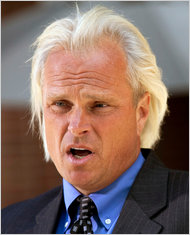

Brendan Hoffman/Bloomberg NewsBart Chilton, a Democratic member of the Commodity Futures Trading Commission, is a champion of the position limits rule.

Brendan Hoffman/Bloomberg NewsBart Chilton, a Democratic member of the Commodity Futures Trading Commission, is a champion of the position limits rule.

7:44 p.m. | Updated

A divided Commodity Futures Trading Commission has rebuffed a request from Wall Street to delay new restrictions on speculative commodities trading.

The commission’s decision, which was reached on Tuesday and announced on Wednesday, was split along party lines, with the three Democratic members voting to reject the request for a stay and the two Republican commissioners supporting the delay. The commission was likewise divided in October, when it adopted the so-called position limits rule, which would cap the number of futures contracts a trader can hold on 28 commodities, including oil and gas.

The Securities Industry and Financial Markets Association and the International Swaps and Derivatives Association had asked the commission to stay the enforcement of the position limits while the groups pursued a legal challenge of the new rule. The two lobbying groups filed a lawsuit against the commission last month in the Federal Court of Appeals in the District of Columbia, a move that escalated Wall Street’s war against new regulations.

The commission’s adoption of the position-limits rule, which is expected to take effect in part later this year, was seen as a crucial step in the Obama administration’s effort to enforce the Dodd-Frank Act, the regulatory crackdown passed in response to the financial crisis.

“Congress was clear that we were to impose position limits promptly,” Bart Chilton, a Democratic commissioner who championed the rule, said in a statement on Wednesday. He added that the denial of the stay request was “a good step toward keeping the ball rolling, and getting these limits in place.”

A spokesman for the Securities Industry and Financial Markets Association said the decision would not affect the group’s broader legal challenge to the rule. “We disagree with the C.F.T.C.’s denial of the stay request and look forward to presenting the issue to the D.C. Court of Appeals,” said the organization’s spokesman, Andrew DeSouza.

In the lawsuit, the two lobbying groups accused the agency of failing to adequately assess the economic effects of the rule. They also said that Dodd-Frank left it to regulators to enforce position limits “as appropriate,” arguing that, in essence, no limits were appropriate. Mr. Chilton has called this argument “trying to dance on the head of a legal pin.”

The rule’s supporters say it will help protect consumers from speculative commodities trading. While the financial industry has increased its speculation in the futures market over the last few years, the prices of the underlying commodities have fluctuated wildly. In turn, energy costs and food prices have risen, pinching consumers at the gas pump and the grocery store.

Article source: http://feeds.nytimes.com/click.phdo?i=ddf28c4366c2825e6c5aa35367f0f0e5