Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at BAM Advisor Services. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

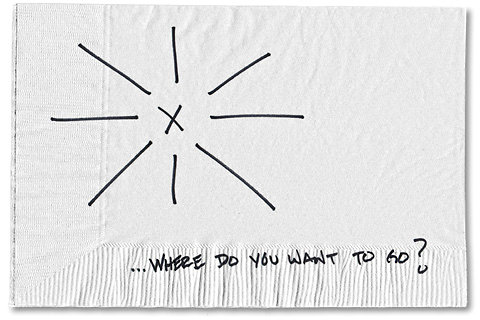

If you managed to get unstuck and created your personal balance sheet recently, then you should have a really clear idea of where you are today. The next questions you need to be address are these: Where do you want to go? What are your financial goals?

This can be a frustrating process, since it involves making some really important decisions under extreme uncertainty. None of us know what next week will look like, let alone where we will be in 30 years. On top of that, making financial goals involves a whole bunch of assumptions — guesses, really.

We have to guess what our 60- or 80-year-old self will want to do. We have to guess what the markets will do, where interest rates will be and how much we can save. Those reasons and many more often lead us to forget that this is a process. We get stuck, unsure what to do next.

Well, despite all the uncertainty and assumptions, we need to have goals. It reminds me of the conversation between Alice and the Cheshire Cat:

“Would you tell me, please, which way I ought to go from here?”

“That depends a good deal on where you want to get to,” said the Cat.

“I don’t much care where,” said Alice.

“Then it doesn’t matter which way you go,” said the Cat.

“— so long as I get somewhere,” Alice added as an explanation.

“Oh, you’re sure to do that,” said the Cat, “if you only walk long enough.”

But the problem is that we do care where we end up, and part of deciding where to go depends on setting goals.

So there are a few really important things to keep in mind here. Before you get too excited or frustrated, here are a few things to consider.

1. These are guesses.

While it is important to admit these are guesses, you should still make them the best guesses you can. Be specific. Just saying, “I want to save for college for my kids,” isn’t enough. How about, “I’ll find $100 to add to a specific 529 account on the 15th of each month”?

Even though you need to be specific, give yourself permission to be flexible. An attitude of flexibility goes a long way toward dealing with uncertainty. There is something very powerful about having specific goals but not obsessing about them.

2. These goals will change.

It’s a continuing process, and it will change because life changes. But don’t let this knowledge stop you from doing it. You need to start somewhere.

3. Think of these goals as the destination on a trip.

You would never spend a bunch of time and energy worrying about whether you should take a car, train or plane without first deciding where you are going. Yet we spend countless hours researching the merits of one investment over another before we even decide on our goals. Why are you stressing about what stocks to pick if you don’t have goals in mind?

4. Prioritize these goals.

Once you have them all written down, rank each goal in terms of importance and urgency. Sometimes you will have to deal with something that is urgent, like paying off a credit card bill, so you can move on to something really important, like saving for retirement.

5. This is a process.

If you set goals and then forget about them forever, that is a worthless event. This is a process. Since we’ve given ourselves permission to change our assumptions about the future as more information becomes available, we need to do it. Part of the process of planning involves revisiting your goals periodically to see how you are doing and making course corrections when needed.

6. Let go!

As important as it is to regularly review your progress, it’s also very important to let go of the need to obsess over your goals. Define where you want to go, review your goals at set times, and in between, let go of them! Goals for the future are important, but so is living today. Find that balance.

This list may not seem like a big deal, but you would be surprised at the number of people who cannot tell you their goals, let alone break them down into categories or rank their priority. Once you have your goals, you will be able to move on to the next step: making a plan.

Article source: http://bucks.blogs.nytimes.com/2012/10/29/six-tips-for-setting-your-financial-goals/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.