Bruce Bartlett held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He is the author of the forthcoming book “The Benefit and the Burden: Tax Reform – Why We Need It and What It Will Take.”

Today’s Economist

Perspectives from expert contributors.

When the most recent recession began in December 2007, there was no reason at first to believe that it was any different from those that have taken place about every six years in the postwar era. But it soon became apparent that this economic downturn was having an unusually negative effect on the financial sector that threatened to implode in a wave of bankruptcies. The Federal Reserve reacted by doing exactly what it was created to do — be a lender of last resort and prevent systemic bank failures of the sort that caused the Great Depression and made it so long and severe.

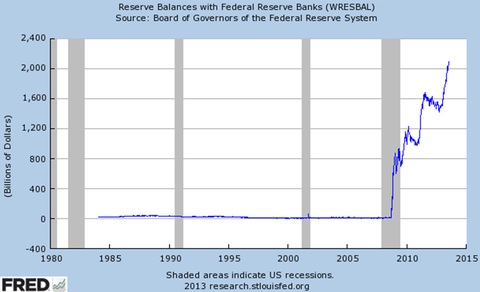

As the Fed lent freely to banks and other financial institutions, its balance sheet grew very rapidly. The reserves of the banking system grew concomitantly; reserves are funds that banks have available for immediate lending that theoretically should lead to credit expansion and new investment by businesses, durable goods purchases by households and so on.

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis

During the inflation of the 1970s, most economists became convinced that if the Fed adds too much money and credit to the financial system it will inevitably cause prices to rise. Since the increase in the money supply in 2008 and 2009 was unprecedented, many economists reacted fearfully to the Fed’s actions.

Given the order of magnitude of the increase in bank reserves, from virtually nothing to more than $1 trillion almost overnight and now to more than $2 trillion, it was not unreasonable to be concerned about the potential for Zimbabwe-style hyperinflation.

But inflation fell rather than rising. In the five and a half years since the start of the recession, the consumer price index has risen a total of 10.2 percent. In the five and a half years previously, it rose 17.7 percent. That is, the rate of inflation fell by almost half.

Now, I don’t expect all the people who filled The Wall Street Journal’s editorial page in 2008 and 2009 predicting an imminent rise in inflation to offer a mea culpa, but at some point I think the inflationphobes should at least stop saying that hyperinflation is right around the corner.

By 2010, the annual inflation rate was down to 1.5 percent, and the yield on the Treasury’s 10-year bond had fallen to 3.2 percent from 4.3 percent in 2007 – historically, long-term interest rates rise when inflationary expectations rise. In short, there was no evidence that Fed policy was causing inflation to rise.

Yet in November 2010, both Sarah Palin and Paul Ryan warned that inflation was imminent. As they are Republicans, one can assume they were just playing politics, pandering to their constituency. But a week later, a group of professional economists signed an open letter to the Fed chairman, Ben Bernanke, warning that continuation of an easy money policy risked “currency debasement and inflation.”

In 2011, there were still no signs of actual inflation, but the economist Allan Meltzer nevertheless asserted, “Inflation is coming.” He wisely chose not to say when. Writing in The New York Times, the former Fed chairman Paul Volcker made the time-honored slippery-slope argument: a little inflation always leads to higher inflation.

The inflationphobe Niall Ferguson at least acknowledged that official data showed no evidence of inflation but asserted that the data were wrong, that the consumer price index is “a bogus index.” He cited the authority of a Web site called ShadowStats, which, like the Unskewed Polls site that said all polls showing Mitt Romney losing were simply wrong, just arbitrarily adjusts the data to make it conform to its belief that inflation is high, not low.

In 2012, the consumer price index rose just 1.7 percent, but the inflationphobe Amity Shlaes feared that inflation could suddenly appear out of nowhere, apparently because there was hyperinflation in Germany in the 1920s. Representative Ron Paul, Republican of Texas, was so alarmed by the danger of inflation that he suspended his presidential campaign to lead a Congressional hearing on the subject in June.

In October 2012, Rick Santelli of CNBC said “printing money” caused the German hyperinflation and the same thing was happening in the United States. He, like other inflationphobes, saw the rising price of gold as an ominous sign of a takeoff of consumer prices.

Since Mr. Santelli made his prediction, the seasonally adjusted monthly inflation rate has been negative 0.2 percent in November 2012, zero in December and January 2013, 0.7 percent in February, negative 0.2 percent in March, negative 0.4 percent in April, 0.1 percent in May and 0.5 percent in June. Without seasonal adjustments, the annual inflation rate was 1.4 percent over that time.

