Casey B. Mulligan is an economics professor at the University of Chicago. He is the author of “The Redistribution Recession: How Labor Market Distortions Contracted the Economy.”

Even without employer penalties, part-time work will become more common next year and more expensive for taxpayers.

Today’s Economist

Perspectives from expert contributors.

Much attention has been paid to people without health insurance, but for the purposes of understanding the entire labor market we must acknowledge that the uninsured are a minority of the population. Most of the work force has health insurance through full-time employment or through a spouse’s employment.

Part-time employment rarely includes health benefits. The lack of health benefits and the lower pay for part-time work have traditionally discouraged people from taking part-time jobs rather than full-time jobs, but both of those attributes of part-time jobs are about to change.

Beginning next year, the Affordable Care Act will subsidize the health expenses for non-elderly families with income of 100 to 400 percent of the federal poverty line (about half of the non-elderly population has incomes in that range), but only if they are not offered health insurance through an employer. In other words, the new subsidies will not be available to most of those who do full-time work.

Because part-time workers will be eligible for the subsidies except in the rare instances in which their employer covers them, full-time work will no longer carry the advantage of access to health insurance. That by itself will encourage more people to seek part-time work.

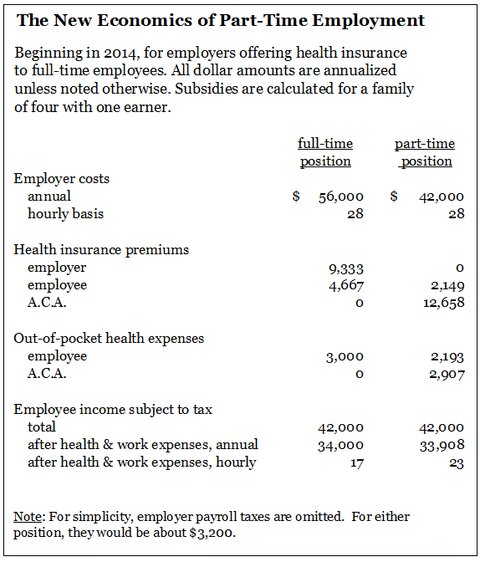

Moreover, the subsidies will many times be generous enough that workers can make as much money in a part-time position as in a full-time one. The table below illustrates what may happen.

The left column of the table shows the economics of a full-time position (40 hours a week). Between employer health insurance premiums and the employee paycheck, this position costs the employer $56,000 a year, or about $28 an hour. The full-time employee’s pay after his portion of health insurance premiums are withheld is $42,000.

Although covered by health insurance, the employee and his family incur $3,000 in additional health costs because of health insurance deductibles, co-payments and so on ($3,000 is typical for a family of four with a comprehensive health plan). The employee also has work expenses for commuting and child care, which I assume to be $100 a week when working full time.

The part-time column of the table shows a part-time position with the same employer cost per hour: $28. Because the position is part-time (only 30 hours a week), the annual employer cost is $42,000. All of the $42,000 consists of cash compensation for the employee, because the part-time position does not include health insurance.

The part-time employee has to pay for his own health insurance, but the new law limits his premiums to $2,149 (the new law pays the other $12,658 from the United States Treasury) and limits his out-of-pocket health costs to $2,193 (the new law pays the other $2,907; by design the new law increases deductibles and co-payments but uses subsidies to offset those increases for low- and middle-income families).

After work expenses ($75 a week for part-time employment) and health expenses, the part-time position pays $33,908: almost exactly the same as the full-time position’s $34,000.

By taking a part-time position, the employee can have comprehensive health insurance coverage and make almost the same money as he would in a full-time position. Thus the two traditional deterrents to part-time employment are disappearing. In effect, the new subsidies totaling almost $16,000 offset, from the point of view of employers and their employees, the loss of production that occurs from working 30 hours a week rather than 40.

None of the above relates to the employer penalties associated with the new law, because the employers covered by my example avoid the penalty by continuing to offer comprehensive insurance to full-time employees. Those penalties create yet another set of reasons that part-time employment will become more common next year.

Shifts from full-time to part-time work will be remarkably more attractive for employers and employees than they used to be, and taxpayers will be picking up the tab.

Article source: http://economix.blogs.nytimes.com/2013/07/03/the-new-economics-of-part-time-employment/?partner=rss&emc=rss