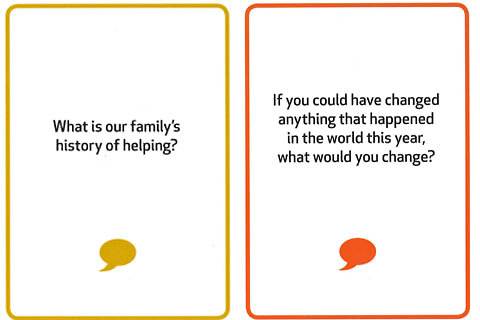

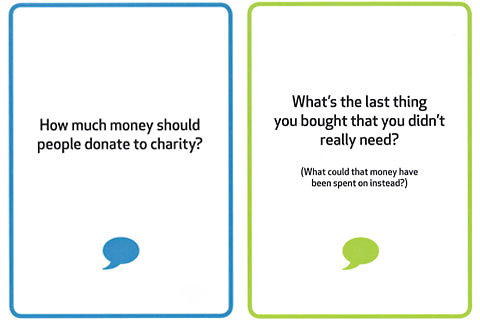

In this past weekend’s Your Money column, I mentioned the “Talk About Giving” game. It’s a $13 offering (including shipping and handling) from the Central Carolina Community Foundation, and you pick cards from a deck and use the questions as a way to begin a family discussion about values and philanthropy.

Some of my favorite questions are shown above and below. Here are a few more questions:

- Should we volunteer even if we don’t want to?

- If we give money, how will we know if our money was used well?

- Suggest a new family tradition.

- What do you appreciate most about our town?

- What does it mean to be charitable?

- Name a kind act that someone did for you in the past week.

- How many pairs of shoes do you need?

- Should children get paid for doing chores?

- How much did tonight’s dinner cost?

If you like what you see here, get the whole set and test them on your brood.

And if you think of it, please come back and leave a comment letting us all know what you asked and how your family members answered.

Article source: http://bucks.blogs.nytimes.com/2012/12/10/playing-the-talk-about-giving-game-with-your-family/?partner=rss&emc=rss