. By comparison, the credit was received by only one-sixth of the returns with wage and salary income but no unemployment income.

Among returns with unemployment income, the average earned income tax credit was $486, compared with $347 among the returns with wages but not unemployment income.

For most of the returns with both unemployment income and the earned income tax credit, the credit would have been even greater if the taxpayer had been employed fewer weeks than he or she actually was. Still more returns with unemployment income but no earned income tax credit would have received the credit if the unemployment had lasted longer.

This situation occurs so often because unemployment benefits are based on a person’s weekly work situation while the earned income credit is based on a household’s annual wages and salaries, and because weekly unemployment benefits by themselves are usually less than weekly wages and salaries.

The earned income tax credit is thus a good example of how a so-called tax credit can act like a tax from a working person’s point of view.

Article source: http://economix.blogs.nytimes.com/2013/02/06/earned-income-ironies/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.