Even though Congress’s last-minute deal means higher taxes for almost all Americans, businesses and consumers are relieved that some of the uncertainty about what they will owe the government this year is gone.

“Once something gets settled, even if it’s not the most popular settlement option, it still gives you a sense of what the rules are and what you need to do to readjust,” said Sam Ramey, the owner of Sultan Mediterranean Cafe in North Andover, Mass., who says he hopes the deal will bolster the spirits of his customers.

“It’s not that you say ‘Today I’m not buying a sandwich because of all the uncertainty,’ but if you don’t feel that ease of mind that lets you go out and buy a sandwich, you don’t go out and buy a sandwich,” he said.

Congress’s compromise on taxes eliminates some uncertainty. But there’s no getting around the outcome that it will also reduce how much consumers have available to spend on dining out and other discretionary expenses.

Altogether, the end of the payroll tax holiday, the income tax increase on the wealthiest Americans and other provisions will probably shave 0.7 to 1.5 percentage points off economic growth in 2013, estimate many economists. They are forecasting growth in output this year of just over 2 percent, almost identical to that of 2012.

The housing rebound, the natural gas boom, looser credit for small businesses, pent-up demand for new cars and other encouraging trends will be tempered by the fiscal tightening, though not nearly as much as if taxes had risen as they were scheduled to do without a deal.

“We’ve definitely averted the worst-case recession scenario,” said Jay Feldman, an economist at Credit Suisse. “We’re still looking at some fiscal drag, but it’s an amount the economy can absorb.”

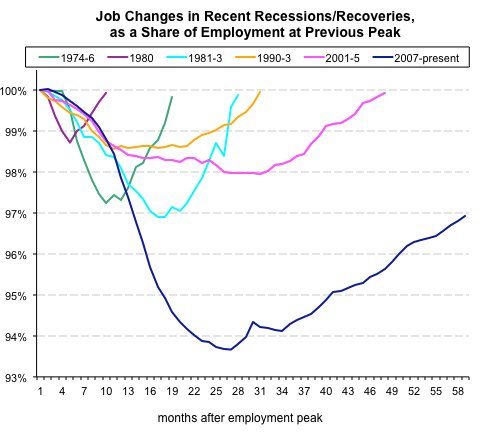

The tax deal is also expected to result in hiring growth at last year’s pace, meaning the creation of 150,000 to 160,000 payroll jobs a month, according to Michael Gapen, senior United States economist and asset allocation strategist at Barclays.

Without the tax increases, employers would probably be adding more than 200,000 jobs a month.

Altogether, that means the economy will “create 600,000 fewer jobs in 2013 — leaving the unemployment rate 0.4 percentage point higher — than it would have if the 2012 tax policies had been kept in place,” said Mark Zandi, chief economist at Moody’s Analytics.

Congress’s tax deal will be felt most keenly in the beginning of the year, since workers around the country immediately have to start paying an additional 2 percent in taxes on their wages and salaries as a result of the end of the temporary payroll tax holiday.

“That may surprise a lot of people as Christmas shopping bills come due and they find they have less in their paychecks,” said Mr. Feldman.

Most analysts’ estimates for the fiscal bargain’s effects on the economy do not take into account remaining negotiations over major spending cuts and an increase in the debt ceiling. Congress seems unlikely to resolve either of these issues until March.

“Only part of the poison pill that gave us the fiscal cliff has been addressed,” said Bernard Baumohl, chief global economist at the Economic Outlook Group. “What Congress did in the last 48 hours is effectively strap on a bungee cord to the economy. That is, we fell off the cliff briefly on Jan. 1, then bounced back safely onto the cliff after both houses passed tax accord.”

Congress decided to pause for two months on the $110 billion in mandated spending cuts set to take effect in 2013. These cuts would be evenly divided between defense and nondefense federal spending, and military contractors and other companies that rely heavily on federal money are expected to pull back some in the coming months, said Michael Feroli, the chief United States economist at JPMorgan Chase.

It remains unclear how much of these cuts will materialize when Congress is done haggling. Neither the Republicans nor the Democrats want them to take effect in full, a result that would shave around a half to a full percentage point off output growth this year.

The across-the-board reductions may be swapped out at least in part for other, unknown kinds of spending cuts or tax increases, which has left some Americans concerned about whether they might be in the cross hairs themselves.

Republicans have been pushing for a new formula that would curb Social Security benefits, for example.

“Hopefully Congress has at least some compassion left buried in their minds and hearts and will step up to the plate and make sure our benefits aren’t cut,” said Terry Grigg, 63, of San Diego. His only income is about $12,000 from Social Security and disability benefits while he undergoes treatments for invasive skin cancer and a hernia. “That would really be a slap in the face to the common man, to seniors, to vets.”

Medicare would be the primary target for cuts if Congress wanted to address the country’s long-term debt problems, many economists say. So far, though, most politicians have been reluctant to do so.

“From a political standpoint we’ve got this tax deal done,” said Steve Blitz, director and chief economist at ITG Investment Research. “Then we need to get this debt ceiling and spending piece done. And I think if we can get the second piece done, however minimal it ends up being, that allows the process to begin a serious discussion on the obvious: medical costs.”

Article source: http://www.nytimes.com/2013/01/03/business/after-tax-deal-economists-see-drag-on-growth.html?partner=rss&emc=rss