Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah. His sketches are archived here on the Bucks blog. His new book, “The Behavior Gap,” will be out in January.

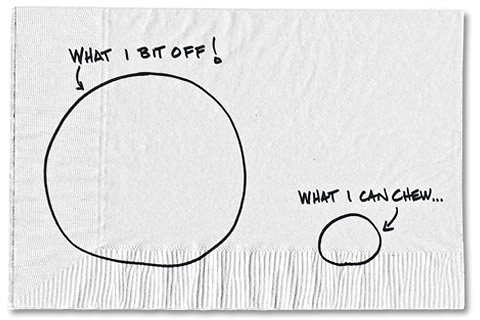

One of the most common mistakes, and certainly the most dangerous, that we make as investors is taking on more risk than we originally intended to.

The tragic story unfolding at MF Global is just the most recent very public example of a situation where things turned out to be far riskier than the people who took them initially thought. But this isn’t just a problem among aggressive traders. Each time there’s a market decline, it seems like we have to re-learn this lesson.

How often have you heard someone say they were surprised, shocked, disappointed or depressed about the fact that their investment portfolio was down during a bear market? And why are we surprised, anyway?

Bear markets are part of the normal market cycle and have been around since we started providing operating capital in exchange for fractional ownership of companies (i.e., the stock market). We shouldn’t be surprised when portfolios go down, but we still are. For some, the surprise isn’t the decline itself, but the magnitude or severity of the decline.

So why do we keep making the mistake of designing investment portfolios that are more risky than we want or need them to be?

The solution to this problem is taking the time to understand the risk associated with diversified exposure to the stock market. Then you can build a portfolio based on your unique need, willingness and ability to take on that risk.

Because this is such an individual pursuit, and every portfolio should be crafted to match your situation, following rules of thumb can be dangerous. But everyone needs a starting point, so here are a few things to get you thinking:

1. Accept that there is no reward without risk.

Risk and return are related. I’m talking about responsible, diversified risk, not stupid, thoughtless risk. Owning one individual stock is a stupid risk. Taking huge bets on distressed European sovereign debt is another stupid risk. But owning a diversified basket of index funds? That’s responsible, diversified risk. See the difference?

After building a plan to meet your goals, you may determine that you need, and are willing, to have a portion of your money invested in the stock market. Because of the historical returns, you’re willing to live with the risk. And that risk is the high probability that the market will go down temporarily as part of a long, upward march.

I’ve often heard it said that the primary risk to owning stocks is that you’ll get scared out of them at the wrong time. One of the key implications of this idea is that there is no way to own equities without taking on the risk. So give up on the idea that you can time the market. There is no one that stands ready to ring a bell before the market goes down.

If you understand this and believe it, it’s actually a very freeing concept. Design a portfolio to match your goals and your ability to take the risk. Rebalance it periodically to match your original plan design, and live your life.

2. Practice a lifeboat drill.

The great thing with investing, and our investing behavior, is that the numbers don’t lie. After all we have records of this stuff.

So here’s an exercise that can help. Pull out your tax returns and investing statements. Review your investment behavior over the last 12 or so years. Did you buy technology stocks in 1999? Did you get out of the market in 2002? Did you become a “real estate investor” in 2006 or 2007? Did you go to cash in early 2009?

Reviewing behavior can tell us a lot about how we feel about risk. If we made the classic mistakes of buying high and selling low over and over again, clearly it’s time to consider a portfolio that won’t be vulnerable to our own mood swings.

3. Review economic and stock market history.

This suggestion needn’t be painful or boring, particularly if you recognize the benefits of understanding the history of investing and cycles. There’s been serious debate recently about the value of history to investing. But we have a choice: we can either choose to make important decisions with our life savings while ignoring history, or we can make those important decisions with the benefit of the weighty evidence of history.

Even if you tell yourself that “this time is different,” there are still lessons to be learned from history that can help avoid poor decisions. Go back and look at the major declines in the stock market. Look at the early 1970s. Read the history of Black Friday. Review what happened in 1999 and then the decline that followed.

The major lesson from these events is that while periods of incredible pessimism and panic get most of the headlines, things have a way of working out. It turns out that rational optimism has been the correct view of the world for the last hundred years. It would seem to be a reasonable assumption that it will continue.

This short-term panic and pessimism hasn’t turned out to be the right outlook for the long term, so why let it keep you awake at night? We usually find ways to work through the underlying problems, and chances are high we will again. Yes, we face serious problems, but we have faced serious problems in the past.

So now, let’s apply this thinking to our investment portfolios. Building a broadly diversified portfolio that matches your need, ability, and desire to take risk, then holding onto it, has been the correct way to build wealth in the past. It seems reasonable to assume that the same will hold true in the future.

Certainly we will be surprised again in the future, as we have in the past, about the timing, nature, and cause of major market turmoil. But we shouldn’t be surprised that it happens. And that fact should play a major role in how we design our investment portfolios.

Hat tip to @slarkpope whose own similar sketch from several months ago inspired mine this week.

Article source: http://feeds.nytimes.com/click.phdo?i=6de6206713edc0c86731a93a0d4bcc99