Before Ben S. Bernanke became chairman of the Federal Reserve, he served on the school board in Montgomery Township, N.J., as it debated whether to raise taxes to build schools.

Book Chat

Talking with authors about their work.

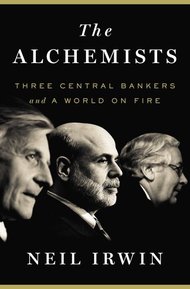

Steve Goldenberg Neil Irwin, author of “The Alchemists: Three Central Bankers and a World on Fire.”

Steve Goldenberg Neil Irwin, author of “The Alchemists: Three Central Bankers and a World on Fire.”

In “The Alchemists: Three Central Bankers and a World on Fire,” Neil Irwin, a columnist for The Washington Post, recounts that Mr. Bernanke, then a professor of economics at Princeton University, ultimately cast the tie-breaking vote in favor of raising taxes.

“Bernanke’s instincts were to side with the low tax group,” a former colleague, Dwight Jaffee, told The Washington Post, “but he would look at the numbers and make computations about whether it made sense to build new schools.”

“He really has faith in doing the numbers right and then living with them,” Mr. Jaffee said.

The book, a history of central bankers as firefighters, is sprinkled with similarly illuminating anecdotes about Mr. Bernanke and his crisis-years peers at the world’s major central banks, particularly Mervyn King of the Bank of England and Jean-Claude Trichet of the European Central Bank.

Mr. Irwin, a former colleague, breathes considerable life into the dry work of central banking. Indeed, the book is most convincing in making an argument that it does not quite make explicitly: that personalities and politics dictate central bank policy as much or more than economic theories.

Following is a condensed transcript of our recent e-mail exchange.

Americans generally view the financial crisis as a domestic event, and it’s already fading from memory. A central message of your book seems to be that it was primarily a European event, and it’s not over yet.

If history teaches one thing, it is that when a severe global financial panic sets in, it can easily bend and warp and metastasize. That’s how what we once quaintly called the subprime crisis came to have such varied effects as banking collapses in Iceland and Ireland and Cyprus, a lost decade for the British economy, and a series of events that nearly unraveled 60 years of progress toward a united and peaceful Europe. At its worst, those types of unpredictable domino effects can lead to some very bad places, of which the Great Depression and World War II are the prime examples. Fortunately nothing nearly that bad has happened this time. But as catastrophic as the 2008 experience was for the U.S. economy and millions of Americans, it was closer to the start of the crisis than the end.

You illustrate in striking detail that the Fed’s efforts during the crisis often were focused on Europe — a point that was little understood at the time in part because of the Fed’s intentional obfuscation. The efforts were necessary because the world runs on dollars. The obfuscation was necessary because the Fed has no mandate to help other countries. Do we need a different system to fight global crises?

On paper, the system of national central banks would seem to be ill-suited for addressing the crisis we faced, and have continued to face, for the last half-decade. In theory, Ben Bernanke is charged with maintaining stability for the U.S. economy, full stop, and what happens beyond our borders is only his concern if it redounds to affect the U.S. economy. But in practice, I found that the global central bankers have an extraordinary ability to think of themselves as part of the same team.

The most concrete example of that is the international swap lines that were first used on large scale in the fall of 2008 and repeatedly extended during acute phases of the European crisis. In simple terms, the Fed would give dollars to the E.C.B. or Swiss National Bank or Swedish Riksbank, and get euros or Swiss francs or Swedish kronor in return, with the transactions to be reversed at a fixed date. Those international central banks would then lend the dollars to banks in their countries, helping to prevent their financial systems from freezing up. At the peak these swap lines totaled $583 billion.

So why was the Fed so comfortable making such vast U.S. taxpayer resources available to the rest of the world? It is deeper than just the various legal guarantees that ensured the swap lines were virtually risk free for the Fed. It also has to do with the bonds formed over years of meals and seminars in Basel, Switzerland, and at various international gatherings. There is a deep-seated attitude of mutual trust.

