Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of the forthcoming book “The Benefit and the Burden.”

Last week, the Senate rejected proposals by both Democrats and Republicans to pay for an extension of the 2 percent temporary payroll tax cut enacted a year ago. The Democratic plan to finance it with a 3.25 percent surtax on millionaires garnered significantly more votes than the Republican plan to cut the number of federal jobs and freeze the pay of federal workers.

Today’s Economist

Perspectives from expert contributors.

This time last year Republicans were insisting that the Bush tax cuts be made permanent without paying for a penny of the cost, even though there is no evidence that they stimulated the economy.

Saying that they are now concerned about the impact of the payroll tax cut on the deficit and its lack of stimulative effect makes Republicans sound a lot like Captain Renault in “Casablanca,” when he said he was shocked to discover gambling going on as he was handed his winnings.

Republicans like to pretend that cutting spending is economically costless, even stimulative, whereas raising taxes in any way whatsoever is so economically debilitating that it dare not be contemplated. This view is complete nonsense.

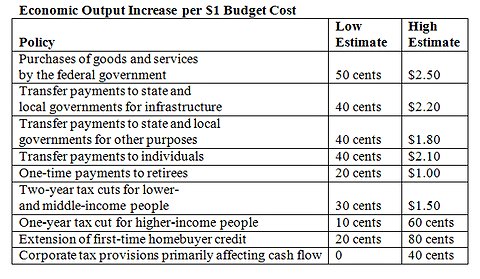

Careful studies by the Congressional Budget Office and others show that certain spending programs are highly stimulative, whereas tax cuts provide very little bang for the buck.

Congressional Budget Office

Congressional Budget Office

Keep in mind that these results are symmetrical. A policy with a high multiplier, such as government purchases, will reduce the gross domestic product by exactly the same amount if it involves spending cuts. A tax cut with a low multiplier will have an equally small negative economic effect if it is instead done as a tax increase.

This would suggest that one of the worst ways to cut spending, from a macroeconomic point of view, would be to do it the way Republicans proposed last week: by cutting government employment. Judging by the table above, cutting taxes for lower- and middle-income people and paying for it with higher taxes for higher-income people, as Democrats have proposed, is unambiguously stimulative.

In any case, the Republican position is politically weak. Polls consistently show that a large majority of Americans favor higher taxes on the rich. For example, the New York Times/CBS News polls in September and October found that about two-thirds of Americans would raise taxes on households earning $1 million or more to reduce the deficit; only 30 percent were opposed.

Growing numbers of millionaires and billionaires have gone on record as favoring higher taxes on the rich, because they can afford them and think they’re necessary to deal with our nation’s fiscal problem, which is largely due to historically low revenues.

These include Warren Buffett, Carlos Slim, Mark Cuban and Nick Hanauer, among others. The group Patriotic Millionaires for Fiscal Strength has been lobbying Congress to raise taxes on people like themselves. A similar movement is under way in Europe as well.

It is no longer possible to deny that there has been a sharp rise in the income and wealth of the ultra-rich while everyone else’s income has stagnated. Authoritative recent studies by the Congressional Budget Office and by Anthony Atkinson, Thomas Piketty and Emmanuel Saez prove that fact beyond question.

The point is not to punish the rich for being rich — Republicans routinely scream “class warfare” whenever anyone suggests higher taxes on the rich — but to raise revenue. If the rich don’t pay more, everyone else will have to.

Recognizing the intellectual and political weakness of their position, Republicans have responded that there is nothing to stop rich people from sending checks to the Treasury Department to reduce the debt. About $3 million is annually donated to the government for this purpose. On Oct. 12, Senator John Thune, Republican of South Dakota, introduced legislation that would add a line on tax returns to make voluntary contributions to the Treasury. It was enthusiastically endorsed by the anti-tax activist Grover Norquist.

Reducing the deficit through voluntary contributions is not a serious idea. It would be a drop in the bucket, such contributions are not sustainable, and it would be unwise to have the government dependent on them because inevitably they would come with strings attached.

Republicans often say that tax evasion and avoidance by the wealthy would cause revenues to fall, rather than rise, if their taxes are raised. But according to the Tax Policy Center, rates higher than the current top rate of 35 percent accounted for 29 percent of individual income tax revenue as recently as 1986, during the Reagan administration.

Recent studies by Peter Diamond and Emmanuel Saez and by A.B. Atkinson and Andrew Leigh find that increasing the top income tax rate would raise net additional revenue at least until it reached 63 percent and probably much higher.

Nor is it correct that low taxes on the rich are essential for economic growth. Recent studies by Dan Andrews, Christopher Jencks and Andrew Leigh and by Thomas Piketty, Emmanuel Saez and Stefanie Stantcheva show that while tax cuts for the rich have raised their share of aggregate income, they have not raised the rate of economic growth.

There are legitimate questions about whether the temporary payroll tax cut stimulated employment or if its expiration will reduce growth, about whether a surtax on millionaires is the best way to pay for it and how much additional revenue can reasonably be expected.

But the idea that the rich cannot or should not pay more should be dismissed out of hand. They can and must pay more; the only question is how best to do it.

Article source: http://feeds.nytimes.com/click.phdo?i=62cce55087457c53f597da43e43ccf40