CATHERINE RAMPELL

Dollars to doughnuts.

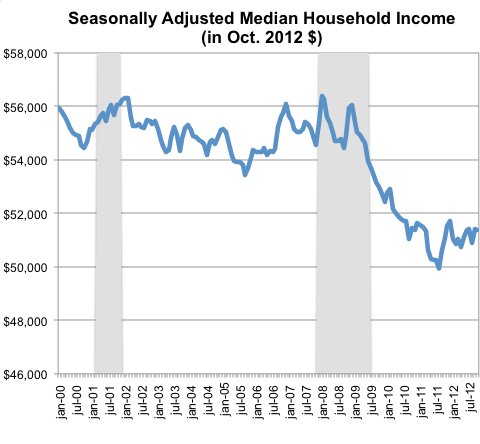

Inflation-adjusted median annual household income was more or less flat in October, stuck at $51,378.

That figure comes from Sentier Research’s analysis of the government’s Current Population Survey data, which is charted below. Gray areas indicate periods of official recession (which economists define as when the economy is actively shrinking, as opposed to growing).

Source: Sentier Research. Gray areas indicate period of economic contraction.

Source: Sentier Research. Gray areas indicate period of economic contraction.

Annual median household income has been circling around the $51,000 mark for about two years, even though the recession officially ended more than three years ago. In fact, October’s median household income measure was 4.7 percent lower than its counterpart of $53,937 in June 2009, the official end of the Great Recession. Labor market measures usually trail other economic indicators (like manufacturing orders or some other categories of business spending), but measures of the job market and workers’ incomes have been particularly atrocious in this recovery.

As you can see in the chart, incomes were relatively stagnant during the last expansion, too, indicating that flat living standards may have deeper causes than just the most recent business cycle.

Article source: http://economix.blogs.nytimes.com/2012/11/26/household-income-stagnates-again/?partner=rss&emc=rss