Trulia, the real estate information site, rose 30 percent in its debut to open at roughly $22, defying the recent lackluster performance of newly public stocks.

It’s a solid debut for the start-up, which priced its offering at $17 per share late Wednesday, above its expected range of $14 to $16 per share. The company, which is based in San Francisco and trades under the symbol “TRLA” on the New York Stock Exchange, raised $102 million in its initial public offering.

As the housing market begins to show signs of life, investors are warming up to companies like Trulia that focus on real estate. Trulia’s I.P.O. follows last year’s debut of rival Zillow, which wowed Wall Street with a 79 percent pop on the first day pop. Earlier this month, Zillow successfully pursued a second stock offering, raising $172 million, more than in its I.P.O.

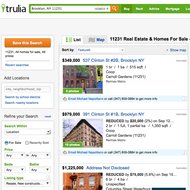

Trulia, a real estate information site.

Trulia, a real estate information site.

Zillow fell about 1 percent on Thursday morning to $45 per share. However, its shares remains 125 percent above their offering price.

Despite rising enthusiasm for Trulia and Zillow, some analysts have questioned whether their financial results merit such lofty valuations. Trulia, which helps consumers find information on real estate listings and home loans, has yet to record a profit. The company’s revenue nearly doubled in 2011 to $38.5 million, but its loss widened to $6.2 million. In its prospectus, the company also warned that it expects to make significant, future investments to expand its business, which could hamper future profitability.

Article source: http://dealbook.nytimes.com/2012/09/20/trulia-jumps-30-in-debut/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.