Carl Richards

Carl Richards

Carl Richards is a financial planner in Park City, Utah, and is the director of investor education at the BAM Alliance. His book, “The Behavior Gap,” was published last year. His sketches are archived on the Bucks blog.

A recent New York Times article highlighted the sad trend of investors getting fleeced after putting their money in exotic, alternative investments they hoped would help them recover from past investing losses.

I understand the problem. Many of us lost a bunch of money in 2008-9. And if you’re retired or coming up on retirement, the situation is even tougher. You’re sitting on less money than you planned for and have little time to rebuild your savings.

At the same time, you may have been planning to live off the income from that money. But with interest rates near zero, the income you can safely earn has been cut dramatically.

It’s a double whammy! Less money, earning less interest.

That is leading to a frantic search for alternative investments that can make up the difference quickly.

Often the search for a “solution” comes in two flavors:

- Looking for investments that will grow fast. This is a bit like doubling down at the casino to make up for losses, often with the same outcome.

- Looking for investments that pay higher interest. This is also called “chasing yield.” When traditional, income-generating vehicles like savings accounts or certificates of deposit are paying next to nothing, you start looking for something “just as safe,” but with a higher interest rate.

Enter slick salespeople with alternative investments that just happen to solve your problem. One sentence in the Times article perfectly illustrates this point:

While the offering was unfamiliar — part ownership in a fleet of luxury cars — Ms. Beck bought the pitch because her broker had been around for years, and the product offered what seemed to be a modest annual interest rate of 7 percent.

Who wouldn’t prefer a “modest 7 percent” return to living with stock market gyrations or earning 1.5 percent on a bank C.D.? Sign me up!

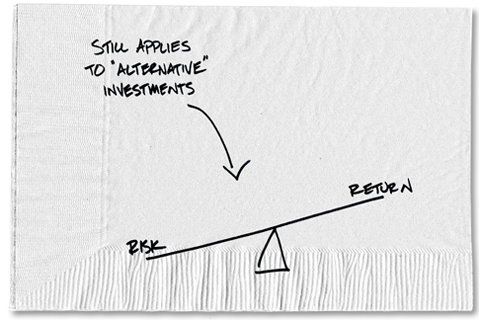

It would be great if we could find an alternative investment like this, but what we’re really talking about is finding an alternative to the basic idea of taking a risk to generate a return. The trouble is that risk and expected return are still — and will always be — closely related.

Take, for instance, stock mutual funds, which come with the risk that the value of your investment will go up or down a lot in the short term. The reward comes over the long term, with the higher returns historically associated with owning stock versus other types of investments.

Now there are other “safer” investments that don’t come with as much risk, but offer a smaller reward, like bank C.D.’s. It’s common to see alternative investments pitched as comparable to these safe investments, but the numbers tell a different story.

The current average one-year C.D. nationwide pays 0.6 percent, and a five-year Treasury bill yields 0.78 percent. Those returns should give you a benchmark for the return on a relatively low-risk investment.

So when someone comes to you offering an investment that’s “just like a C.D.,” but it pays 7 percent, guess what: This investment is NOT just like a C.D. If it was just like a C.D., it would pay you what you expect a C.D. to yield.

Yes, we’re in a terrible, tight spot. But the answer isn’t to hope that a dubious, new product someone sells you will solve your problem. The odds are high it will only make things worse.

Let’s use these sad stories of fraud and loss as a important reminder. Be honest with yourself if you discover what appears to be a brilliant loophole to the fundamental rules of investing. As tough as the current situation is, you’re likely to make things worse when you think you can separate risk from expected returns.

Article source: http://bucks.blogs.nytimes.com/2013/02/26/beware-of-investments-promoted-as-just-like-a-c-d/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.