Carl Richards

Carl Richards

Carl Richards is a financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

If you’re an entrepreneur, you’ll spend years pouring everything — time, money, passion — into your businesses with the hope that someday it will pay off. If things go well, you’ll wake up one morning and find yourself with excess time, energy and, of course, cash.

Great! But now you have to figure out what do with that cash, and this is when things can get dangerous, fast.

Most entrepreneurs get twitchy at the thought of idle money. They’re used to taking big chances and are comfortable with risk. So, there’s a temptation to assume the same approach to controlled risk when investing outside their business.

One of the smartest guys I know runs an incredibly successful company but provided a textbook example of this approach. As the business matured and started throwing off excess cash, he began thinking about what to do with it. He invested in some pretty strange ventures. He backed a doctor with a new toothbrush design, a car wash and a company that made kayak paddles.

He knew nothing about any of these businesses. Not surprisingly, he lost that money.

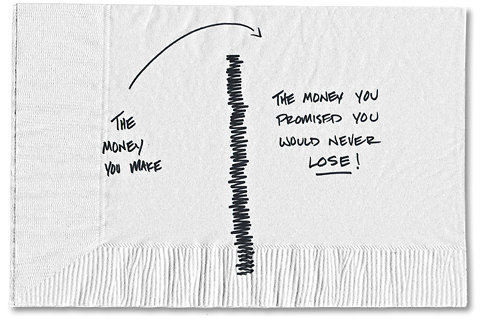

Instead of sticking to what he knew to make money and protecting the profits, he made the classic mistake of thinking he could do more. He took risks with money that he promised himself he would never lose.

It’s like what Warren E. Buffett said about the super-smart and incredibly wealthy founders of Long-Term Capital Management, who ended up doing something really dumb: “To make money they didn’t need, they risked what they did have and did need, and that’s foolish.”

Don’t be foolish. If you’re fortunate to have enough money to last for a good long while, the game can, and should, change. Of course you can still focus on growing your business. Or, if you’re a serial entrepreneur, you can build the next one. But at the same time, you can start building a portfolio to protect your future.

One thing I have heard over and over when interviewing successful entrepreneurs is the idea of what I call the Over-the-Wall Portfolio. Of course, the entrepreneurs didn’t call it that. They often referred to it as the safe money or the money they promised their spouse they’d never lose.

Whatever you call it, the concept is pretty simple: You take the excess cash your business generates, or the lump sum from the sale of a business, and throw it over the wall into stable (and probably boring) investments.

Then you forget about it.

The allocation of an Over-the-Wall Portfolio will vary, but here are a few general guidelines to consider:

- Boring. Remember: excitement comes from being an entrepreneur (or the movies), not your over-the-wall money.

- Liquid. If something goes wrong, you want to be able to get to the money.

- Diversified. You can get rich by putting all your eggs in one basket, but you stay wealthy by being diversified.

- Passive. The Over-the-Wall Portfolio can’t depend on you for day-to-day management. You’re too busy with your business and having a life. The last thing you should be doing at night is logging into your day-trading account.

The best part of this strategy? It lets you get back to doing what you do best — running your business. But you get the added comfort of knowing that if your business fails, you’ll be O.K.

Eventually, my entrepreneur friend recognized his problem. One day, he told me, “Carl, I finally figured it out. My job is to stay focused on my business and make money. And with the money I make, I have to be sure I never lose any of it.”

I couldn’t have said it better myself.

Article source: http://bucks.blogs.nytimes.com/2012/12/17/the-over-the-wall-portfolio-for-excess-cash/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.