Today, it stands as a symbol of how far the mighty may fall.

Like the vast majority of new buildings that have blanketed the Istanbul hills in recent years, the Sapphire — at 856 feet it is the tallest in Turkey and among the loftiest in Europe — was built on the back of cheap loans, in dollars, that have flooded Turkey and other fast-growing markets like Brazil, India and South Korea. The money began to flow when the Federal Reserve and other major central banks cut interest rates to the bone in 2009 and cranked up the printing presses in a bid to spur recovery in United States and other advanced industrial nations.

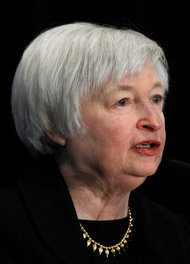

But now, with expectations mounting that the Federal Reserve, led by its departing chairman Ben S. Bernanke, may soon begin to tighten its monetary spigot, Istanbul’s skyline could well be a harbinger of an emerging-market bust brought on by unpaid loans, weakening currencies, and, eventually, the possible failure of developers and banks.

This week, stocks and currencies in several developing Asian markets, including India, Indonesia and Thailand, have been hit hard as global investors continue to withdraw funds from emerging markets in anticipation of the Fed’s move to reduce its stimulus efforts in the United States. Indonesia’s benchmark index, which fell 5 percent on Monday, dropped 3.2 percent more on Tuesday. India’s stock market fell 0.3 percent after sliding 5.6 percent in the previous two trading sessions.

Other worldwide markets are also suffering. Stocks on Wall Street have fallen for four days in a row as borrowing rates climb. The Nikkei 225 index in Japan fell 2.6 percent on Tuesday, hitting its lowest closing level since June 27. South Korea and Hong Kong both fell as well.

Some analysts see it as the markets reacting to an end — real or perceived — of the Bernanke boom.

“What we are witnessing is a huge bubble, a Bernanke bubble if you will,” said Tim Lee of Pi Economics, an independent consultancy based in Greenwich, Conn.

Not everybody is as alarmed as Mr. Lee. Still, 16 years after emerging markets in Asia imploded after local currencies collapsed, even optimists are starting to grow nervous over the rapid accumulation of dollar-denominated debt not just in Turkey but in other now-struggling economies like Brazil, India and South Korea.

As it turned out, some of the biggest beneficiaries of the Fed’s largess were not so much in the developed world, but among the politically connected elite in emerging nations like Turkey, where vanity towers, glitzy shopping malls and even grander projects to come — a third bridge across the Bosporus and a vast new airport — have become representative of Turkey’s new dynamism, economic as well as geopolitical.

What these elites have so far ignored, Mr. Lee warns, is that their obligations carry with them a significant and more pressing danger beyond the risk that the investments may turn sour. That is currency risk.

Unlike the risky loans made to subprime borrowers in the United States or Irish real estate developers in the euro zone, dollar debts taken on by companies erecting skyscrapers in Istanbul, manufacturing steel in India and prospecting for oil in Brazil, need to be largely paid back in dollars by entities that earn most of their revenues in their home currency.

When the Turkish lira or the rupee in India was strong — as these currencies were until recently — local companies had every incentive to borrow in dollars at comparatively lower interest rates.

But when local currencies start to weaken, in line with diminished economic prospects, then the effect is twofold: paying off dollar loans becomes more costly for the borrower and the lender becomes increasingly skittish about his exposure to a fragile currency and may move to reduce or even slash credit lines.

The worst prospect is a currency crash and a deep recession as foreign investors leave the country and locals rush to dump their liras, reals and rupees in favor of dollars.

Article source: http://www.nytimes.com/2013/08/21/business/global/turkish-skyline-foreshadows-emerging-market-slowdown.html?partner=rss&emc=rss