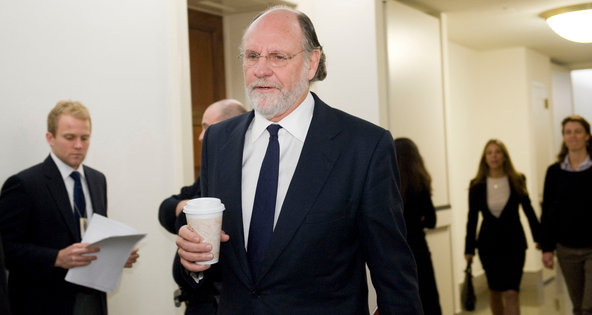

Jay Mallin/Bloomberg NewsJon S. Corzine, former chief of MF Global, arrived to testify at a House Agriculture Committee hearing.

Jay Mallin/Bloomberg NewsJon S. Corzine, former chief of MF Global, arrived to testify at a House Agriculture Committee hearing.

Jon S. Corzine, the former chief of MF Global, is set to appear before the House Agriculture Committee on Thursday to answer questions about the collapse of his brokerage firm and the disappearance of up to $1.2 billion in customer money. The panel began at 9:30 A.M.

Refresh now Updating…FeedTwitter

Updating…FeedTwitter

Article source: http://feeds.nytimes.com/click.phdo?i=a9b69114604f64c6037d552135c1de95