Carl Richards

Carl Richards

Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at BAM Advisor Services. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

Graduate from college, get a job with a stable paycheck that grows each year by a little, work for 30 or 40 years and retire with a pension.

While it may have been common among Tom Brokaw’s book “The Greatest Generation” and even with many baby boomers, the idea of working at the same place your whole life, having a stable paycheck and getting a pension check afterwards seems like a fairytale now. It’s hard to pin down the numbers, but increasingly it seems like we’re facing the new reality of living in Daniel H. Pink’s book, “Free Agent Nation”.

It is a place where many of the structures we used to rely on have either gone away or are predicted to go away. Retirement accounts we manage ourselves have replaced company pensions, and in many cases our income has become more variable.

The issues that come with variable or lumpy incomes are not new. Think of farmers, small business owners and artists. Add to that list all the real estate agents, trial attorneys and other jobs that rely heavily on commissions or bonuses. These jobs come with fat years followed by lean ones.

But most of the personal financial literature focuses mainly on the nonlumpy, on people with steady incomes and a paycheck every two weeks.

For this group, it’s logical to think of saving a percentage of your income each year and allocating that savings to different buckets, like college and retirement. It’s a strategy that works fine if your income is steady and steadily growing over time.

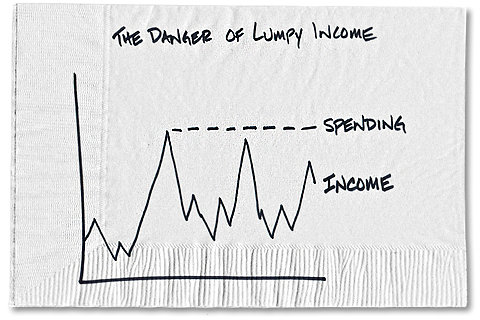

This approach gets confusing when you fall into the lumpy category though. In one year you may have X amount, then the next year you may may earn 10 times X or one-tenth of X. The variation can be incredibly difficult to predict, making it a challenge to plan for your financial future.

For example, think of artists who have a big art show and make two to three times their annual income from that one show. They may not make any income during the next two years while preparing for a new show.

You may not be an artist, but it’s hard to miss the drastic changes in the job market. How many people still work for the same employer for 30 years? I predict that over time more of us will face the challenge of lumpy incomes even if we don’t right now.

People with lumpy incomes need to think about financial planning a bit differently. Many of the standards will hold true, but if you find yourself looking at a lot of ups and downs in your income, you want to be aware of a few things.

1) SPENDING When you have that first big year, where your income is two, three, or even 10 times as big as your previous high mark, there’s a tendency to think of it as the new normal. It’s easy to assume that you’ll always earn that new income. It’s also very easy to start and continue spending at that level.

A friend told me the story of a trial attorney she knew who won a big trial many years ago. He made upgrades to his lifestyle that he still follows today, even though he hasn’t had another big win since the original one. It’s starting to catch up with him, but he appears unwilling to modify his lifestyle. So with your first big year, be careful that you don’t reset your expectations to a markedly higher level and then years later realize you’re in trouble.

2) SAVINGS Depending on your situation, saving a percentage of your income may still make sense, but it can also help to think in terms of setting a spending threshold. With a spending threshold, you spend a certain amount and then everything over that amount gets saved. From that savings, you’ll allocate some to retirement, education or other goals you’re working towards.

3) TAXES Often people with lumpy incomes are in for a big surprise every April. You’ll want to work with a certified public accountant to set aside enough to cover you, particularly if you’ve done really well that year. There are few things worse than having a big year, something that’s cause for celebration, and then being shocked by the tax bill.

When I think of the lumpiest incomes, it’s hard not to think of farmers and their time-tested rules. For instance, when you have a fat year, set some aside for lean years, or live on far less than you make. The problems come when you try to manage a lumpy income using a set salary mindset. If you have lumpy income, you should act like a farmer, not a salaried employee.

We need to start rethinking some of the rules of traditional financial advice and adapting them to better fit incomes that go up and down, often without warning. It’s easy to forget that most people lived this way for years before we got used to the idea of company pensions and working at the same place for 30 years.

If you earn a lumpy income, what have you done to better align your spending and saving with your income?

Article source: http://bucks.blogs.nytimes.com/2012/09/17/tips-for-managing-your-increasingly-lumpy-income/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.