Carl Richards

Carl Richards

Carl Richards is a financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

First, congratulations! You’ve just won more money than most of us could ever imagine.

And you’re probably thinking that your financial problems are over. That’s true – as long as you avoid costly mistakes.

Let’s be clear: Your financial life is no longer about spreadsheets and managing money. Now it’s about managing behavior.

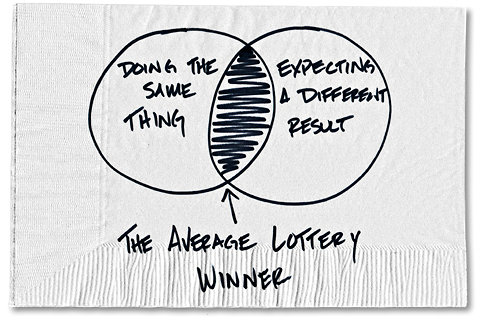

You see, I have a pretty good idea of what will happen to you. It’s not a secret. On average, 90 percent of lottery winners go through their winnings in five years or less.

And I know there’s a temptation to think you’re different from everyone else. All those other lottery winners? They were foolish.

Which brings us to the first mistake you need to avoid: Overconfidence.

Think about what happens when you ask a room full of men how many of them believe they are above-average drivers. You’ll probably see over 60 percent of the hands go up. It’s just not possible for 60 percent of the men in a room to be above-average drivers, unless you’re at a Nascar convention.

Recognize that there’s a high probability that your life after winning the lottery will turn out like other average lottery winners. You will indeed be broke and back at work within five years, unless you do something different.

So what can you do differently?

After splitting this particular jackpot between two winners and accounting for a generous estimate of federal and state taxes, let’s say you end up with around $55 million each.

Go ahead and do anything you want with $5 million of that. Want to pay off debts or take trips? Fine. Want to invest in your brother-in-law’s “sure thing?” Go for it. Or, maybe you want to start your own business. It requires some capital and might also be a little risky. Don’t worry about it.

But take that other $50 million and put it in good, safe investments and spend only the interest. Let’s say, hypothetically, you earn only 1 percent a year on those investments — you’ll still have $500,000 a year before taxes to spend for the rest of your life. And the money will still be there for your children and their children (if you’ve also taught them how to behave).

You’re going to be tempted to do crazy or even stupid things with that money. That’s why you have to put something in place to make sure you stick to that commitment. Maybe you can have a lawyer or a financial adviser put that money into something like a blind trust. The goal is to put one or two steps between you and your ability to spend the principal.

Another idea is to find someone you trust, like that lawyer, financial adviser or even just a committee of three of your best friends. Then make a commitment that you’ll talk to them before ever touching the money.

One idea I like a lot: Write a letter to yourself or record a video that describes how much you love your life now and how you never want to go back to work again. Tell yourself that you’re going to be different than all those other lottery winners. Then, put that video or letter some place safe and pull it out at least once a year, or anytime you think about spending the money.

With these guardrails in place, you’re increasing your odds that you don’t become like the other lottery winners who blew through their money. It’s pretty simple, really. You’ve got to put something between you and stupid.

And this advice doesn’t just apply to lottery winners. The rules apply to anyone with sudden money, like people who receive an inheritance, sell a business or even get a tax refund they didn’t expect. Think about your latest windfall. Can you even remember where it went?

Probably not. In fact, there’s actually research that says we tend to spend a windfall more than once. Need a new television? Hey, we’ll spend the tax refund. Need a vacation? That tax refund will help cover it!

It’s easy to make too big a deal of windfalls, regardless of their size. But when we receive any sort of unexpected money, we’ve got to put something in place to control our behavior and make sure we don’t lose that money.

So again, congratulations on your new wealth. If you can manage your behavior, you won’t have to worry about managing money ever again.

Article source: http://bucks.blogs.nytimes.com/2012/12/03/a-financial-plan-for-misbehaving-lottery-winners/?partner=rss&emc=rss