CATHERINE RAMPELL

Dollars to doughnuts.

One of the big questions about the sustainability of the housing recovery is whether it’s being driven by owner-occupants — the people who live in the houses they buy — or speculators.

In the last year or so, after all, some of the big institutional investors have bought up a lot of distressed properties because they perceived the market to be undervalued, and saw some major opportunities in the rental market. Blackstone, for example, is now the biggest owner of single-family homes, having purchased about 20,000 homes across the country, most of them foreclosures.

New data released by the National Association of Realtors suggests that investors are still playing a role in the market, but their influence is down from its peak.

Source: Realtors Confidence Index, National Association of Realtors

Source: Realtors Confidence Index, National Association of Realtors

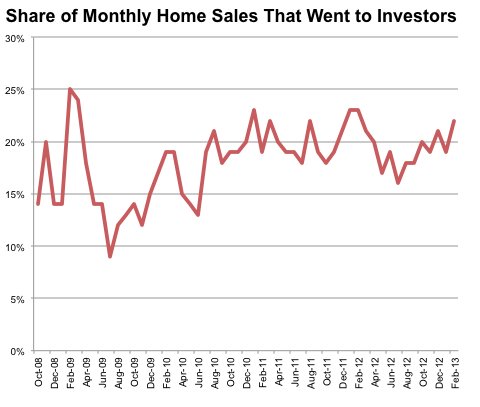

The chart above shows the share of monthly home sales that went to investors. The data come from the Realtors Confidence Index, which is based on about 3,000 responses each month from members of the National Association of Realtors. In February, investors accounted for about one in five purchases, which is close to the long-term average, according to Walter Molony, who works in the association’s public affairs office.

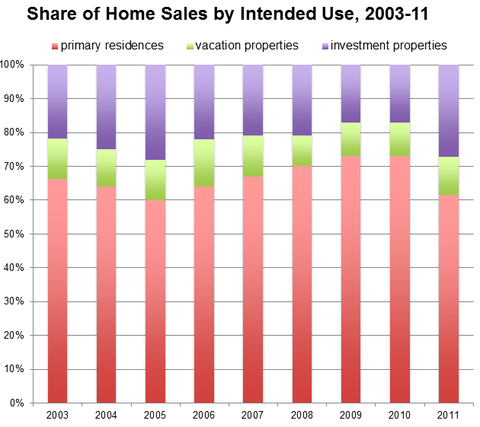

From Mr. Molony, here is the breakdown of home sales by use for 2003-11, from a separate, annual questionnaire filled out by about 2,000 home buyers each year. The 2012 numbers come out next week.

Source: National Association of Realtors

Source: National Association of Realtors

He writes:

This tracked well with findings from the Realtors Confidence Index, but digression from monthly data in the R.C.I. that began in 2011 appears to result from additional purchases outside of [Multiple Listing Service] listed property (courthouse auctions, bulk purchases, etc., outside of publicly marketed property). That pattern likely began to reverse in 2012 as foreclosure inventory, most popular with investors, declined over the course of the year.

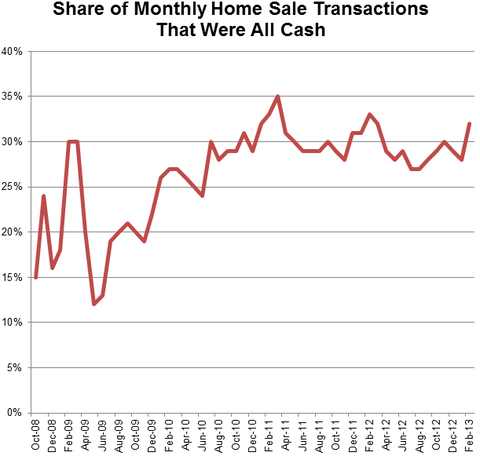

When I went to Sacramento a couple weeks ago to write about the recovery, I found some resentment of investors, at least among buyers. Investors have helped a very depressed market recover, but they have also been outbidding owner-occupants, particularly since many investors can finance their purchases entirely in cash rather than having to wait for a loan.

Here’s a look at the share of sales that were paid for in cash, from the Realtors Confidence Index survey:

Source: Realtors Confidence Index, National Association of Realtors

Source: Realtors Confidence Index, National Association of Realtors

As of February, the share was about one in three, whereas Mr. Molony says that in a “normal market,” all-cash transactions account for closer to 10 percent.

Article source: http://economix.blogs.nytimes.com/2013/03/27/investors-vs-occupants-in-the-housing-recovery/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.