Well, for “Young Sheldon,” plenty.

For the first time, Mr. Lorre is abandoning the formula that has made him one of the most successful producers in the business for the last couple of decades. He’s not using a studio audience. He’s relying on a single camera instead of the multicamera format that’s done him well. He’s also using a voice-over narration, from Mr. Parsons (a first). And he’s working with a child actor in the show’s starring role (another first).

“Young Sheldon” is so different from “Big Bang,” the show’s producers have taken to comparing it to “The Wonder Years” more often than the show it’s spun off from. And with a show that looks and sounds so different, are producers risking alienating the millions of viewers that made “Big Bang” a hit?

As Mr. Lorre put it in a recent interview here on the show’s set: “It’s got to hold its own. It’s got to live or die on its own merits.”

On Sept. 25, “Young Sheldon” will debut with a special premiere episode, and then follow “Big Bang” on Thursday nights starting in November.

Plenty is riding on its success. CBS executives have tried to use the huge audience that “Big Bang” draws to roll out new comedies for some time but to decidedly mixed results. (Remember “The Great Indoors,” which followed “Big Bang” on Thursdays this past season? That’s fine; few do.)

Advertisement

Continue reading the main story

Even so, the prospect of a “Big Bang” spinoff has executives extremely hopeful.

“It was the quickest pitch and the quickest yes in the history of television,” said Leslie Moonves, the chief executive of CBS. “Chuck said, ‘Sheldon, East Texas, 9 years old.’ I said, ‘Done!’”

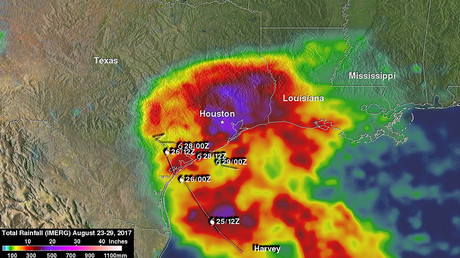

The series zooms back 28 years to find Sheldon as a wide-eyed, brilliant and slightly irritating kid (played by Iain Armitage from HBO’s “Big Little Lies”), living outside Houston with his parents, older brother and twin sister. In the premiere, family friction is a theme, as is Sheldon’s intelligence and sheer naïveté. Sheldon enters high school years ahead of schedule and is under the severely misguided impression that is this will be a haven of higher learning.

When a bow-tied Sheldon arrives for his first day of school, and sees a sea of sleeveless shirts, tattoos and punk haircuts, he sums it up this way: “Oh dear.”

One thing that’s missing from every scene, however, is the roar of approval from a studio audience.

“When I first heard it, I was like, ‘Oh no! Why!’” said Mr. Parsons, who is an executive producer of the show. “I just thought, ‘But y’all are so gifted at that multicam format.”

Mr. Lorre did not initially intend to drop a studio audience, but producers ultimately concluded that putting several children in front of an audience numbering in the hundreds would put too much pressure on them.

The loss of the audience, and dropping from four cameras to one, also allowed for the show to stand out from the brightly lit “Big Bang” — and fit in with other contemporary comedies like “Veep” and “Master of None.”

But the switch has required an immediate crash course for Mr. Lorre and his fellow producers.

“Take the dinner scene from the pilot,” Mr. Lorre said on the set here, referring to a scene that takes a couple of minutes. “We could have shot two episodes of ‘Big Bang’ in the time to do the dinner scene. It took six hours. You’re getting every possible shot — reaction shots — and different performances. You’re getting all these options, so in editing you have choices.”

Advertisement

Continue reading the main story

Sitting a few feet away, the “Young Sheldon” co-creator (and “Big Bang” executive producer) Steven Molaro chimed in, “This is apparently common knowledge.”

“It’s new to us!” said Mr. Lorre.

But some things — like ending a scene with a zinger — don’t change. A few minutes later, filming resumed on the cold open of the fourth episode. In it, Sheldon starts choking on a piece of sausage, with his parents bumbling around trying to help him. There were multiple shots to take: Sheldon’s sister looking on with some concern, Sheldon witnessing his brother, unbothered, licking some jelly off a knife before putting it back in the jar.

