Carl Richards

Carl Richards

Carl Richards is a financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published last year. His sketches are archived on the Bucks blog.

Often when we think of risk, we’re only focused on the risk of investing in the stock market. We think, “Oh, the stock market is risky, and it’s a little scary to buy risky things.”

I can’t tell you how many conversations I’ve had with friends — particularly when they get a little older — that are only focused on this one risk. “I don’t want to own stocks because, boy, that’s risky.”

I remember a conversation I had with a friend of mine who lives in a small town. She was telling me how worried she was about the stock market going up and down. Now, keep in mind, she had very little of her money in the stock market. But she had some money in stocks, as is appropriate for somebody who could expect to live for another 15 or more years.

Here’s the interesting part. When she finished telling me about her stock market worries, she told me she was also very worried about how the price of everything seemed to be getting more and more expensive each year.

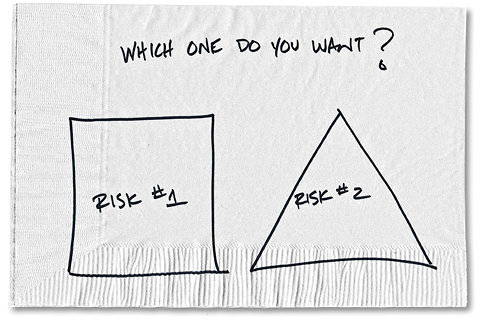

This gets us to the big point. When you make a decision to avoid one type of risk, you might be exposing yourself to another one.

In this case, my friend was very concerned about the risk of holding stocks. But she overlooked the risk that comes with holding too little in stocks — which can help her keep up with inflation.

It’s going to cost you more to buy the same loaf of bread in 20 years. Just look at prices 30 years ago, when a loaf of bread cost $0.53, and a gallon of gas was $1.36.

I remember when I was a kid, 30 years or so ago, riding my bike down to the gas station and putting a quarter in the soda machine to get a bottle of Fanta Red Cream Soda. Today, if my kids wanted to ride down to the gas station to get a soda, it would cost them at least a dollar. (Bikes are also a lot more expensive than they used to be.)

The point is that we shouldn’t be thinking in terms of avoiding risk. It can’t be done. Instead, we should be considering which risks we’re willing to take on.

The reality of investing is about making these tradeoffs. It’s about raising your hand and saying, “I’m O.K. with taking on this risk over here, in order to get rid of that one over there.” That’s essentially what the market is —- a place to trade risk and reward.

Back to my friend in the small town. (She isn’t unique. I seem to have this same conversation about risk with lots of people.) When I heard her concerns, I told her a story that always seems to help. If you have a well-designed investment portfolio that’s tied to your goals, you’ve already made decisions and tradeoffs about the risks you’re willing to take. We’re better off in the long run sticking with those plans, because once you start looking for a no-risk investing solution, you’ll likely to veer off into some shady, perhaps fraudulent, investment schemes.

So next time you’re nervous about the risk you’re taking with your investments, remind yourself which risks you’ve actually gotten rid of because of those decisions.

Article source: http://bucks.blogs.nytimes.com/2013/01/14/stock-investing-isnt-the-only-risk-in-your-life/?partner=rss&emc=rss