There will be tough talking ahead for the new Greek Finance Minister Yanis Varoufakis. He’ll have to enact the newly-elected government’s pledge to end the austerity measures and writing off a large part of the country’s debt.

Varoufakis is a 53-year-old economist with Greek-Australian nationality. He is taking the reins of the economy labeled the ‘sick man of Europe’ with a total debt of €317 billion, more than 50 percent youth unemployment, and 20 percent of the population living below the poverty line.

He says the new government is seeking to reform the current system, first by destroying the oligarchy, ending the ‘humanitarian crisis’ in Greece, and recalculating the country’s debt to the ‘troika’ of international lenders.

The new finance minister succeeds two centrist technocrats who oversaw the imposition of austerity measures demanded by the European Commission, European Central Bank and International Monetary Fund.

“We are going to destroy the basis upon which they have built for decade after decade a system, a network that viciously sucks the energy and the economic power from everybody else in society,” Varoufakis told Britain’s Channel 4 television ahead of the Sunday elections.

Yanis Varoufakis describes himself as ‘an atheist theologian ensconced in a Middle Ages monastery,’ as he stands against budget austerity and suggests that market-friendly structural reforms would solve Greece’s debt difficulties.

He has been a longtime critic of Europe’s handling of the economic crisis. Varoufakis says the risks it faces threaten to undermine the region’s democratic foundations and breaking the eurozone apart. “A cynical transfer of banking losses onto the shoulders of the weakest taxpayers cannot be a solution to the issue,” he said in a blog post early in January, announcing his candidacy for parliament.

Why I am running for a parliamentary seat on SYRIZA’s ticket http://t.co/ZPyfk9si7H

— Yanis Varoufakis (@yanisvaroufakis) January 9, 2015

An active media commentator, Varoufakis described the bailouts of struggling eurozone countries as ‘fiscal waterboarding’ that threatened turning Europe into ‘a form of Victorian workhouse.’

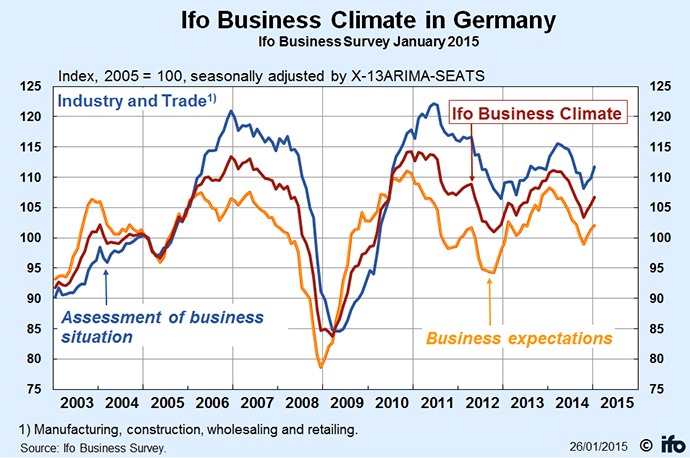

Varoufakis considers Greece’s joining the euro in 2001 a mistake, and says Europe must change its concept of battling the crisis or risk plunging into pitch-dark deflation and stagnation.

The new finance minister spent most of his life teaching in academia in Britain, Australia and the US. He left the University of Texas ahead of the elections to join Tsipras’ campaign.

The left-wing Syriza party won Sunday’s parliamentary election with the majority of votes and, therefore, the right to form its own government.

READ MORE: ‘5yrs of humiliation, suffering over’: Anti-austerity party to form govt in Greece

The Greek crisis started in 2010 and the country’s debt reached €317 billion. The continuous and deep economic recession resulted in a high unemployment rate, increasing property taxes and a low minimum wage.

Now the new government is expected to hold negotiations on Greek debt repayment with its international lenders. Syriza said it would abandon austerity measures in favor of its own program to repay the national debt.

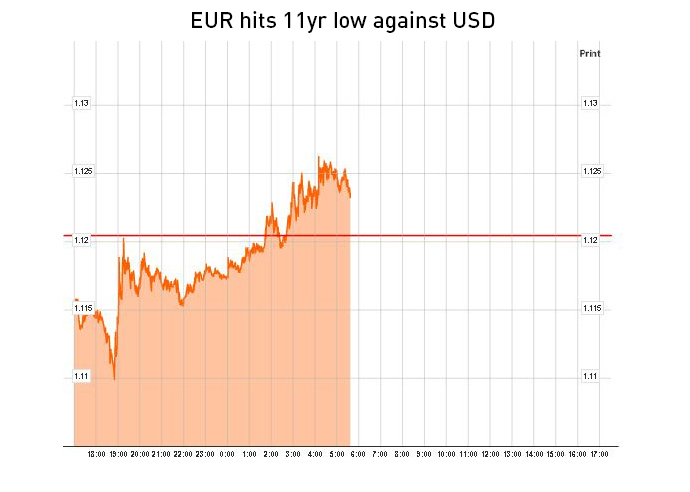

The uncertainty over the political and economic situation has resulted in cautious discussions on the outcome, including the country’s possible exit from the eurozone.

International rating agency Standard and Poor’s warned the new government it could downgrade its sovereign credit rating earlier than planned.

Article source: http://rt.com/business/226623-greece-cdebt-finance-minister/