CATHERINE RAMPELL

Dollars to doughnuts.

The latest Small Business Optimism Index data from the National Federation of Independent Business — a major industry group for small businesses that surveys a sample of its members each month — is very disappointing. The report, issued Tuesday, showed business optimism to be near recessionary levels in December. Hiring plans in particular weakened substantially.

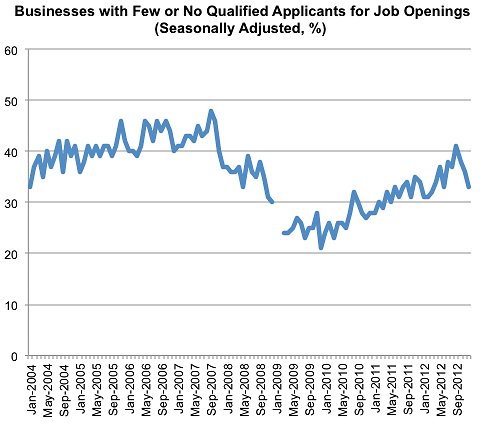

There was potentially one bright spot: the share of businesses saying that there were few or no qualified applicants for open positions fell for the third month in a row. In December about 3 in 10 firms said they had trouble finding qualified workers, down from about 4 in 10 in September.

Source: National Federation of Independent Business, via Haver Analytics. Gaps in the line represent missing data from those months.

Source: National Federation of Independent Business, via Haver Analytics. Gaps in the line represent missing data from those months.

It’s hard to tell if this is the start of a real, sustainable trend or just statistical noise. In any case, December’s figure is still bafflingly high, given that there were more than 12 million unemployed workers available to hire last month. That’s around three unemployed workers per available job, based on the latest Labor Department job openings data.

Despite the glut of workers, the share of small businesses saying they couldn’t find the talent they wanted was generally rising from December 2009 until September 2012, when it reached its highest point since the recession began five years earlier.

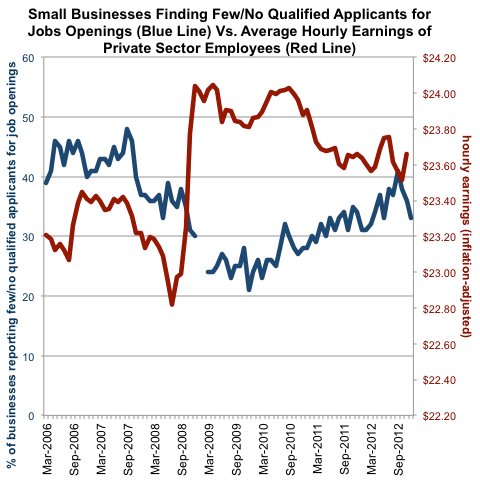

What’s especially odd about these survey responses is that if employers are having trouble finding qualified workers, they should be bidding up wages to attract the few qualified workers who are out there. But that’s not what the data show.

Source: National Federation of Independent Business and Bureau of Labor Statistics, both via Haver Analytics. Wages are adjusted using the consumer price index. Left vertical axis refers to small business survey data (blue line), and right vertical axis refers to hourly earnings data (red line).

Source: National Federation of Independent Business and Bureau of Labor Statistics, both via Haver Analytics. Wages are adjusted using the consumer price index. Left vertical axis refers to small business survey data (blue line), and right vertical axis refers to hourly earnings data (red line).

Average hourly earnings in the private sector fell over the period that businesses reported having increased trouble finding qualified workers (December 2009 to September 2012). Perhaps this means businesses are having trouble finding qualified workers precisely because they’re unwilling to pay new hires enough money. Since September, as you can see, wages ticked up slightly as businesses reported having less trouble finding workers, although both data sets are a little noisy.

One possible explanation for why a third of employers say they are having trouble finding qualified workers, despite the surplus of unemployed people, is that so many workers on the job market are long-term unemployed at this point. Employers are often loath to hire workers who have not been gainfully employed in a long time; some job ads even specify that workers must be currently or recently employed to be considered for an open position. That may mean that the very same pool of workers looks increasingly unattractive to companies as time marches on and those workers rack up more weeks of unemployment.

A corollary of all this is that relatively few new workers are joining the pool of unemployed — layoffs are near record lows — so employers may have already considered and rejected all the existing applicants for their latest job openings.

Other theories behind any of these trends?

Article source: http://economix.blogs.nytimes.com/2013/01/09/are-there-really-no-good-job-applicants-out-there/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.