Even so, “there are specific things that are hard to imagine being attributed to anything else” other than the tax legislation, said Alan Auerbach, professor of economics and law at the University of California, Berkeley, and Professor Slemrod’s co-author on the study of the 1986 reform.

With that in mind, here’s a look at the major areas where Mr. Trump claims credit.

The Stock Market

The S.P. 500 index rose 23 percent during Mr. Trump’s first year in office, an increase surpassed only by Franklin Roosevelt and Barack Obama, both Democrats who took office in the wake of financial crises and stock market crashes. Mr. Trump’s policies and Republicans in Congress deserve some credit, given that economists expect the cut in corporate taxes to raise company earnings, and stock prices are fundamentally a reflection of earnings expectations.

“There’s no question after-tax earnings will be higher” thanks to the tax legislation, Professor Slemrod said.

But the estimated impact on after-tax earnings — a range of 7 to 10 percent, according to most economists — accounts for less than half the stock market’s rise over the past year. The rest is because of other factors, which may include Mr. Trump’s pro-business outlook, but also many things beyond his control.

Stock market valuations are reaching lofty levels by many measures, and those gains may prove ephemeral if growth doesn’t live up to investors’ rosy expectations. “The value of the stock market isn’t an indicator of the economic health of America,” Professor Slemrod noted.

The Economy

Gross domestic product grew by 2.3 percent last year, lower than Mr. Trump’s predictions of 3-plus percent, but significantly better than the 1.6 percent growth in 2016, Mr. Obama’s last year in office.

As should be obvious, passage of the Republican tax legislation was too recent to have had any impact on those numbers. To the extent that expectations of tax reform fueled investment decisions, they may have had some effect, but that’s nearly impossible to measure.

Advertisement

Continue reading the main story

The first real clues will come next year, when 2018 gross domestic product numbers are released. The Joint Committee on Taxation estimated that the new tax legislation would raise G.D.P. by seven-tenths of a percent over what it would have been under the old law.

“The economy has been strong, and forecasts for next year have been bumped up due to the tax cut, ” said Professor Auerbach. “But there’s a lot going on. You won’t be able to tell what the impact is from just a few quarters.”

Even 10 years after the 1986 law, “it was very difficult to tease out the impact of tax reform on the economy,” he said. “The best estimate is it didn’t have much effect.”

Professor Slemrod agreed. “Tax policy might not be as critical to the rate of business investment as had been thought,” he said.

Still, if United States economic growth hits Chinese levels of 7 percent a year or more, which Mr. Trump repeatedly has said is attainable, then Republicans will have a “much stronger” basis for claiming credit for it, Professor Slemrod said. But he deemed such an outcome “extraordinarily unlikely.”

Wage Growth and Bonuses

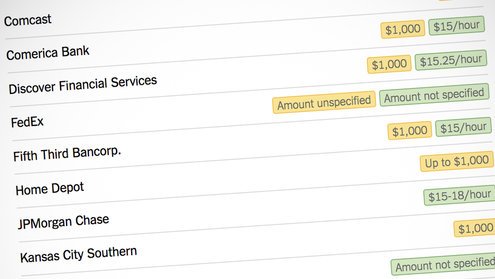

What Companies Are Doing With Their Savings From the Tax Law

The tax overhaul has prompted hundreds of employers, including at least 40 members of the Standard Poor’s 500-stock index, to pass on savings to workers.

Many companies have been doling out bonuses to employees since the tax legislation passed, but “I don’t think that tells us anything,” Professor Slemrod said. That’s because in standard economic theory, labor market conditions dictate employee compensation levels, not cash flow or profitability.

“The labor market was strengthening long before Mr. Trump was elected or the tax bill was passed,” Professor Slemrod said. “If companies were going to raise wages anyway to stay competitive, they have a public relations incentive to attribute it to tax cuts.”

Wage growth actually slowed during the first year of Mr. Trump’s presidency compared with the last year of Mr. Obama’s.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

Mr. Auerbach added that given the length of the recovery and low levels of unemployment, many economists “have been wondering why we haven’t seen stronger wage growth” as competition for labor heats up. “Now we may be starting to see it.”

Advertisement

Continue reading the main story

Much the same can be said about unemployment, which fell to 4.1 percent from 4.7 percent during Mr. Trump’s first year as president, and which also reflects the tight labor market conditions that have been developing for years. The unemployment rate fell much more during the Obama years (three full percentage points, from when Mr. Obama took office until when he left), which would be expected given the severe recession he inherited.

In any event, it’s far too soon to evaluate Mr. Trump’s impact on the labor market. Economists generally agree that at least some of the Republican tax cuts will flow through to workers, although there are widely differing projections about how much, and most say the largest share will go to shareholders in the form of dividends, stock buybacks and higher share prices. Professor Slemrod said we may never know for sure, but “in five or six years we may be able to tell if some of the more extreme claims are reasonable.”

Interest Rates and Inflation

It’s interesting what President Trump didn’t claim any credit for: low interest rates and inflation. Perhaps that’s because they’re moving upward, although slowly, and pose the biggest threat to the economic indicators he extolled. (On Wednesday the Federal Reserve kept its benchmark rate unchanged after raising it three times during the last year.)

Unlike the 1986 tax legislation, which claimed to be revenue-neutral, the latest Republican bill is a huge tax cut. The Joint Committee on Taxation estimated that the new law would add just over $1 trillion to the deficit over the next decade. It predicted higher interest rates as a result, which it estimated would cost the Treasury an additional $66 billion in debt service costs.

Some supporters of the tax law contend that economic growth will come so quickly that increased tax revenue will more than make up for the cuts. The actual impact on the deficit won’t be evident for at least a year, but the rising deficits that followed tax cuts in 1981 forced Republicans to raise taxes in both 1982 and 1984.

Interest rates are already trending higher. Both Professors Auerbach and Slemrod agreed that rates are likely to rise further and would be an important measure of the impact of the tax legislation and Mr. Trump’s economic policies. If they rise faster than at the cautious pace the Federal Reserve has projected and investors expect, that could bring the stock market rally to an abrupt end. Higher-than-expected rates could also slow the economy, or even tip it into recession.

How sensitive the stock market is to interest rates was on display the same day as Mr. Trump’s speech, when shares plunged on fears of higher rates after the 10-year Treasury yield rose above 2.7 percent; that’s still very low by historic standards, but higher than when Mr. Trump took office.

The big tax cut is a large economic stimulus, and “right now stimulus is a danger,” said Professor Auerbach, given that there is nearly full employment and already-strong economic growth.

We’ll know a year from now whether the Federal Reserve stuck with its projected three increases in rates this year, and whether any exceeded quarter-point increments.

Advertisement

Continue reading the main story

The bottom line: Presidents tend to get credit (or blame) for whatever economies they preside over, but it’s far too soon to evaluate Mr. Trump’s long-term impact. Even after years have passed, Professor Slemrod said, “We’ll never know with 100 percent certainty.”

Continue reading the main story

Article source: https://www.nytimes.com/2018/02/01/business/economy/trump-tax-cuts-economy.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.