8:49 p.m. | Updated

Demand for pork in China reflects its booming economy and rising middle class. But that rapidly growing appetite has strained its food production systems, leading to breakdowns and a number of food safety scandals.

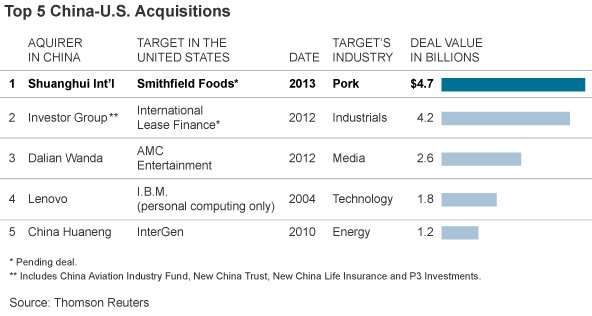

Now China’s biggest pork producer, seeking plentiful supplies and technical expertise, has agreed to buy Smithfield Foods, the 87-year-old Virginia-based meat giant with brands like Armour and Farmland, for $4.7 billion in cash.

If completed, the deal that was announced on Wednesday would be the biggest takeover of an American company by a Chinese concern. But it must first overcome skepticism in Washington — and a potentially close examination process by United States regulators. Both Smithfield and its suitor, Shuanghui International, said that they will submit the deal for review by the Committee on Foreign Investment in the United States, or Cfius, a panel of government agencies tasked with clearing deals for national security.

Related Links

Typically, the committee is concerned with acquisitions that involve technology or vital natural resources. The nation’s food supply chain is not specifically mentioned in its mandate, but the panel’s jurisdiction is considered broad. Among the deals it has reviewed and approved in recent months are the proposed takeover of Nexen Energy by a Chinese oil company and the proposed sale of control of Sprint Nextel to a Japanese telecommunications firm.

The committee may consider whether Shuanghui has ties to organizations like the Chinese army, as well as whether Smithfield’s customer rolls include sensitive information like the locations of secure military installations.

“There’s a difference between a foreign company buying Boeing and one buying a hot dog stand,” said Jonathan Gafni, president of Compass Point Analytics, who was involved with the foreign investment committee when he was a deputy national intelligence officer. “But it depends on which corner the stand is on.”

Still, he expects the deal to pass muster.

Other hurdles lie in wait. A takeover by a Chinese company — because of well-publicized food safety scandals in that country — could prompt concerns among American consumers and consumer groups, who may worry that Shuanghui will ultimately export the pork it produces in China to the United States.

Smithfield and Shuanghui said that the deal was meant to do the opposite: increase exports of American products to China, already the nation’s third-largest export market for pork. Meat consumption in China has exploded over the past decade because of a growing middle class and a shift in diet from rice and vegetables to more protein.

The New York Times

The New York Times

“This transaction will allow us to access Asia in a big way,” C. Larry Pope, Smithfield’s chief executive, said in a telephone interview. “This is an export deal, and they are very interested in exporting products out of the U.S.”

Even so, many critics of Wednesday’s deal fear that the Chinese company may eventually seek to sell meat to the United States.

“They’re already trying to send their chicken products over here,” said Stanley Painter, chairman of the National Joint Council of Food Inspection Local Unions, which represents federal inspectors. “So I’m of the opinion this is going to get their foot in the door, letting them claim, We’re an American-based company now, and so why would you try to block us?”

China is no stranger to complaints about food quality. In recent years, the Chinese government has announced a crackdown on food makers while it also deals with an outbreak of bird flu and images of thousands of dead pigs floating in the Huangpu River in Shanghai.

The advantage of acquiring Smithfield is that it would give Chinese consumers greater access to imported meat that meets stricter food safety standards.

And China is struggling to produce its own supply. The nation’s production is considered inefficient and costly. Farms are smaller, and production and processing facilities are less sophisticated.

Although China, the world’s biggest market for pork, has begun introducing bigger farms and processing facilities, the country is still dominated by family-style farms and logistical bottlenecks that raise the cost of producing pork and other meat products.

“They’re not very efficient at producing it, which is why they’re importing it from us,” said David Warner, a spokesman for the National Pork Producers Council, a trade group based in Washington.

By comparison, the United States has ample grain and space for enormous hog farms. Last year, American producers exported about $866 million in pork products to China, 14 percent of all United States pork exports.

Some food experts said that Chinese ownership should not affect food safety at Smithfield. The company has had a good record on controlling pathogens, said Bill Marler, a Seattle-based lawyers who represents the victims of food-borne illnesses.

“They have had few recalls, and none that I know of that were ever linked to illnesses,” he said.

On the other hand, Shuanghai, which also goes by the English name Shineway Group, has struggled with food quality issues.

Two years ago, China’s biggest state-run television company, China Central Television, broadcast an investigation that found that Shuanghui was selling pork produced with clenbuterol, which is banned as a food additive in the United States, the European Union and China because of health risks.

That year, the country arrested scores of people for producing, selling and using clenbuterol, which is believed to produce leaner meat.

Shuanghui apologized and promised to improve its food safety program.

Founded nearly 20 years ago, the company was a state-run enterprise until a division of Goldman Sachs and CDH Investments, one of China’s leading private equity firms, paid more than $100 million several years ago to buy out the government’s interest.

Shuanghui now has a publicly listed company and other food divisions with assets of more than $5 billion.

Wednesday’s deal fulfills a major ambition of the Chinese government, to encourage companies to venture abroad by acquiring assets, resources and technical expertise. In North America, Africa and Australia, Chinese companies, flush with cash, are buying up land and resources to help a country that is plagued by water shortages and short of arable land, a situation exacerbated by a long running property and infrastructure boom.

In the meat industry, few companies loom larger than Smithfield, an empire whose operations extend from raising pigs to processing them into ham and pork for an array of customers. Founded as a packing plant in the Virginia town that shares the company’s name, it has since grown into a behemoth that reaped $13 billion in revenue last year.

Under the terms of the deal, Shuanghui will pay $34 a share for Smithfield, which is 31 percent above the company’s closing share price on Tuesday.

Smithfield and Shuanghui have long had ties, and over the past four years the companies discussed ways to cement an alliance. Shuanghui has been especially keen to find ways to increase the amount of pork it could import from the United States.

Late last year, Mr. Pope, Smithfield’s chief executive, said the two discussed buying stakes in each other. Around March, an adviser to Shuanghui called Smithfield and offered a different approach: an outright takeover of the American company.

“They said, ‘Larry, let’s make this thing happen. We think you’re going to like it,’ ” Mr. Pope said.

But Smithfield had received takeover proposals from two other foreign suitors before signing its deal with Shuanghui, according to people briefed on the matter.

Smithfield was advised by Barclays and the law firms Simpson Thacher Bartlett and McGuireWoods. Shuanghui was advised by Morgan Stanley and the law firms Paul Hastings and Troutman Sanders.

Michael Moss and Mark Scott contributed reporting.

Article source: http://dealbook.nytimes.com/2013/05/29/smithfield-to-be-sold-to-shuanghui-group-of-china/?partner=rss&emc=rss