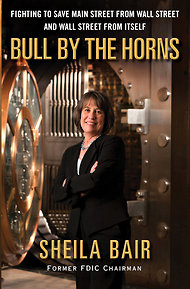

Chip Somodevilla/Getty ImagesSheila Bair has written a book about her time as chairwoman of the F.D.I.C.

Chip Somodevilla/Getty ImagesSheila Bair has written a book about her time as chairwoman of the F.D.I.C.

Sheila C. Bair, who tormented Wall Street and its Washington allies as a banking regulator, is taking a fresh swipe at her foes in retelling the dark days of the financial crisis.

In a book to be released on Tuesday, the former chairwoman of the Federal Deposit Insurance Corporation takes aim at the bankers she blamed for the crisis. She also criticized fellow regulators, including current Treasury Secretary Timothy F. Geithner, for their response to the problems.

Ms. Bair painted Mr. Geithner, the former head of the Federal Reserve Bank of New York, as an apologist for Wall Street, opposing some postcrisis reforms. She questioned whether his effort to inject billions of dollars into nine big banks masked a rescue intended solely for Citigroup, a theory that other government officials have rejected.

Related Links

“Participating in these programs was the most distasteful thing I have ever done in public life,” said Ms. Bair, in the book, “Bull By the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself.”

People close to Mr. Geithner note that he issued early warnings about Wall Street risk-taking and championed a regulatory crackdown on big banks.

Lee Sachs, a former top Treasury Department official, said on Monday that Mr. Geithner never acted to protect Citigroup or any single institution, but rather the entire system. In 2004, the New York Fed under Mr. Geithner ordered Citigroup to pay $70 million for consumer lending violations.

“If anything, he was quite focused on the pain the country was suffering,” Mr. Sachs said.

Another government official who attended some of the meetings with Ms. Bair and Mr. Geithner said she was overstating the animus. A Treasury Department spokeswoman declined to comment on Ms. Bair’s attacks because officials had not read the book.

In a statement, a Citigroup spokeswoman defended the bank, whose bailout earned a profit for taxpayers. “Since Vikram Pandit became C.E.O. during the financial crisis, Citi has executed a strategy based on returning to the basics of banking and building a culture of responsible finance. It is a simpler, smaller, safer and stronger institution than it was five years ago and this record speaks for itself.”

Drawn from personal e-mails and notes, Ms. Bair’s book joins the growing collection of financial crisis histories. While the book contributes a few revelations to the annals of Wall Street, Ms. Bair mostly notably highlights the challenge of being the only woman in the room. At crucial times during the crisis, she said, Mr. Geithner and other top regulators kept her in the dark.

“Maybe the boys didn’t want Sheila Bair playing in their sandbox,” she wrote.

A Kansas native, Ms. Bair portrayed herself as a lifelong Republican with a populist streak. She was among the first regulators to sound the alarms about the subprime mortgage bubble. When the crisis emerged, she pushed for banks to replenish their capital cushions.

Ms. Bair, who is now senior adviser to the Pew Charitable Trusts, spent much of the book criticizing the go-go attitude that fueled the crisis. She also delivered blistering assessments of several crisis-era chiefs. She said, for example, that the deal-making skills of Kenneth D. Lewis, then Bank of America’s chief, “were clearly wanting.”

But she saved the sharpest critique for Mr. Geithner, calling him the “bailouter in chief.”

When the F.D.I.C. was negotiating the contours of a plan to guarantee bank debt, she said that Mr. Geithner pushed the agency to charge banks only a “minimal” fee in return for the government support. Mr. Geithner and other regulators argued that it was counterproductive to assign hefty costs at a time when the industry needed saving.

“Geithner just couldn’t see things from my point of view,” Ms. Bair wrote.

Over her five-year tenure, Ms. Bair struggled to break into the clubby nature of high finance, detailing in the book how Mr. Geithner and others shut her out of major decisions. The F.D.I.C., for example, was not involved in picking which banks would receive the first round of bailout funds. One regulator circulated an e-mail questioning “the audacity of that woman.”

Much of the book is devoted to the regulators’ dealings with just one company, Citigroup, which received more government support than any other bank. Ms. Bair fleshed out her frustrations with Mr. Geithner and his desire, in her eyes, to treat a dysfunctional bank with kid gloves.

She even suggested that the industrywide bailouts were meant mainly to help Citigroup. Other commercial banks were in considerably better shape, she noted, and beleaguered investment banks like Morgan Stanley had secured private investments.

“How much of the decision-making was being driven through the prism of the special needs of that one, politically connected institution?” Ms. Bair wrote.

Other players in the crisis will most likely criticize her concerns as reductive, especially in light of major problems at Bank of America, which required two bailouts. While other banks were healthier than Citi, regulators opted for an across-the-board plan to instill confidence in the industry and the economy.

Even so, Ms. Bair laid out new details in the book suggesting that regulators went further than previously thought to protect Citigroup.

Early on in the crisis, she said, Mr. Geithner wanted Ms. Bair’s agency to financially support Citigroup’s planned $1-a-share acquisition of Wachovia. In turn, the F.D.I.C. would receive $12 billion in preferred stock and warrants.

Mr. Geithner and Citigroup held private talks about the deal without telling Ms. Bair, according to her account. Regulators then planned to allow Citigroup to count the stock as capital, a boost to the bank’s “sagging capital ratios.”

When Wells Fargo swooped in with a higher offer that required no government backing, Ms. Bair indicated her support for the new deal. Mr. Geithner, she said, was “apoplectic” and wanted the F.D.I.C. to stand behind Citigroup, which then raised its bid. The Fed ultimately approved the Wells Fargo deal and Citigroup required two infusions of government capital.

As Citi continued to suffer in 2009, Ms. Bair pressed for the bank to put its troubled assets into a “bad bank” supported by private money. Ms. Bair said she received no support from other regulators, who feared it would unnerve the markets.

In the book, Ms. Bair also scrutinized Mr. Geithner’s approach to reforming Wall Street. Detailing new elements of the debate over the Dodd-Frank act, she argued that Mr. Geithner worked with Republican lawmakers to “water down” new regulations like the so-called Volcker Rule. Other people close to the Dodd-Frank debate recall that Mr. Geithner supported the rule but agreed to exemptions to secure Republican votes.

When Ms. Bair and other officials mentioned to lawmakers their concerns about a draft version of the legislation, she said Mr. Geithner summoned regulators to deliver an “expletive-laced tongue lashing.”

For her part, Ms. Bair acknowledged her own temper flare-ups. When preparing for Congressional testimony one night, she recalled having stomped out of the room in a fit of exhaustion. Ms. Bair, who received a security detail after threats on her safety, also lashed out at journalists who she felt were unfair, underscoring her sensitivity to the glare of the spotlight.

“I get cranky when sleep-deprived,” she wrote.

Bull by the Horns Chapter 1 (PDF)

Bull by the Horns Chapter 1 (Text)

Article source: http://dealbook.nytimes.com/2012/09/24/ex-regulator-has-harsh-words-for-bankers-and-geithner/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.