Cracks are surfacing within the world’s largest oil cartel as the 12-nation group considers supporting the oil price of letting it fall even further.

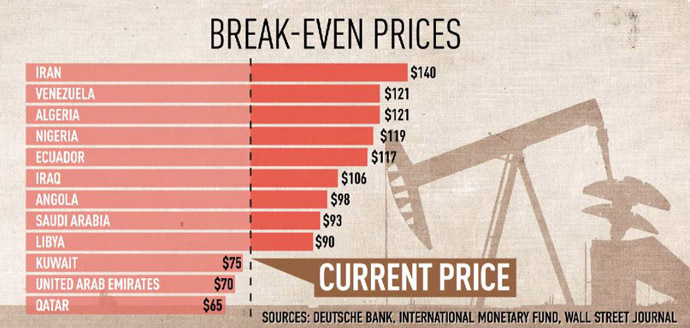

Many of the major Gulf producers, Saudi Arabia, Qatar, Kuwait, and the UAE, have large financial surpluses to survive low oil prices. The others don’t, and rely on oil revenues month-to-month. Less cash-cushioned members such as Nigeria, Venezuela, and Iran- the so-called price hawks – are pushing for a cut.

“I think in the end the Saudis and the Gulf states will hold sway- I doubt there will be a cut in production – I think the price will continue to go down and we’ll probably see a floor somewhere around $65-70 per barrel,” Amir Handjani, energy expert and managing director of PT Capital, told RT.

Each country has a different “break-even” oil price at which their economy balances its books. Kuwait, for example, can balance its budget if oil prices fall below $60 per barrel. Iran needs oil prices at $140 per barrel to balance its budget.

“OPEC is not exactly a monolithic organization- its countries have varying interests and histories,” Adrian Salbuchi, an international politics analyst, told RT.

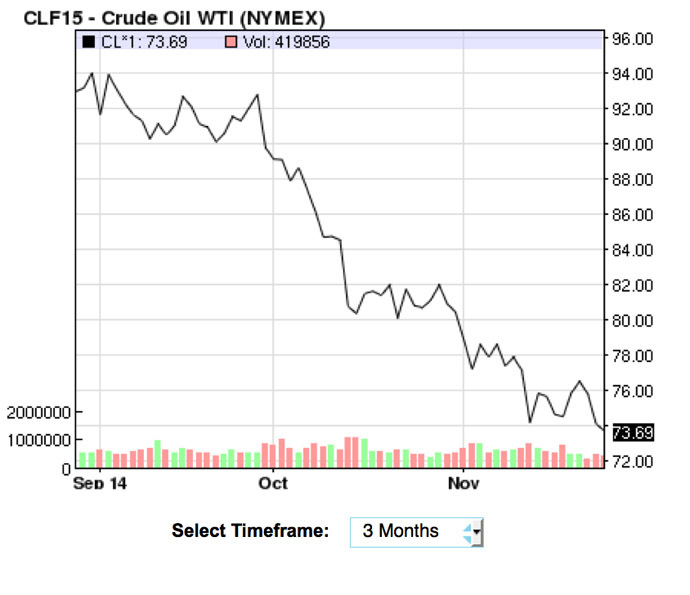

Cutting production would help curb 4-year low oil prices, which fell below $76 per barrel on Thursday. Low prices have been triggered by an oversupply created by increased US production and waning demand from China and Europe.

RT’s correspondent Murad Gazdiev spoke with OPEC ministers before they went into closed door meetings.

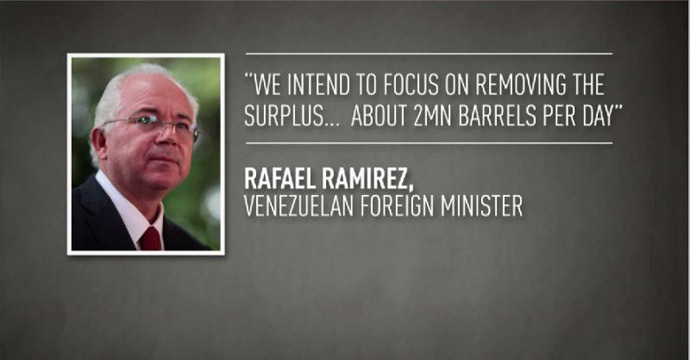

The Venezuelan foreign minister said his country is ready to support a five percent production cut across OPEC.

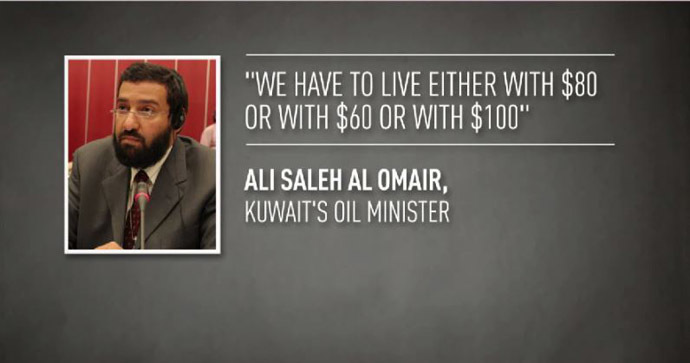

Kuwait says it is fine with prices at $60 per barrel.

The oil minister from Nigeria said that some of the OPEC members weren’t being driven by economics, but are after political objectives.

A decision to cut or not will have a big effect on energy markets worldwide, as OPEC produces more than 40 percent of the world’s oil.

Low oil prices help big importers like China and India because petroleum products become cheaper, but hurt exporting countries because billions in revenue are lost. Oil prices also affect currencies, such as the Russian ruble, which, in tandem with oil, has lost more than 30 percent since June.

A decision is expected to be announced at 4:00pm in Vienna, and a live feed is available.

Spendy Shale

North American shale as the biggest threat to Saudi Arabia and OPEC dominance, according to Handjani. High prices allow shale to be profitable, whereas the Saudis can produce barrels for just pennies.

The US shale boom, which began in 2008, has increased US crude output by 60 percent, posing a threat to major oil exporter Saudi Arabia, which produces 16 percent of global oil. US production is ready to soon overtake the Saudis, which they could see as encroachment.

Unlike oil from the Gulf States, US shale is expensive, and becomes unprofitable below $70-80 per barrel, according to different analysis.

“US production, which has been a real game changer, doesn’t really work when the oil price goes down. Therefore I think the Saudis and the Arab Gulf States want to keep the price of oil hovering around $70 to keep the US uneconomical at the moment,” Handjani said.

Low oil prices help big importers like China and India because petroleum products become cheaper, but hurt exporting countries because billions in lost revenue.

“I don’t necessarily see a price war going on yet, but I see that producers are in line to break the back of US production,” Handjani said.

Low prices not only hurt the US market, but also countries like Russia which have oil reserves in hard to extract places- such as the Arctic- which are more expensive to produce.

Oil prices also affect currencies, such as the Russian ruble, which, in tandem with oil, has lost more than 30 percent since June.

Oil companies have an interest in developing new technologies and areas, which becomes less likely as profitability falls.

Article source: http://rt.com/business/209375-opec-cut-vienna-meeting/