Carl Richards

Carl Richards

Carl Richards is a financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

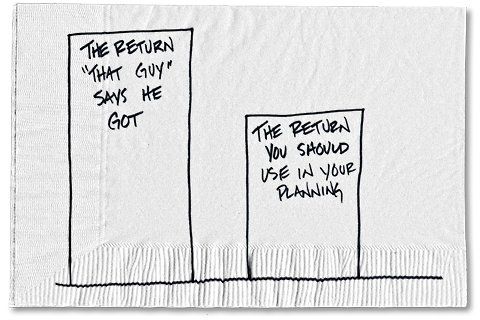

I’m sure I’m not alone in running into “that guy.”

You know, the guy who always seems to make the best investment decisions. I seem to run into him (and it’s almost always a “him”) everywhere: the neighborhood barbecue, the company party or even a family event. Maybe it’s your co-worker or your brother-in-law.

Based on the stories he tells you every time you run into him, making money in the stock market is easy. Picking the best mutual funds, easy! Beating the S.P. 500, easy! Then, in his oh-so-casual way, he says, “If I can do it, anyone can do it. It’s easy.”

These run-ins used to leave me with a sick feeling in my stomach. I wondered what I was doing wrong. How come that guy makes it sound so easy? How come his experience seems to be so different from mine? I must be missing something, right?

Here’s a perfect example of “that guy” in action.

Dave Ramsey recently answered a question about investing with this:

I recommend mutual funds because they always beat the S.P. … For example, take a mutual fund with a 25-year track record. Over the course of those 25 years if you can see that the mutual fund almost always beats the S.P., then that mutual fund contains stocks that are winning more than the overall market is winning.

At the end of his answer (it’s on the audio, but not reflected in the transcript), Mr. Ramsey concludes with, “But I’ve honestly done better” than 12 percent, “and I’m no rocket scientist.”

I think most of us hear 12 percent (Mr. Ramsey has mentioned this number before), and our jaws drop. Combined with his certainty (“always beat the S.P.”), it’s hard to square what he says with what the rest of us have experienced. We must be doing something wrong, right? (Mr. Ramsey’s public relations representative did not respond to messages seeking comment.)

When I asked the Reuters blogger Felix Salmon about all of this, he confirmed something similar among the people he knows:

In New York, there’s a huge class of people earning in the $200,000 to $500,000 range who have money, don’t feel rich, and — most importantly — have very rich friends. When I meet them, they invariably tell me about their very rich friends and how those very rich friends are always making the most amazing investments, selling all their stocks and going to gold right before the financial crisis, etc. etc. It really is a Thing.

So the next time you’re talking to “that guy,” remember that you aren’t alone. Other people feel the same way. In an effort to help you with that sick feeling in your stomach, here are a few of the facts.

1) Beating an index isn’t a financial goal

Getting a better return than your neighbor isn’t a financial goal either. I realize that this is not necessarily the goal of many financial gurus either. Still, it’s important to understand that a real financial goal is, say, sending your children to college or having enough money to retire.

Sure, getting the best return you can is a part (I’d argue a small part) of the equation. But remember that it’s possible to beat an index and still retire broke if you don’t focus on the things that really matter, such as how much you save, what you spend, how much you earn and having realistic goals.

2) Skill versus luck

If your conversations with “that guy” veer toward past performance, remember that you still need to determine if that mutual fund did well because of skill or luck. In other words, is the performance repeatable? And will it happen again once your money is in the fund?

Statistically, even if a fund beat the market average for 25 years we still can’t say with any degree of confidence it was because the manager was skillful versus lucky. Prof. Ken French at Dartmouth has already worked out these numbers. If you assume the fund beats the market by five percentage points per year, which is a huge number, and had volatility of 20 percent per year, you would still need 64 years of data before you could be confident the superior performance was because of something other than luck.

64 years!

The point is that finding skill in the world of mutual funds is almost impossible, and betting your retirement money on luck sounds like a bad idea to me.

3) Rear-view-mirror investing leads to accidents

Even though it seems logical, making investment decisions based on past performance doesn’t add up. In almost every other area — business, construction, medicine — past performance matters. But with investing, past performance tells us virtually nothing about future performance. At this point, it’s settled doctrine. The academics, regulatory agencies and most professionals agree: when it comes to investing, past performance has zero predictive value.

