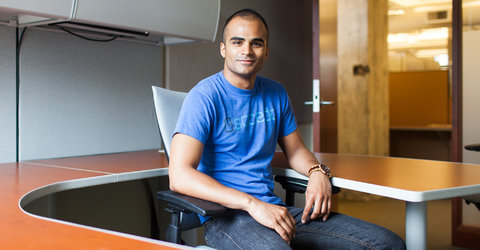

Matthew Staver for The New York Times Saul Garlick: Looking for a sustainable business model.

Matthew Staver for The New York Times Saul Garlick: Looking for a sustainable business model.

Case Study

What would you do with this business?

We just published a case study about a young entrepreneur, Saul Garlick, who is debating which business model to adopt for his social enterprise, ThinkImpact.

In high school, Mr. Garlick started a nonprofit organization called Student Movement for Real Change. By the age of 23, he had graduated from college, and the nonprofit had evolved with a new name, a new mission and a small team of employees. The organization, ThinkImpact, was coordinating trips for young adults to go to South Africa where they gained firsthand experience developing community projects and social businesses. But as the nonprofit grew, Mr. Garlick felt overwhelmed by financial burdens. Rather than focusing on the operations, he spent the bulk of his workweek connecting with potential donors and trying to raise money.

As a result, he is debating whether he should keep ThinkImpact a nonprofit that is dependent on donors or transform it into a commercial organization — or possibly some sort of hybrid that combines both.

Staying a nonprofit would mean Mr. Garlick would have to continue his constant fund-raising. On the other hand, converting to a commercial business would give Mr. Garlick a blank slate. He would gain the ability to take on debt, raise equity and build a sustainable business model. But it would also mean rebranding the organization, which can be tricky. Would other individuals and organizations be as responsive to ThinkImpact if it were in business to make a profit?

As a hybrid, the organization might keep its nonprofit status but develop a commercial offshoot. This way, the company could continue to apply for grants and take donations but also obtain debt capital. This would allow Mr. Garlick to ease off on fund-raising and build the business.

Below, you will find the recommendations of an academic and expert, a nonprofit executive and a social entrepreneur. Please read the case study and use the comment section below to tell us whether you agree or disagree with their advice — and to offer your own suggestions for Mr. Garlick. Next week, we will publish a follow-up.

Pamela Hartigan, director of the Skoll Centre at the University of Oxford, England, said, “ThinkImpact has to get itself off the treadmill of donor dependency and create a revenue stream through a fee-for-service approach. This does not mean morphing into — or separately setting up — a for-profit venture. After all, ‘nonprofit’ is not synonymous with ‘no revenue.’”

Jonathan C. Lewis, founder of MicroCredit Enterprises, which converted from a commercial business to a nonprofit, said, “The distinction between nonprofit and for-profit in my estimation is overestimated. The test should be what works in any given situation.” In the case of ThinkImpact, Mr. Lewis said he would recommend starting a new commercial company because it would “allow ThinkImpact to grow at its own pace, based on revenues, while avoiding donor fickleness.”

Shivani Siroya, founder and chief executive of InVenture, a mobile technology social enterprise that incorporates both structures, said, “Neither entity type constrains their efforts to earn revenue. As a nonprofit they can earn revenue and bring in donor funds that can additionally support their work until they become sustainable or potentially support the work that they may not earn revenue from. I think deciding to be a nonprofit is more about marketing and the way that you discuss your work with the public and your supporters.”

What do you think?

Article source: http://boss.blogs.nytimes.com/2013/07/10/should-a-social-enterprise-go-for-profits/?partner=rss&emc=rss