6:30 p.m. | Updated to include new data from a New York Times/CBS News poll.

CATHERINE RAMPELL

Dollars to doughnuts.

The much-anticipated May jobs report comes out Friday morning at 8:30, and economists are expecting more of the same: a gain of about 165,000 jobs — the same number added in April — and a flat unemployment rate of 7.5 percent.

Many economists have warned that there may be risks to the downside, though, given a steady stream of disappointing economic data over the last few weeks. The construction spending numbers, the Institute for Supply Management’s nonmanufacturing index and the ADP employment report all came in below expectations. Talk of a “spring swoon” is resurfacing.

“In general, the economy is just puttering along,” said Joshua Shapiro, chief United States economist with MFR Inc. “Companies can get by without hiring people, so they do. I don’t see any reason to break out of the pattern this month.”

Consumers themselves have been pretty upbeat nonetheless, according to recent polling data.

In a New York Times/CBS News poll conducted May 31-June 4, 39 percent of respondents said that the condition of the economy these days was very or fairly good, the highest share saying this both since President Obama took office and even since the recession officially began in December 2007. About a third of respondents said that the economy is getting better, similar to what the trend had been in the previous six months. (Another 24 percent saying it’s getting worse and 42 percent say it is staying about the same.)

Nearly half of respondents – 46 percent — rated the job market in their area as very or fairly good these days, with a third saying that they think their local job markets will improve over the next year. (The poll has a margin of sampling error of plus or minus 3 percentage points.)

Some of this optimism likely has to do with rising home and stock market values, which makes consumers feel wealthier. Given the positive outlook among consumers, it’s not clear what’s dragging on the economy and the job market, particularly given how well the housing market seems to be doing.

One explanation has to do with weird weather.

Usually a lot of economic activity slows down during the winter — when frigid, snowy weather makes it difficult to build, for example — then picks up in the spring, when the weather is more accommodating. (The organizations and agencies that release economic data usually adjust the numbers with these predictable patterns in mind.) This year, though, the country had a mild winter and a cold spring, which means some of the economic activity usually tied to spring-temperature weather happened earlier than usual, and some of it may occur later than usual. In addition, there was a lot of rebuilding over the winter as a result of Hurricane Sandy, which put construction workers to work earlier than usual.

“There’s hiring that took place when it wouldn’t normally take place,” Mr. Shapiro said. “There are all these construction workers who were already hired, and maybe they’re moving on to something different now, but that’s not being counted as a new job.”

All of this could make recent job numbers look weaker than they might otherwise be.

The across-the-board federal spending cuts that officially began on March 1 — known as the sequester — may also be hurting the private sector, although it is hard to tell how much.

“Any negative news is going to be blamed on the sequester, which I think is becoming a bit of an excuse at this point,” said Joseph A. LaVorgna, chief United States economist at Deutsche Bank. “It’s a factor, but it’s not as big as people believe it is.”

All the same, when the jobs report comes out on Friday, economists will be looking at changes in the federal employment numbers, as well as sectors like manufacturing and professional services, to see if they are being obviously affected by the spending cuts. Much of the effect will be hard to detect, particularly if people directly harmed by the sequester are furloughed rather than laid off.

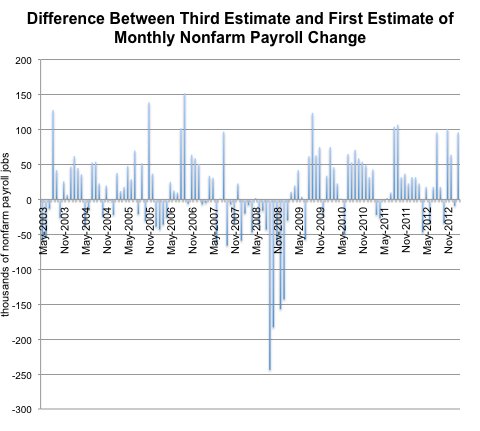

Another explanation for the weak string of economic data is that the numbers may be misleading — that they’re understating the “true” strength of the economy. That’s based on a pattern of revisions in recent months, particularly to the jobs report.

The first release of a month’s employment numbers, put out by the Bureau of Labor Statistics typically on the first Friday of the subsequent month, is an initial guess at what happened with hiring and firing, based on incomplete data. It gets the most attention, even though revisions to that initial estimate in the following two months, based on more complete data, can be significant.

For whatever reason, recent revisions have been very pro-cyclical: That is, when there were job losses, they turned out to be worse than initially estimated, and when there were job gains, they turned out to be much better than initially estimated. Whatever happened with employment, the initial release underestimated the change.

Here is a chart showing the difference between the third estimate (for example, the job change from February, as shown in a jobs report released in May) and the first estimate (the job change from February, as shown in a jobs report released in March):

Source: Bureau of Labor Statistics, via Haver Analytics

Source: Bureau of Labor Statistics, via Haver Analytics

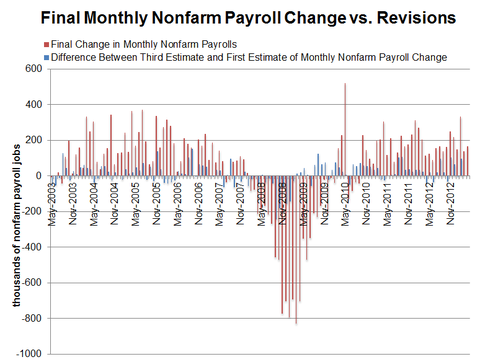

And here’s that same data series (the revisions) shown alongside what the change in payrolls was ultimately determined to be once all the data were in:

Source: Bureau of Labor Statistics, via Haver Analytics

Source: Bureau of Labor Statistics, via Haver Analytics

Economists are hopeful that the job changes from the last couple of months will likewise be revised upward, and that even if Friday’s number disappoints, that it will understate the real job growth in the economy.

Article source: http://economix.blogs.nytimes.com/2013/06/06/handicapping-mays-job-numbers/?partner=rss&emc=rss