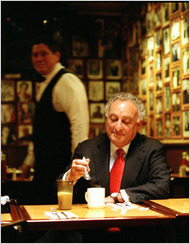

Damon Winter/The New York TimesSanford I. Weill, whose Primerica acquired Travelers, which merged with Citicorp in 1998.

Damon Winter/The New York TimesSanford I. Weill, whose Primerica acquired Travelers, which merged with Citicorp in 1998.

Citigroup‘s longstanding relationship with the life insurance company Primerica is coming to an end, as the bank prepares to sell the last of its remaining shares in the firm it took public last year.

The bank “has commenced a public offering of approximately 8 million shares of Primerica’s common stock, representing all of the remaining shares beneficially owned by Citigroup immediately following Primerica’s initial public offering,” according to a statement by Primerica on Tuesday.

Primerica, based in Georgia, was a keystone of the plan Sanford I. Weill, Citigroup’s former chief executive and chairman, came up with to create a global financial supermarket. But after the financial crisis, as the bank was badly battered and scrambling to spin off noncore assets, Citigroup’s chief executive, Vikram S. Pandit, decided to take Primerica public, an offering that raised $320.4 million and left the bank holding approximately 40 percent of the company’s shares.

Last month, Citigroup further diluted its stake in Primerica to about 12.5 percent, allowing nearly 9 million of its shares to be repurchased by the company at a price of $22.42 a share. The latest offering of about eight million shares is being run by Citigroup Global Markets, with the proceeds going to a subsidiary of Citigroup, Primerica said in its statement.

Primerica’s largest shareholder is now Warburg Pincus, the private equity firm, which controls approximately 22 percent of the company’s shares.

Primerica’s stock was down about 6 percent in premarket trading on Tuesday.

Article source: http://feeds.nytimes.com/click.phdo?i=d29a4c77e02af6b6bd2445e4e1be87b0

Speak Your Mind

You must be logged in to post a comment.