Central bankers repeatedly underestimated the real-world impact of allowing financial firms to fail during the recent crisis. Mr. King let Northern Rock hit bottom; Mr. Bernanke threw up his hands as Lehman Brothers collapsed; Mr. Trichet made the same mistake several times over. Why was it so hard for central bankers to anticipate a lesson that seems so terribly obvious in retrospect?

After all the activism we’ve seen from the central banks these last few years, it’s easy to forget that these are economists schooled in how the free market ought to work. In most cases, the idea of using central bank resources to rescue banks that are failing due to their own errors violates their basic understanding of how things should be. Sometimes it has been that pro-market ideology that has driven their reluctance to act. Other times it is political constraints; central banks may be designed to be independent from politics, but that doesn’t mean politics don’t matter. For Mr. Bernanke, in the case of Lehman, the reality is that political will for bailouts had worn thin within the Bush administration (and there were no obvious policy tools to rescue Lehman). A central banker is always going to be more comfortable taking action at the outer limits of his authority if he knows political authorities have his back.

Which of the three men would make the best dinner companion?

No question: Mervyn King, the governor of the Bank of England. I am told he is a marvelous dinner companion, charming and erudite, with a twinkle in his eye and a dry wit.

You’ve written that you do not expect Mr. Bernanke to serve a third term as Fed chairman. Do you think he deserves one?

On merit, he has absolutely earned another four years; he has kept the U.S. and world economies from coming unglued. But I also think that central bankers or any high government officials serving for too long can be dangerous. I wonder how much of the Fed’s failure in the period before the crisis can be attributed to the sense that Alan Greenspan, who served for 17 years, was an all-powerful demigod who had mastered the art of managing the U.S. economy. We limit the president to eight years, the F.B.I. director (in theory) to 10 years, and the E.C.B. limits its president to eight years. Eight years for a Fed chairman seems about right to me.

You describe the efforts the financial industry made to secure a second term for Mr. Bernanke, including bank executives like Lloyd Blankfein and Jamie Dimon lobbying senators on his behalf. What should the public make of this relationship between banks and their primary regulator?

It is troubling. I have often found while reporting on financial regulatory issues that many of the strongest defenders of the Fed as an institution also happen to be the people who are paid to lobby for the banking sector. A variation of this seems to exist in many arenas where there is a deeply technical industry that requires intensive regulation, in areas like mining safety and regulation of nuclear plants. One way to make sure regulators are acting in the public’s interest rather than the interest of the regulated industry is to create a strong esprit de corps at the regulator, and the Fed is better at that than most agencies, with a high-functioning environment and maybe less of a revolving door than some places. But it’s far from ideal.

There is a powerful scene near the end of your book: people drinking on an Athens rooftop while neo-Nazis march through the streets below. Contrasting those two sides of Europe, you write that it is the work of central bankers “to bring back a world of economic possibility that would again suppress the ugliest instincts that lurk in the hearts of men.” In your view, where does that work now stand?

We’ve moved past the most intense phase of the crisis. The United States is not going to fall into depression. Europe will probably remain peaceful and united, though the human tragedy in Greece and Spain is already immense and I am less confident of its continued unity than I was before Cyprus flared up. The central bankers have succeeded at getting us past a set of profound threats to human well-being, for now at least. New ones will emerge, and they will be different from those of the past. How should the financial sector be regulated to restore prosperity without pumping up a series of bubbles? How should governments adjust to an epic demographic shift that will stress fiscal policy? How do the central banks disentangle themselves from years of intense activism to prop up economies and rescue banks and restore their place as behind-the-scenes technocrats rather than first responders? The crisis is over in a narrow sense, but the challenges for the central bankers are as great as they have ever been.

Article source: http://economix.blogs.nytimes.com/2013/04/04/politics-and-personalities-at-the-central-banks/?partner=rss&emc=rss