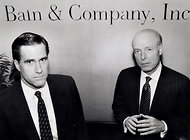

Justine Schiavo/The Boston GlobeMitt Romney, left, with William W. Bain Jr. in 1990. Mr. Romney began his rise in business working for Mr. Bain, who encouraged him to move into the private equity firm that he ran for 15 years.

Justine Schiavo/The Boston GlobeMitt Romney, left, with William W. Bain Jr. in 1990. Mr. Romney began his rise in business working for Mr. Bain, who encouraged him to move into the private equity firm that he ran for 15 years.

It was a long-held fear of Wall Street’s private equity titans. If Mitt Romney won the Republican nomination in 2012, the industry would come under intense scrutiny and withering attacks from his opponents.

As Mr. Romney has established himself as the front-runner in the large Republican field, those fears have come to fruition.

So the private equity titans are fighting back.

The industry’s lobbying group has hatched plans to counter the intensifying criticism of private equity’s business practices. In the coming weeks, the group, the Private Equity Growth Capital Council, will roll out an image campaign, according to two people with direct knowledge of the plans who requested anonymity because they were unauthorized to discuss them publicly.

Initiatives include online advertising that will promote the industry as one that creates jobs and expands companies. The council plans to reach out to political reporters and columnists in an attempt to disabuse them of what it views as gross misconceptions about private equity. It will also hire more people in the coming months, adding to its lean 10-person operation.

“There is a lot of misinformation being spread, purely for political purposes and on both sides of the aisle, as it pertains to private equity,” Steve Judge, the group’s interim president and chief executive officer, said in a statement issued on Monday. “While the business model has evolved over time, the fact of the matter is private equity provides capital and operational expertise to companies that are often underperforming or on the brink of failure.”

Those comments were in direct response to the stepped-up attacks against Mr. Romney’s business record this weekend.

Newt Gingrich said Bain Capital, the firm Mr. Romney ran, looted companies and left people unemployed. “When Mitt Romney Came to Town,” a soon-to-be released film backed by Mr. Gingrich’s political action committee, focuses on four soured Bain deals, including one where it laid off a hundred steel workers in South Carolina. A number of investigative articles in the media have also raised questions about Bain’s investment record while Mr. Romney ran the firm.

This is hardly the first time that the industry has come under assault. In 2007, the world’s largest firms, including Bain Capital, formed the private equity trade group at the peak of the buyout boom. Within months, the industry became a symbol of corporate greed and excess, in part a result of the lucrative initial public offering of the Blackstone Group and a fin de siècle 60th birthday party thrown by its chief executive, Stephen A. Schwarzman.

Michel Euler/Associated PressStephen A. Schwarzman, chief executive of the Blackstone Group.

Michel Euler/Associated PressStephen A. Schwarzman, chief executive of the Blackstone Group.

Congress, as it began to explore ways to cut the deficit, also homed in on what it saw as tax advantages enjoyed by Mr. Schwarzman and his private equity peers.

The trade group, originally called the Private Equity Council, fought back on tax reform, and has continued to lobby aggressively against it. It has so far succeeded in holding off any tax increase on private equity executives, though Congress is expected to again raise the issue this year.

One of the council’s core aims is to rebut what it views as negative stereotypes about the industry, promoting an image of private equity practitioners as job creators who fix and expand companies. It publishes studies and white papers with titles like “Driving Growth: How Private Equity Investments Strengthen American Companies.”

On its Web site it seeks to disprove various “fictions.” For example: “Fiction: Private equity firms are ‘quick flip’ artists that buy companies and sell them to make a fast buck.” It then tries to debunk the statement: “It takes time to grow and strengthen companies so that they are worth more to future buyers.”

The council has evolved in recent years. Originally a group of the 11 largest buyout shops, like the Carlyle Group and Blackstone, it expanded its membership ranks in 2010 and changed its name to the Private Equity Growth Capital Council.

The council’s rebranding, and its recruitment of smaller firms, was an attempt to promote the industry as doing more than just classic private equity transactions — the risky leveraged buyouts in which large amounts of debt are used to acquire big companies in deals that sometimes end up in bankruptcy.

But the council has had growing pains. Its first chief executive, Douglas Lowenstein, resigned last summer and the group has not yet found a permanent successor.

Last year, Mr. Romney’s former firm, Bain Capital, dropped out of the council. Bain’s partners decided to leave because of dissatisfaction with the group’s direction and the belief that its annual dues of nearly $1 million a year could be better spent elsewhere, according to a person with direct knowledge of the firm’s thinking.

Mr. Romney’s candidacy, combined with Bain’s withdrawal, have complicated the council’s lobbying and advocacy efforts, said two people with direct knowledge of its work. Most of the recent criticism of the industry has been focused on Bain, but the council has resisted directly refuting those attacks. It wants to remain nonpartisan and not appear in any way to be supporting Mr. Romney’s candidacy.

A number of the country’s top private executives — Blackstone’s Hamilton E. James and TPG Capital’s David Bonderman, for example — are big Democratic donors.

The private-equity-is-evil narrative first emerged during the 1980s, when buyout executives began using large amounts of debt to buy companies. They were branded as “barbarians at the gate,” which was the title of a 1990 book about the takeover of RJR Nabisco by Kohlberg Kravis Roberts.

A year before, The Wall Street Journal published a Pulitzer Prize-winning article by Susan Faludi about the human toll of K.K.R.’s leveraged buyout of the grocery chain Safeway. The article opened with a laid-off Safeway truck driver shooting himself in the head.

In 1994, Mr. Romney learned firsthand the power of a negative attack on private equity. That year, he started his political career by running for the Senate and challenging Senator Edward M. Kennedy. He promoted his record of job creation and building businesses at Bain.

Mr. Kennedy turned the tables on Mr. Romney by focusing on American Pad Paper, or Ampad, a company that, under Bain’s ownership, shed factory jobs and cut wages. The Massachusetts senator played television ads featuring laid-off Ampad employees, even though those layoffs occurred after Mr. Romney left Bain.

Mr. Romney later acknowledged that he was unprepared for Mr. Kennedy’s private equity assault.

“He characterized me as a coldhearted, unfeeling robber baron,” Mr. Romney said at the time, in an interview with The Boston Globe.

With Mr. Romney in the spotlight on a national stage and facing a well-funded Obama re-election campaign, the industry’s top officials know that Mr. Romney’s opponents will continue to push the portrayal of Mr. Romney as a fat-cat job-destroying deal maker.

“We were bracing ourselves for this but we’re not even in the general election yet,” said a senior private equity executive who spoke on the condition of anonymity. “Expect more pain.”

This post has been revised to reflect the following correction:

Correction: January 10, 2012

The first name of Hamilton E. James, the Blackstone Group’s top executive, was misspelled in an earlier version of this article.

Article source: http://feeds.nytimes.com/click.phdo?i=5ff1f0629752f9586a579eb9bc750619

Speak Your Mind

You must be logged in to post a comment.