The nation’s employers added 146,000 jobs last month, in line with the average of 151,000 a month in 2012. But the pace was a substantial improvement from earlier this year, when job growth slowed sharply and many observers feared a double-dip recession.

The biggest surprise was that Hurricane Sandy created so little drag. Economists had estimated that only 86,000 jobs would be added in November, a decline from October largely because of the storm.

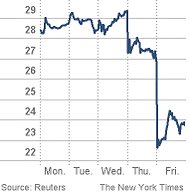

According to the monthly snapshot from the Labor Department, released on Friday, the nation’s unemployment rate dropped to 7.7 percent last month from 7.9 percent in October. Economists cautioned that this bit of seeming good news was the result of a shrinking labor force, rather than the addition of jobs. At the current pace of job creation, the unemployment rate will gradually decline to 7.1 percent by December 2013, said Dean Maki, chief United States economist at Barclays Capital.

“The underlying trend in unemployment is downward, and that’s what we continued to see in the November figures,” Mr. Maki said. “Over the past year, unemployment has fallen a full percentage point and is now down 2.3 percentage points from its high in 2009.”

Many economists worry that job creation will slow markedly, however, if President Obama and Congressional Republicans cannot agree on a plan to reduce the deficit by the end of the year, leading to more than $600 billion in government spending cuts and automatic tax increases in 2013. The Congressional Budget Office, as well as many private economists, warn that this path will lead to a recession in the first half of 2013 and push unemployment back up.

While it is encouraging that businesses seem to be hiring in spite of the uncertainty in Washington, that could change quickly, said Ethan Harris, co-head of global economics at Bank of America Merrill Lynch.

“If the budget impasse can’t be resolved this month, it’s likely that jobs growth will weaken early next year,” he said. “The fiscal cliff is a very dangerous game.”

Even if both sides in Washington come up with a short-term solution on the budget, as many observers expect, the pace of job growth remains well below what is needed to push wages substantially higher or to significantly reduce the broadest measure of unemployment anytime soon. Factoring in people seeking work, as well as those who want jobs but have stopped looking and those forced to take part-time jobs because full-time employment was not available, the broad unemployment gauge dipped to 14.4 percent in November from 14.6 percent in October.

Average hourly earnings rose 0.2 percent in November, and are up about 1.7 percent from a year earlier — about half the annual rate of growth seen in 2007 before the recession hit, when unemployment was below 5 percent.

The size of the labor force, according to a household survey separate from the one showing how many jobs were added by businesses and government, shrank by 350,000 in November. Part of that drop can be explained by the number of baby boomers deciding to retire, but a significant number of workers remain discouraged, prompting them to drop out of the job hunt.

As a result, the labor participation rate, which represents the portion of the adult population that is either employed or actively looking for work, remains low by historical standards, said Nigel Gault, chief United States economist for IHS Global Insight.

At 63.6 percent in November, Mr. Gault said, this measure is near the low point in this economic cycle.

“We’re not at the point in which the jobs market is strong enough to pull discouraged workers back into the labor market,” he said. Although job growth in November exceeded expectations, the Labor Department revised downward its figures for the preceding months. For September, the Labor Department said the economy created 132,000 jobs, down from an earlier estimate of 148,000, and the figure for October was lowered to 138,000 from 171,000.

Article source: http://www.nytimes.com/2012/12/08/business/economy/us-creates-146000-new-jobs-as-unemployment-rate-falls-to-7-7.html?partner=rss&emc=rss