CATHERINE RAMPELL

Dollars to doughnuts.

The stock market has been doing well, reaching new nominal highs in recent weeks. Economists have been arguing that such equity gains make people feel richer, which might encourage consumers to pick up their spending despite their stagnant wages and recent tax increases.

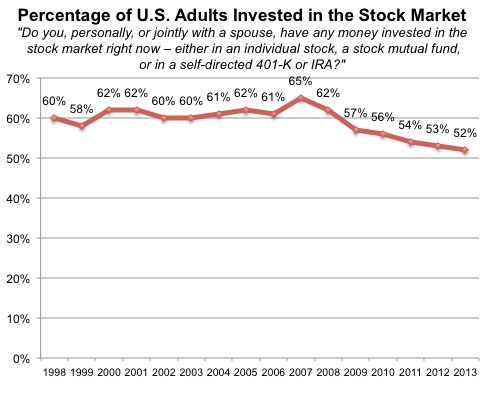

One possible problem with this hopeful story: the share of Americans who actually have money invested in stocks has been falling in recent years.

Source: Gallup. Selected trends are from surveys conducted closest to April each year. Most recent results are based on telephone interviews conducted April 4-14, 2013, with a random sample of 2,017 adults. The margin of sampling error is plus or minus 3 percentage points.

Source: Gallup. Selected trends are from surveys conducted closest to April each year. Most recent results are based on telephone interviews conducted April 4-14, 2013, with a random sample of 2,017 adults. The margin of sampling error is plus or minus 3 percentage points.

In its annual Economy and Finance survey, conducted April 4-14, Gallup found that 52 percent of Americans said they (personally or jointly with a spouse) owned stock outright or as part of a mutual fund or self-directed retirement account. That’s not statistically different from the share last year (53 percent), but is down substantially from pre-recession levels. It’s also the lowest recorded share since Gallup started asking this question in 1998.

Lydia Saad of Gallup suggests that Americans’ withdrawal from the stock market may be “more a function of their ability to buy it, than of whether its value is soaring,” and notes that high unemployment seems to correlate with low stock ownership rates.

I wonder also whether the experience of the financial crisis may frighten Americans away from riskier assets like equities for a while, long after the unemployment rate has returned to more normal levels. Research from Ulrike Malmendier and Stefan Nagel about the so-called “Depression babies” found that people who had experienced low stock market returns throughout their lives are less willing to take on financial risk, are less likely to take part in the stock market and invest a lower fraction of their liquid assets in stocks if they do take part.

There are signs that the appetite for risk is returning among more sophisticated investors and institutions, but that may not extend to the median American, who did not not recover as quickly or as fully (if at all) as the finance industry did.

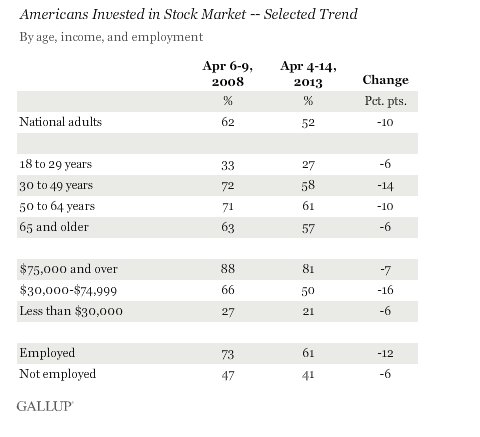

Gallup also found, by the way, that recent declines in equity ownership had been largest among 30- to-49-year-olds and among middle-income Americans. The employed also had sharper declines than those who were not employed, although the latter started from a much lower base.

Source: Gallup. Most recent results are based on telephone interviews conducted April 4-14, 2013, with a random sample of 2,017 adults. The margin of sampling error for the national sample is plus or minus 3 percentage points, and will be larger for subgroups.

Source: Gallup. Most recent results are based on telephone interviews conducted April 4-14, 2013, with a random sample of 2,017 adults. The margin of sampling error for the national sample is plus or minus 3 percentage points, and will be larger for subgroups.

Article source: http://economix.blogs.nytimes.com/2013/05/08/stock-markets-rise-but-half-of-americans-dont-benefit/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.