Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

On Dec. 3, the Government Accountability Office released new estimates of the federal government’s long-term budget outlook. They show that our real long-term problem is quite different from the one constantly portrayed by congressional Republicans.

Today’s Economist

Perspectives from expert contributors.

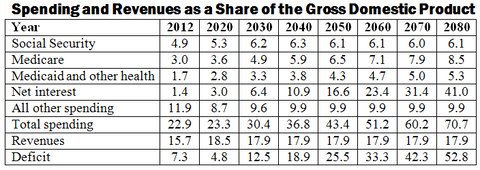

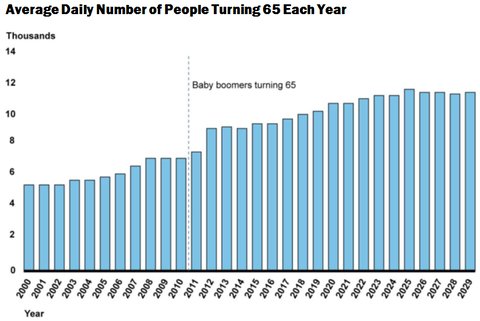

As the table shows, spending is not out of control. Entitlement programs like Social Security and Medicare are rising gently as the baby-boom generation retires. All other spending, including that for the military and domestic discretionary programs, falls – with the notable exception of interest on the debt. Interest rises sharply as the deficit rises, principally because the G.A.O. assumes that revenue will not be permitted to rise above its historical average – as Republicans continually insist.

Government Accountability Office

Government Accountability Office

Government Accountability Office analysis of Census Bureau data

Government Accountability Office analysis of Census Bureau data

Republicans demand that Social Security and Medicare be cut immediately to deal with the so-called fiscal cliff. Popular suggestions for doing so include raising the age of eligibility for Medicare and changing the indexing formula that adjusts Social Security benefits for inflation.

To be sure, some restraint is needed in federal entitlement programs. But the idea that we are facing a crisis is complete nonsense. Spending for Social Security, in particular, is very stable. Relatively modest changes, such as raising the taxable earnings base slightly, would be sufficient to put the program on a sound footing virtually forever.

As a Nov. 28 Congressional Research Service report explains, historically 90 percent of covered earnings was subject to the Social Security tax. In recent years, this percentage has fallen to 84 percent, as the bulk of wage gains has gone to those making more than the maximum taxable income, currently $110,100. Raising the share of covered earnings back to 90 percent would be sufficient to eliminate almost half of Social Security’s long-run actuarial deficit, according to the Social Security actuaries.

Frequently, Republicans assert that domestic discretionary spending is the major source of bloated government. These are basically all programs other than entitlements and interest on the debt outside the Department of Defense, which always needs more money in the Republican world view. These include agriculture, education, energy, science, law enforcement and many other programs that people take for granted and oppose reducing. Moreover, such programs have already been cut sharply by the Budget Control Act of 2011.

That leaves interest on the debt as the principal driver of long-term spending and deficits. As the G.A.O. projections show, net interest rises from 1.4 percent of gross domestic product this year to 3 percent in 2020, 4.9 percent in 2030 and continues rising astronomically thereafter as interest accrues on the bonds previously sold to pay interest on the debt.

Interest rises from 6.1 percent of the federal budget in 2012 to 12.9 percent in 2020, 21 percent in 2030 and eventually reaches 59 percent if current projections are maintained through 2082, the last year in the G.A.O. analysis. As a share of the deficit, interest would rise from 19.2 percent this year to 62 percent in 2020. In the long run, virtually all of the deficit is accounted for by interest on the debt.

These facts explain why the tax pledge that virtually all Republicans blindly support is ultimately self-defeating. Refusing to raise revenue automatically leads to higher spending for interest on the debt. However, Republicans routinely deny this, asserting that capping revenue at some arbitrary percentage of G.D.P. will somehow or other force huge cuts in spending that will prevent deficits from rising to inconceivable levels. Implicitly, they believe in a nonsensical theory called starve-the-beast that is totally refuted by the budgetary experience of the last 20 years.

The frightening thing is that the projections for interest on the debt assume that interest rates don’t rise in the near term and don’t rise at all even as the federal debt rises to 200 percent of G.D.P. in 2037 and to 885 percent of G.D.P. in 2082. The G.A.O. assumes that short-term rates on Treasury securities average 1.3 percent through 2017 and 3.7 percent in the long run, and rates on 10-year Treasuries will average 3.4 percent in the short-run and 5 percent in the long run.

These assumptions cannot be taken at face value. Federal borrowing of the magnitude projected would undoubtedly raise inflation and real interest rates, both of which would raise market interest rates far above those projected, sharply raising federal spending for interest. Rising inflation would also force the Federal Reserve to tighten monetary policy, which would also raise real rates.

In short, the G.A.O. projections are a best-case situation insofar as interest on the debt is concerned. It could get a lot worse very quickly, and at that point it is almost a certainty that taxes will rise far more than would be necessary to stabilize the debt-to-G.D.P. ratio and hence interest on the debt. Therefore, the absolutist position against raising revenue is essentially penny-wise and pound-foolish.

It’s too bad that misplaced fears about the fiscal cliff have taken off the table the option of simply letting all the automatic tax increases and spending cuts go into effect. While this would indeed reduce short-run growth, the Congressional Budget Office says the reduction in projected deficits would actually raise growth in the medium- and long-term (see pages 24-25 of the report).

Article source: http://economix.blogs.nytimes.com/2012/12/11/the-real-long-term-budget-challenge/?partner=rss&emc=rss