A new analysis suggests that the tide of home foreclosures isn’t going to recede soon.

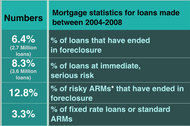

The report from the Center for Responsible Lending, “Lost Ground, 2011,” finds that at least 2.7 million mortgages loaned from 2004 through 2008, or about 6 percent, have ended in foreclosure and that nearly 4 million more home loans (roughly 8 percent) from the same period remain at serious risk.

Put another way, “The nation is not even halfway through the foreclosure crisis,” says the report, which analyzed 27 million mortgages made over the five years.

While most of those who have lost their homes are white, the report found, African-American and Latino borrowers have been disproportionately affected. Roughly a fourth of all those borrowers have lost their home to foreclosure or are seriously delinquent, compared with just under 12 percent for white borrowers.

And across the country, low- and moderate-income neighborhoods and neighborhoods with high concentrations of minorities have been hit especially hard, the report found.

The Center for Responsible Lending is a nonprofit group that works to eliminate abusive financial practices.

Its report also noted that certain types of loans have much higher rates of completed foreclosures and serious delinquencies. They include loans originated by brokers; hybrid adjustable-rate mortgages, option ARMs, loans with prepayment penalties and loans with high interest rates (subprime). African Americans and Latinos were more likely to receive a high-cost mortgage with risky features, regardless of their credit. For example, among borrowers with good credit (a FICO score of over 660), African-Americans and Latinos received a high-interest-rate loan more than three times as often as white borrowers.

Accompanying the report is an online map showing foreclosures and delinquencies by state.

Are you at risk for foreclosure? How has your neighborhood been affected by the crisis?

Article source: http://feeds.nytimes.com/click.phdo?i=9c9eeced7b2b02c7a84403b6c3404f4a

Speak Your Mind

You must be logged in to post a comment.