The EU won’t provide any new funds for Ukraine to pay off its gas debt to Russia, and Moscow has no guarantees should Kiev use agreed funding elsewhere, said the EU Energy Commissioner’s spokeswoman Marlene Holzner.

The European Commission is allocating €760 million ($954 million) of financial aid to Ukraine earlier than scheduled to help it pay for gas deliveries, said Mrs. Holzner on Friday, adding some light on the agreements reached in Brussels, TASS informs.

She explained that the EU isn’t proposing to step in and pay if the Kiev government can’t.

“The EU is not paying new money or additional money to help Ukraine pay its gas bills,” she said. “And the EU is not giving any guarantee to Russia in case Ukraine says it cannot order an extra amount of gas or it cannot pay.”

However, in case Russia breaches the price terms agreed in Brussels, the European Commission will interfere, according to the letter sent to Ukraine on Friday.

“The results of the negotiations in Brussels were recorded in the following documents…a letter from the President of the European Commission, Jose Manuel Barroso, to the President of Ukraine, Petro Poroshenko, in which the head of the EC secured guarantees of the European Commission to Ukraine regarding financial support in case Russia doesn’t fulfill its obligations on gas prices, as well as the willingness of the EC to stimulate reverse-flow deliveries of gas to Ukraine from the EU Member States,” RIA quotes from the statement.

On Friday, Ukrainian Prime Minister Arseniy Yatsenyuk instructed the country’s finance ministry, National Bank of Ukraine and Naftogaz to start paying off the gas debt to Russia. This applies to both paying the debt for Russian gas and prepayment for new supplies, which must be provided before the end of 2014, RIA reports.

Russia says it hasn’t seen any specific documents confirming Kiev has funds for prepayment.

“…but officials confirmed that the funds will be found,” Russian Energy Minister Aleksandr Novak told Rossiya 24 TV channel after trilateral talks on October 30.

He explained that the money is expected to come from international financial institutions, the European Union and Naftogaz’s own funds. “Ukraine has enough funds to pay off a $3.1 billion debt,” the minister added.

Gazprom head Aleksey Miller also said it was difficult to answer the question of where Ukraine was going to take the money from.

“Ukraine has assumed guarantees and put its signature on the documents also guaranteed by the European Commission,” Miller told Rossiya 24.

Aleksey Grivach, deputy head of the Russian National Energy Security Fund, said in an interview with TASS that the agreements have certain risks.

“The issue of providing assistance to Ukraine hasn’t been fleshed out, it remains hanging in the air,” Grivach said. He noted that the scheme of paying the first tranche of debt shouldn’t cause problems, but “when the time of paying the second tranche comes, there can be no money.” Grivach warned it could end up in another crisis.

Russia, Ukraine and the EU agreed four basic sources of financing for Ukraine to repay its gas debt, outgoing EU Energy Commissioner Gunther Oettinger said after the three-party gas talks in Brussels on Thursday.

“First, there is an operating program of the IMF. The Fund provides money to cover the country’s general needs, and then it can be used to pay bills for gas,” Oettinger said.

Secondly, the EC is planning to “create a special fund of $3.1 billion to pay off the debt to Gazprom,” the commissioner said.

The third option means Naftogaz could use its revenues, as it is a commercial company.

Finally, the EU “will continue funding Ukraine in the framework of European aid program.”

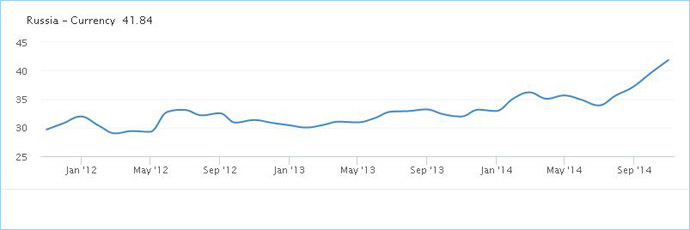

Russia, Ukraine and the European Commission signed a legally binding tripartite agreement, fixing the winter gas plan. The plan suggests resuming gas supplies from Russia to Ukraine and ensuring uninterrupted transit to Europe during the winter. Ukraine’s has to repay $3.1 billion of its $4.5 billion debt by the end of the year, and purchase from Gazprom additional gas on a prepay basis.

Article source: http://rt.com/business/201187-eu-russia-no-guarantees/