But for the sake of argument, let’s say there is some value in past performance. Most thoughtful people will not argue that it’s impossible for a mutual fund manager to outperform the market. The bigger question is this: How will you identify that manager in advance?

When you’re talking to “that guy,” be prepared to hear how much he thinks the past influences the future. Now you know better.

4) Reversion to the mean

I know this probably never happens to you, but I’ve found that just about the time I think I’ve identified the best investment, and I decide to buy it, it turns into the not-so-great investment.

It turns out there’s data to support this pattern. If we look at all mutual funds that have been around for 25 years (and they are rarer than you might think), 62 percent outperformed the SP 500 over the last 15 years. This (and the figures below) is according to Morningstar’s Principia database.

Keep in mind that, presumably, the only funds still around after 25 years are ones that have done well. So the 62 percent figure overstates the performance of all funds over time. We call this surviviorship bias.

Meanwhile, when we look at the last 10 years, that number plummets to 37 percent. And keep in mind that we’re including precious metal funds, bond funds, everything — not just stock funds.

Then consider what happens if we look only at funds in Morningstar’s large-blend category of stock mutual funds instead of all funds, as we did previously. Among those funds, only 47 percent beat the S.P. 500 over 15 years. And here’s the reality check: only 32 percent have done it over the last 10 years

The law of averages tells us there’s an increasing likelihood that if a fund has done well in the past, it’s less likely to do well in the future. At some point it’s going to revert back to the mean. So about the time you think you’ve identified the next hot manager, it’s about time for that manager to be the not-so-hot manager.

5) If it’s too good to be true, it often is

Beating 12 percent per year is incredible. People who can achieve those returns year in and year out should be running their own hedge fund. For perspective, consider that among large-cap blend stock mutual funds (funds that should use the S.P. 500 as a benchmark) with a 25-year record, not one had an annualized return of greater than 12 percent over the past 10 or 15 years.

When looking at all mutual funds with a 25-year history, there are only a few that have beaten 12 percent annualized over the last 10 years, and most of those are funds that invest primarily in precious metals. I suspect that 10 years ago most of us weren’t willing to bet our retirement money on mutual funds invested in precious metals, and I sure hope no one is doing that now.

The issue isn’t whether you’re hearing something like this from some self-styled investment guru or your brother-in-law. What does matter is that we need to have realistic investing expectations, and “that guy” rarely provides them. So while some people may claim to have no problem hitting 12 percent, I have yet to see an academic study or hear any planning professional suggest that 12 percent is a realistic number for building a plan.

To see what I’m talking about, let’s walk through two hypothetical examples and use the simple calculator found at Bloomberg.com. For this little experiment, we’ll focus only on the portion of your portfolio invested in stocks.

In one plan, let’s use 12 percent, and in the other let’s use 7 percent. Say you’re 25 years old, and you’re starting a savings plan with no money. Your goal is to have $2 million by the time you retire at 65.

So how much do you need to save? You could:

- Base your plan on 12 percent, which means you need to save $217 a month.

- Base your plan on 7 percent, which means you need to save $834 a month.

Do you understand the implications of these assumptions now? In this hypothetical world, you can assume 12 percent, and if you’re wrong, you’re in big trouble. On the other hand, if you take the more conservative approach and assume 7 percent on the portion you have in stocks, and you wake up 40 years from now having earned more than that, it’s fantastic.

That’s why this issue is so important. If you’re serious about your financial goals, you can’t afford to take “that guy” seriously. I wish there was a shortcut or some magic way to find the best investments, but the fact of the matter is that meeting your goals is about boring things like saving as much as you can, knowing not to chase after past performance and avoiding the pain of buying high and selling low. Counting on a high number like 12 percent takes your eye off those things that matter and over which you have some control.

Now, back to “that guy.” Over time, I’ve learned just to ignore those guys. I used to try to reason with them, but that is a waste of time. It’s a little bit like trying to have a logical conversation with a teenager.

So if you find yourself at a barbecue and “that guy” tries to start up a conversation about his investment prowess, maybe it’s time to excuse yourself and go see if the hamburgers are ready.

Article source: http://bucks.blogs.nytimes.com/2012/12/11/a-warning-about-that-guy-who-is-beating-the-market/?partner=rss&emc=rss