Carl Richards is a certified financial planner in Park City, Utah. His sketches are archived here on the Bucks blog. His new book, “The Behavior Gap,” will be out in January.

Of all the phrases in the financial planning world, “I don’t know” may well be the most powerful.

There are other phrases like “it depends” that are similar, but underlying them all is the fact that we are trying to make money decisions without a great deal of certainty. The reality is that we just don’t know what the next five, 10 or 20 years are going to look like.

Sure we can model it based on history, but that would just be a model. One of the most dangerous things I see in the investment and financial planning world is a false sense of precision.

In fact, I think there is a tremendous sense of freedom that comes with recognizing that we just don’t know what the future will look like. At that point, the process of financial planning becomes about making the best guess we can about that future. Then we consistently course correct as we go, before we get too far off track.

You may have heard me use this example before, but I often put it in terms of a pilot’s flight plan. Pilots take the process of preparing a flight plan very seriously, but they also know that the moment they take off, their plan will probably need to be changed. The weather may change, birds may start migrating or the airport they’re headed to may close halfway there. All they know for sure is that they’ll need to make ongoing course corrections throughout the flight.

Accepting the fact that we just don’t know allows us to let go of any anxiety around the idea that we should be able to find someone who does know. And let me share a secret with you about that: There isn’t anyone who knows what the next week, month, year or even decade will look like in the stock market. Anyone who says they do is someone you should run from.

What are some other things we just don’t know?

1) When our certificate of deposit rates are going to move up.

This comes with all sorts of implications. If you are waiting to refinance your house because gurus are telling you that interest rates will go down, please realize that they just doesn’t know what they’re talking about.

How many people have been sitting in money market accounts earning virtually zero because C.D. rates were “only” 1.5 percent and surely they would be going up soon? The reality is no one knows when interest rates will go up.

In fact, the academic evidence is pretty clear. The best estimate for future interest rates is today’s interest rates, meaning we just don’t know.

2) The direction of housing prices.

3) When the economy is going to turn around.

4) What’s going to happen to Apple (or Google or G.E. or Pepsi) stock.

The reality is no one knows. Jim Cramer doesn’t know. The teams of experts from the large banks and brokerage firms don’t know. And we all know what happens when you rely on a Federal Reserve chairman knowing. It turns out he doesn’t know either.

It’s so tempting to believe that there’s someone out there, someone with a big enough computer or access to a huge research staff. But there isn’t. And even if there is, it’s highly improbable that you or anyone will identify them beforehand, when their predictions will be of any value.

Sure, there are plenty of people who can claim that they got a certain prediction correct after the fact. But remember, if you’re in the prediction or forecasting business, you’re bound to get a few right, just like a broken clock is right at least twice a day.

If you choose to get help making financial decisions, look for someone with the experience to help you navigate the uncertainty. Someone who understands that the really important part is the ongoing course corrections based on what you learn in the future.

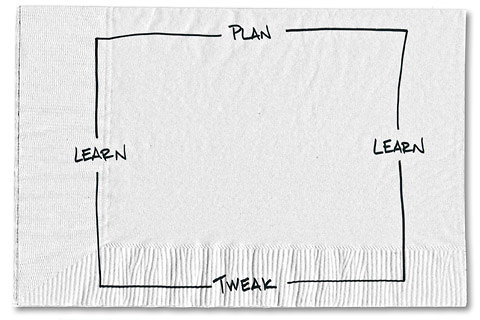

Sorting out our financial lives involves process, not products, and it means making the best decisions we can, learning new information as we go, making subtle tweaks based on that information and continuing to do so over and over and over again.

Article source: http://feeds.nytimes.com/click.phdo?i=6a6df8d6fbae9856a94f8762d51d26f3

Speak Your Mind

You must be logged in to post a comment.