Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah. His new book, “The Behavior Gap,” was published this week, and we’ll be running excerpts all week long. Meanwhile, his sketches are archived here on the Bucks blog.

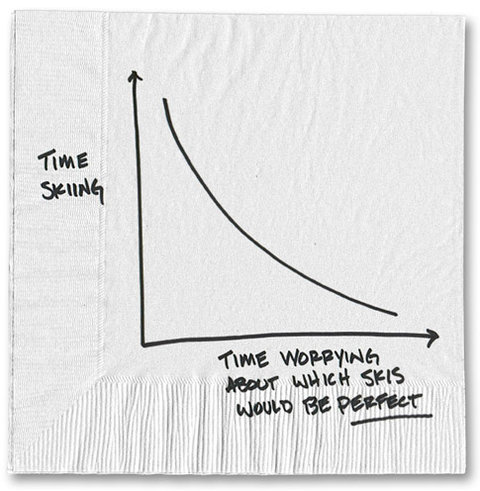

I live in Park City, Utah, where some of us take skiing pretty seriously. One morning some years back, a friend swung by my house to pick me up to go backcountry skiing.

I ran into the garage to grab my skis. I stood there for a second looking at my four different pairs of skis, each designed for particular conditions, and suddenly, I was paralyzed. I just couldn’t choose.

My friend sat in the car honking the horn — Let’s go, Carl! Move it! The sun’s coming up! The snow’s getting soft! — while I stared at those skis. It was ridiculous. I’d spent all that money and time and energy collecting these skis so I would be ready to deal with any situation — and now I just felt powerless.

That day was a turning point for me. I got rid of three pairs of skis, and kept my favorite pair: the ones that would let me do what I really care about doing, which is to move light and fast through the backcountry.

Patricia Wall/The New York Times

Patricia Wall/The New York Times

The skis I kept aren’t perfect in every condition. They’re actually a pretty bad solution in heavy snow or in really steep terrain. So what? They’re a decent compromise in most situations, and they work beautifully in the conditions I like best.

Now I don’t have to think about which skis to bring on a trip. I just grab the ones I have and go. I trust my experience and my instincts and my luck to make it through situations when my equipment isn’t perfect.

Lots of people think that to make good money decisions you need to have a plan for every situation. You need insurance for every possible setback and investments for every market condition. All of your assumptions about the future need to be refined to perfection, so that you will never be surprised. You need to know and understand everything about the financial markets, and you need to budget your spending to the last dime.

But that kind of thinking is based on fear.

We fear (naturally enough) life’s uncertainty, its ups and downs. And so we make plans that we hope will give us the power to control our future. If I do this, that will not happen; if I sell now, I will avoid the coming downturn; if I pick the right investments, I will be financially safe; if I worry enough, I will be ready when bad news comes.

Trouble is, the real world is complicated. We don’t know what’s going to happen.

That means that most of our plans are useless. When I had four pairs of skis, I was always choosing the wrong ones anyway!

The point is, no plan will cover every situation — and that’s O.K. You don’t have to choose the perfect investment or save exactly the right amount or predict your rate of return or spend hours watching television shows about the stock market or surfing the Internet for stock picks.

You don’t need a plan for every contingency.

Excerpted from The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money. Published by Portfolio/Penguin. Copyright Carl Richards, 2012.

Article source: http://feeds.nytimes.com/click.phdo?i=8efa6d45c01e056a3945fb83f9b93ecc