Many conservatives, including the publisher Steve Forbes and Larry Kudlow of CNBC, always say that gold is the perfect forward indicator of inflationary expectations. I’ve often heard Mr. Forbes say that the price of gold is like a thermometer that continually gives us inflation’s temperature in real time.

Most economists think that’s ridiculous, but insofar as the gold price reflects inflationary expectations, its falling price is impossible to reconcile with Fed policy. The Fed has not decreased the money supply and continues its policy of “quantitative easing,” which means further increases in the money supply.

To inflationphobes, all increases in the money supply are inflationary; indeed, many define the word “inflation” to mean a money supply increase rather than a rise in the price level.

Hard-core inflationphobes like Peter Schiff simply ignore the reality of today’s economy and assert without evidence that it is exactly like the inflationary 1970s. Inflation is due any day now and gold is “on the verge of its biggest rally ever,” he said. On June 18, Mr. Paul said gold could go to “infinity.”

To be sure, some inflationphobes never believed their own rhetoric; they were just trying to score political cheap shots or con unsophisticated investors into buying gold – from which the inflationphobe reaped a commission. But many others were sincere in their belief that higher inflation was inevitable.

Intellectually honest inflationphobes need to explain why they were wrong and stop crying wolf or else it will be reasonable to assume they are simply cranks and crackpots.

Article source: http://economix.blogs.nytimes.com/2013/07/23/inflationphobia-part-iii/?partner=rss&emc=rss

DealBook: Geithner Urges an Overhaul of Rules on Money Market Funds

Treasury Secretary Timothy F. Geithner on Thursday urged the regulatory team that he leads to push ahead with new rules aimed at America’s money market funds, which manage $2.6 trillion.

In a letter to the Financial Stability Oversight Council, a special committee of senior regulators set up after the 2008 financial crisis, Mr. Geithner said the changes were “essential for financial stability.”

The Securities and Exchange Commission, which is the primary regulator for money market funds, had proposed the main changes favored by Mr. Geithner in his letter.

But the commission dropped its attempt at a money market fund overhaul last month after it become clear that a majority of its commissioners were not going to vote for the measures. Large mutual fund companies fiercely opposed the reforms, saying they were unnecessary and could harm a type of investment fund that had proved to be popular.

“You can be sure that the firms on the receiving end won’t take this passively,” said Jay G. Baris, a lawyer at Morrison Foerster, which represents money market funds.

During the 2008 crisis, investors fled money market funds in droves, which worsened the credit freeze that gripped the banking system. Money funds then received a big bailout from the Treasury and the Federal Reserve.

Before the passage of the Dodd-Frank Act, attempts to make changes to the money market fund industry would most likely have died after the commission dropped them. But the Financial Stability Oversight Council, set up by the Dodd-Frank financial overhaul legislation, can choose to take over from the commission.

Mr. Geithner lays out a number of ways in which the council, which meets Friday, can act.

In his letter, he urges the council to gather public comments on a range of reforms and then make a final overhaul recommendation to the Securities and Exchange Commission. The commission would be required to adopt those changes, or explain why it did not. Mr. Geithner said the council’s staff was already working on recommendations and he hoped they would be considered at the council’s November meeting.

The recommendation would include two changes supported by the commission. One would require money market funds to hold loss buffers. The other would end the money market funds’ practice of valuing investors’ shares at $1 even when the funds’ assets should reflect a value slightly below $1.

Mr. Geithner said in his letter that, while the S.E.C. is best positioned to regulate money market funds, the Financial Stability Oversight Council could move forward without waiting for the commission. The council, he wrote, could designate certain money market fund entities as systemically important and subject those firms to regulation by the Federal Reserve, which could then impose an overhaul.

Mr. Baris, the lawyer, said that a designating a money market fund as systemically important could make it hard for it to stay in business. “Who would want to invest in a fund that has been designated by the federal government in this manner?” he said. “It will drive investors away.” Mr. Baris said he believed that Mr. Geithner might face resistance on the council if any new rules single out specific money market funds.

In addition, the council could designate money market fund activities as critical to the working of the financial system’s plumbing. That would allow regulators to impose heightened risk management standards on money market funds.

Mr. Geithner wrote that without the changes, “our financial system will remain vulnerable to runs and instability.”

If the council acts, the mutual fund industry will almost certainly fight back. The industry’s lawyers will most likely contest the council’s interpretation of Dodd-Frank and perhaps even the council’s authority to act.

Geithner Letter to FSOC

Article source: http://dealbook.nytimes.com/2012/09/27/geithner-urges-changes-to-strengthen-mutual-funds/?partner=rss&emc=rss