Carl Richards

Carl Richards

Gathering information — being in the know — is not the same thing as being mindful, being aware, being present for what’s actually going on behind the news and the chatter and the stuff that just doesn’t matter.

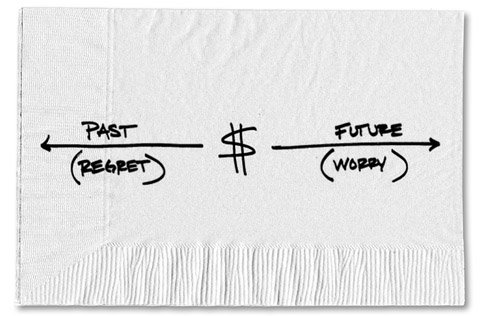

Often when we think about money, it’s in terms of either past mistakes or worries about the future. Both of those types of thoughts take us away from focusing on the present.

Many people have a tendency to beat themselves up when they make a financial mistake. But most of us should spend less time worrying about things we could or should have done differently.

Patricia Wall/The New York Times

Patricia Wall/The New York Times

Instead, we can use our experiences to help ourselves and others avoid similar mistakes without getting involved in feelings of blame or feelings of shame. We can look at our mistakes, make note of the lesson and move on.

Spending too much time worrying about the future can also undermine our enjoyment of the present. This is a tricky issue for me because my work often involves encouraging people to have more meaningful conversations about the role that money plays in their lives — and normally such talks revolve around plans for the future.

One solution is to draw a line separating the time that you spend focused on planning for the future and the time you spend living for today.

Planning for the future is very important, but it needs to be done in isolation to avoid overshadowing the joy of today.

Think about setting aside time each month to evaluate your recent financial behavior. Try to identify any mistakes you may have made, and note the lessons that you need to learn. Think about your goals and what you should do now to move closer to reaching them.

Once you’ve done that, get on with living your life.

Money decisions are emotional decisions — and making good money decisions requires emotional clarity. So try to pay attention to your emotions around money. This can be as simple as considering how you feel when you get your monthly investment statement or when a medical bill arrives in the mail. Acknowledging those feelings and being aware of their potential impact on your decisions can be important, often in ways that aren’t clear right away.

I’ve found myself asking some really fundamental questions during the last several years. Whom I can trust? What’s really important to me? What do I really value? How much is enough? How should I really be spending my time?

I’ve watched as close friends have lost their businesses, their homes and even friendships over money. I’ve seen friends struggle to find jobs at a time when they had planned on being well into retirement. Other friends have had to move parents into care facilities that fall short of their family’s hopes but are all that they can afford. I’ve seen my own children’s disappointment when I had to tell them that we couldn’t afford something they really wanted.

When we go through these experiences we can feel sorry for ourselves and get angry. Or we can try to understand past mistakes, practice self-awareness and act from our deepest instincts.

Which approach will bring us closer to reaching our most important goals?

Excerpted from “The Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” published by Portfolio/Penguin. Copyright © Carl Richards, 2012. Reprinted with permission.

Article source: http://feeds.nytimes.com/click.phdo?i=6d8c2afa6dfcd62e7bbe517c90ab6a3f

Speak Your Mind

You must be logged in to post a comment.