7:24 p.m. | Updated with additional details.

CATHERINE RAMPELL

Dollars to doughnuts.

Americans nearing retirement age have suffered disproportionately after the financial crisis: along with the declining value of their homes, which were intended to cushion their final years, their incomes have fallen sharply.

The typical household income for people age 55 to 64 years old is almost 10 percent less in today’s dollars than it was when the recovery officially began three years ago, according to a new report from Sentier Research, a data analysis company that specializes in demographic and income data.

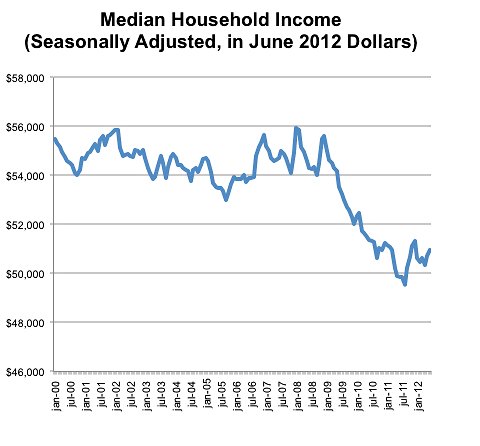

Across the country, in almost every demographic, Americans earn less today than they did in June 2009, when the recovery technically started. As of June, the median household income for all Americans was $50,964, or 4.8 percent lower than its level three years earlier, when the inflation-adjusted median income was $53,508.

The decline looks even worse when comparing today’s incomes to those when the recession began in December 2007. Then, the median household income was $54,916, meaning that incomes have fallen 7.2 percent since the economy last peaked.

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

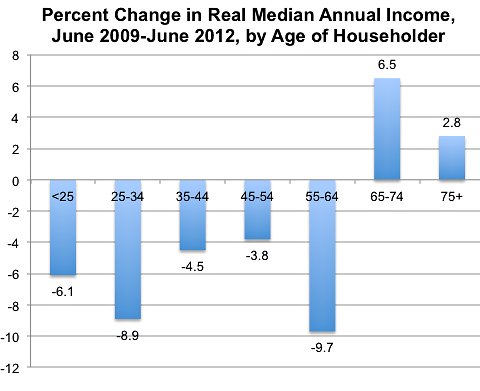

Income drops vary significantly by age, though. Households led by people between the ages of 55 and 64 have taken the biggest hit; their household incomes have fallen to $55,748 from $61,716 over the last three years, a decline of 9.7 percent.

Sustained unemployment among older workers may be at least partly to blame for this decline. Unemployment rates for that age group are relatively low, but once older workers lose their jobs, they have an unusually hard time finding re-employment. And even when they do find new work, they usually take a pay cut.

“I was laid off in ’08, and I never really managed to get back into the job market,” said Jan Thomas, 62, who lives in Sarasota, Fla. She decided to apply for Social Security early, even though that means her benefits are lower than they would be if she had waited until 66. “I’ve pretty much gone through my savings at this point. You know, taking money out of one account, then the other. Then it all just kind of went poof.”

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

Younger Americans have also felt income declines in the three years since the recovery began. The inflation-adjusted median household income for those 25 to 34 fell 8.9 percent, while that for people under age 25 fell 6.1 percent.

Incomes for the oldest Americans, on the other hand, have risen steadily since the recovery began. Among those 65 to 74, the inflation-adjusted median household income rose 6.5 percent (to $42,113 from $39,548), and among those age 75 and older, the increase was 2.8 percent (to $26,991 from $26,244).

It’s not clear why incomes rose for older people when as they fell for everyone else.

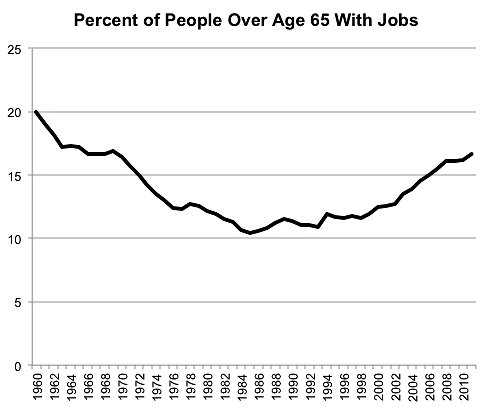

This may be because older Americans are working longer, taking in more income at more advanced ages. Perhaps they are working longer partly to compensate for the decline in the value of their homes. Rising employment rates among older people predate the housing bust, however.