By time the sausage is dislodged, Sheldon, fresh off his near death experience, deadpans, “You have to throw away that jelly.”

The joke worked fine, but this was the kicker before a commercial break. It needed more of a flourish. Mr. Lorre walked over to his director and said that Mr. Armitage should inhale deeply after saying “have to” and “throw away.” Sheldon was just choking, after all, and slowing the line down might work a wee bit better.

“Two inhales and three beats, right?” Mr. Lorre said. “Three beats. Maybe it’ll be funny. Let’s see.”

After a couple of takes, and a chorus of laughter from the crew, Mr. Lorre looked satisfied.

As Mr. Parsons put it, “They’re really good at writing rhythms, and Chuck’s a master at knowing when to end a scene when a scene’s not ending right.”

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

Though Mr. Lorre has long held a distaste for spinoffs — “Why cannibalize a show?” he said — he reconsidered when he got an email from Mr. Parsons last year.

Mr. Parsons, who had just started his own production company, was interested in developing a show inspired by his nephew, a gifted brainiac. Mr. Parsons was well aware that his idea seemed Sheldon-like, so he felt compelled to run it by Mr. Lorre, who he assumed would never do such a thing.

“Part of my hesitation in writing Chuck was I thought I was going to look like an idiot because who in their right mind hasn’t thought of this already?” he said.

Advertisement

Continue reading the main story

No one had.

“I just thought it seemed like a perfect idea,” Mr. Lorre said. “We’ve already done a lot of the heavy lifting. We knew about his family, we knew about his twin sister, his older brother, his meemaw and his relationship with his mother.” (Meemaw, for the uninitiated, is what Sheldon calls his grandmother — Annie Potts plays her in “Young Sheldon.”)

Mr. Moonves signed off immediately, and they went to work to find the young actor who could play him. They purposefully wrote a long, difficult monologue and that’s when they stumbled upon a video from Mr. Armitage.

“I have a pretty good memory so I could do most of it easily,” Mr. Armitage, 9, said. “Well not easily, you can’t memorize a three-page dialogue easily. More like, we did it and we did it and we did it to the point where it seemed natural.”

“Eventually, bazinga!” he added, referring to one of Sheldon Cooper’s trademark lines.

Still, there was another issue. In the wrong hands, Sheldon, socially maladroit as they come, could register as grating.

“Jim Parsons has a magical ability to be abrasive and annoying and still be loved for it,” Mr. Molaro said. “But when we’re doing it with a 9 year old it can come off as precocious and bratty and less appealing.”

That’s when, at the suggestion of Jon Favreau (“The Jungle Book,” “Iron Man”), who directed the pilot, they brought in a voice-over narration — it would relieve the pressure on Mr. Armitage to deliver all the withering jokes. And it brought Mr. Parsons directly into the show.

“I know how hard it will be to end this job of playing this character, and this is going to be a nice way for me to deal with it,” Mr. Parsons said. “Hopefully it won’t feel as much deathlike when that day comes.”

(“Big Bang,” it should be said, has already been renewed through 2019.)

But one of the more surprising subplots is why exactly Mr. Lorre is seeking a new challenge in his career by shedding much of what has made him successful. He’s become fabulously rich from “Big Bang” (and so have a lot of other people, including the studio, Warner Bros., as well as Mr. Parsons and the lead cast members, who make more than a reported $20 million a year).

Advertisement

Continue reading the main story

In between takes, Mr. Lorre considered the question of why, after years of mastery with the multicam, he took the gamble.

“Either way there’s a risk,” he said. “Cannibalizing a show that’s been remarkable for us and the other one — creating something that’s entirely different — is a different kind of risk, but it just feels like the right thing to do.’

“At this time in my life, to do something that I don’t know how to do and never done?” he continued. “That’s a reason to get up in the morning.”

Continue reading the main story

Article source: https://www.nytimes.com/2017/08/31/arts/television/young-sheldon-the-big-bang-theory-spinoff-cbs.html?partner=rss&emc=rss