FLOYD NORRIS

Notions on high and low finance.

My Off the Charts column this week looks at the popularity of junk bonds. Since 1999, they have outperformed stocks during both bull and bear markets. Issuance of such bonds has risen to record levels around the world, and yields are at historic lows.

Those declining yields have produced capital gains for bond owners, making the bonds more attractive to those who invest based on recent history.

As I talk to people these days, there seems to be widespread conviction that stocks are expensive, and that getting into the market now is highly risky. After all, the Dow Jones industrial average and the Standard Poor’s 500-stock index have risen to nominal record highs at a time when the American economy is hardly putting on an inspiring performance and Europe continues to stumble along.

Somehow people are not impressed by the fact that the S.P. 500 has earnings that are about 80 percent higher than they were in 1999, when the index reached levels almost as high as those reached this year.

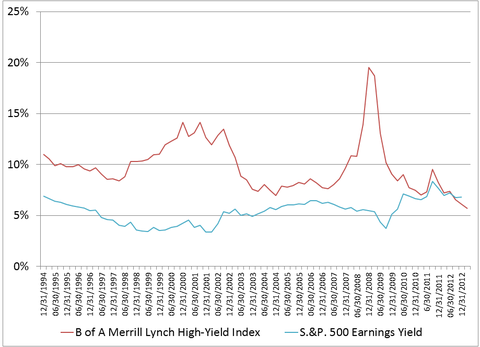

At the suggestion of Bob Barbera, the co-director of Johns Hopkins University’s Center for Financial Economics, I compared the earnings yield on the S.P. 500 to the yield on the Bank of America Merrill Lynch high yield bond index since 1994. Here are the results:

There are, of course, caveats. The earnings yield is simply the operating earnings for the companies in the stock index over the past 12 months, divided by the price of the index at the end of each quarter. There is no guarantee that earnings will be as good over the next year. (But of course, there is no guarantee that all bonds will continue to make their interest payments, either.) The earnings yield is the inverse of the more commonly cited price-earnings ratio.

Earnings come in varying qualities, as companies play games with numbers. The operating earnings are compiled by S.P., which tries to eliminate one-time events from reported profits, but S.P. no doubt makes some decisions about which people could quarrel. These numbers should not be taken as absolutely definitive.

And earnings yield is not the same thing as a dividend yield. Presumably the earnings that are not paid out in dividends are being reinvested for the shareholders’ benefit, but you won’t have to work very hard to find historical examples where that did not work out well for the shareholders.

But with all that, it is clearly unusual for stocks to be yielding more than bonds. And stocks have upsides that bonds lack. Earnings may rise. (They usually do, at least over time.) Bond payouts are fixed. If they change, it will be because the company ran into trouble and halted earnings payments.

At current low levels of interest rates, it is hard to make a case that junk bonds are a better investment than stocks.

Article source: http://economix.blogs.nytimes.com/2013/04/05/based-on-relative-yields-stocks-look-cheap/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.