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

The share of people over 65 who have jobs has been rising since the early 1990s; in 2011, 16.7 of people over 65 worked, compared with 11.1 percent two decades earlier.

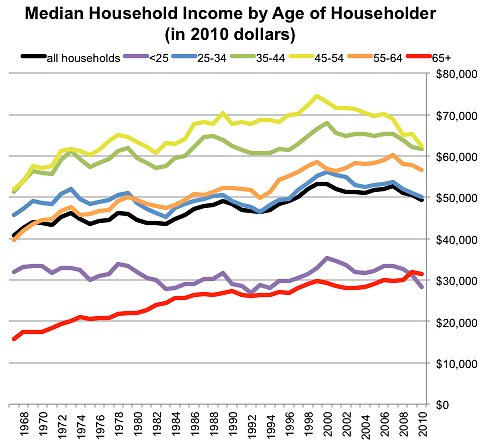

The chart below — which is based on a different Census Bureau survey that goes through 2010 only, unfortunately — shows that almost all age groups have actually seen their income rise over most of the last 50 years, although incomes for non-seniors have been much more volatile. (Remember, though, that during recessions older people have at least some steady income from Social Security.)

Source: United States Bureau of the Census March Current Population Survey annual supplement.

Source: United States Bureau of the Census March Current Population Survey annual supplement.

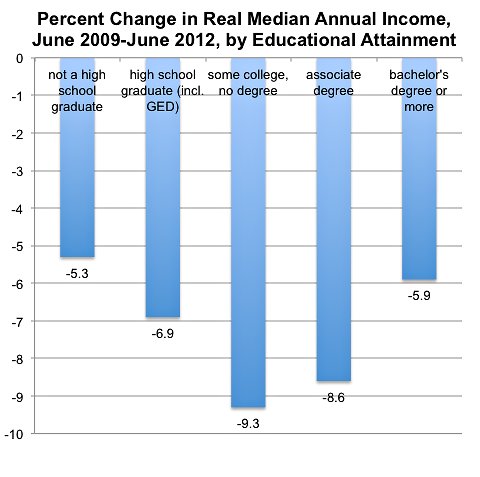

Income losses since the recovery began also varied depending on educational attainment, Sentier Research found.

People with the least education and people with the most education had smaller income losses, supporting the idea that the job market in the United States is “hollowing out,” as the M.I.T. economist David Autor has proposed, meaning that high-skilled and low-skilled jobs are growing while midskilled jobs are thinning out.

The median household income of high school dropouts has fallen 5.3 percent (to $24,495 from $25,860), while that for college graduates has fallen 5.9 percent (to $83,378 from $88,570).

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

Meanwhile, incomes for those with a midlevel education — a high school diploma, some college but no degree, or an associate’s degree — slid much further.

As you can see in the chart above, the biggest percentage decline was for people who took some college courses but never got a degree. Their median income has fallen 9.3 percent over the course of the recovery so far, to $46,200 from $50,948. That must especially sting, given that these income losses are probably accompanied by student loan debt.

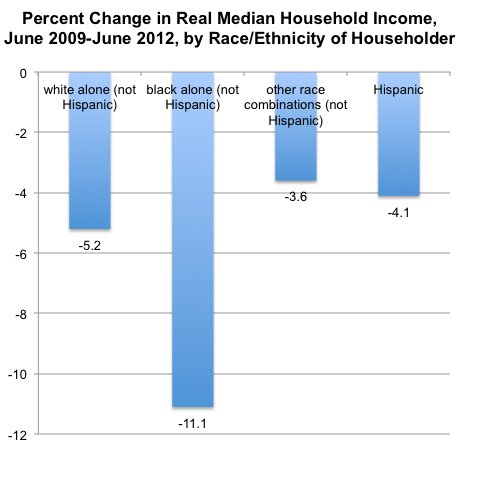

Black Americans appear to have suffered the most, according to the Sentier report.

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

Sources: Sentier Research estimated annual household income derived from the monthly Current Population Survey conducted by the Census Bureau.

The real median annual household income for blacks fell 11.1 percent from June 2009 to June 2012, landing at $32,498 from $36,567. That compares with 5.2 percent for whites, 3.6 percent for other race combinations (including Asians) and 4.1 percent for Hispanics — all of whom started with higher incomes than blacks.

Article source: http://economix.blogs.nytimes.com/2012/08/23/big-income-losses-for-those-near-retirement/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.