The across-the-board automatic federal budget cuts that began in March do not seem to be derailing the recovery so far, given that the job market over all has continued to grow. And certainly some of the scariest predictions about the sequester didn’t come true (partly because Congress stepped in to prevent their occurrence). But if you look closely at the data, the sequester still does seem to be affecting certain industries pretty badly.

CATHERINE RAMPELL

Dollars to doughnuts.

As my colleague Floyd Norris wrote, government payrolls have been shrinking for several years. Those declines were mostly driven by state and local layoffs at first; lately, the layoffs have gotten worse at the federal level. In the last four months, the federal government has laid off 40,000 workers. And that number doesn’t indicate the full extent to which the sequester has affected employment, as many government agencies have resorted to furloughs rather than full-blown layoffs.

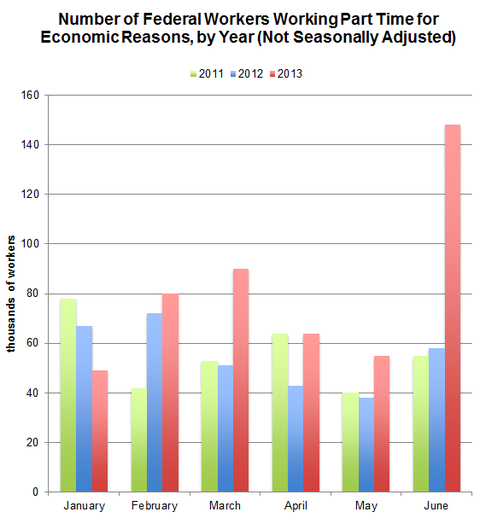

Below is a chart showing the numbers of federal workers who have been working “part time for economic reasons,” a term meaning they want to be working full time, but can’t get their employer to give them full-time hours. The numbers are not seasonally adjusted, so I’ve charted the trends for 2011, 2012 and 2013 to compare the level in a given month with its level exactly one year and two years earlier.

Source: Bureau of Labor Statistics, Current Population Survey

Source: Bureau of Labor Statistics, Current Population Survey

As you can see, there was a huge jump in the number of reluctant federal part-timers in June compared with the same month in 2011 and 2012. In June 2013, 148,000 federal workers were working part-time hours (defined as fewer than 35 hours a week) but wished they were working full time, compared with 58,000 in June 2012 and 55,000 in June 2011.

In fact, in every month starting in February, when agencies perhaps started preparing for the sequester, the number of reluctant federal part-timers has been higher than its level in 2012. In each of those months in 2013, the level has also been higher than in 2011, with the exception of April, when there were an equal number of federal part-timers for economic reasons in 2011 and 2013 (64,000).

And of course, these figures show only what’s happening with federal workers. There are plenty of private-sector workers whose jobs and hours depend on federal money, too, as I wrote in an article last week.

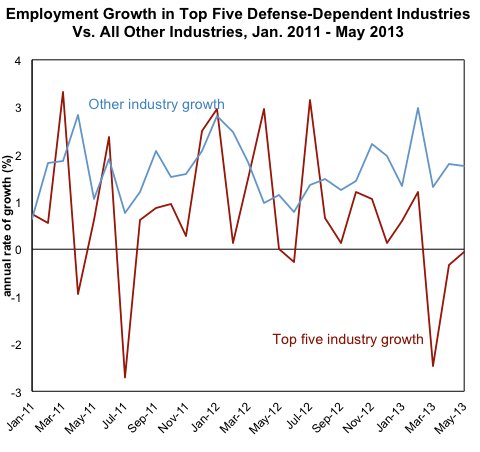

In that article, I calculated which industries were most reliant on federal defense money, based on Labor Department data showing where the Defense Department spends its money, and how money spent in any one sector affects employment in all the others (for example, employment of metal workers might rise when the government orders a new jet). The top five defense-sensitive industries are ship and boat building, facilities support services, aerospace product and parts manufacturing, scientific research and development services and electronic instruments manufacturing (which includes companies that make navigational instruments, for example).

Here’s a look at the monthly change in employment in these defense-sensitive industries, shown at an annualized percentage growth rate, versus all other industries:

Source: Bureau of Labor Statistics. Numbers are seasonally adjusted, and change is expressed at an annual rate. May is the most recent month for which seasonally adjusted data are available for the smaller defense-sensitive industries.

Source: Bureau of Labor Statistics. Numbers are seasonally adjusted, and change is expressed at an annual rate. May is the most recent month for which seasonally adjusted data are available for the smaller defense-sensitive industries.

As you can see, in the last few months, the defense-sensitive industries have been shedding jobs, while the rest of the country’s employers have been adding jobs over all. The trends for the previous months are noisy, but if you smooth them out, it looks as if the defense-sensitive industries and the other industries were both doing about equally well, with the exception of a huge downward spike in employment in the defense-sensitive industries around the time of the summer 2011 debt ceiling crisis.

Article source: http://economix.blogs.nytimes.com/2013/07/05/yes-the-sequester-is-affecting-the-job-market/?partner=rss&emc=rss