Simon Newman/ReutersThe letter “B” is hoisted up the side of Barclays‘ headquarters in London.

Simon Newman/ReutersThe letter “B” is hoisted up the side of Barclays‘ headquarters in London.

LONDON — The problems continue to mount for Barclays, as the British bank disclosed that it was facing lawsuits related to a rate-rigging scandal and that regulators were investigating the company’s financial director on a different matter.

The bank’s legal and regulatory burdens have been a continued source of financial pain for Barclays.

On Friday, Barclays reported that net profit dropped 76 percent to $752 million during the first six months of the year after taking an accounting charge on its debt and a charge for inappropriately selling complex financial products to small businesses. Last month, Barclays and other banks settled with British regulators over those sales, of interest rate swaps.

On Friday, Barclays said that the Financial Services Authority, the British regulator, was looking into the actions of some current and former employees, including the finance director, Chris Lucas, over the disclosure of fees related to the bank’s capital-raising efforts in 2008. The issues revolve around agreements with the Qatar Investment Authority and the Sumitomo Mitsui Banking Corporation of Japan, according to regulatory filings.

After the collapse of Lehman Brothers in 2008, the British bank tapped Middle Eastern investors for a combined £11.8 billion, or $18.6 billion, in two rounds of capital raising. Existing shareholders have voiced concerns that their rights were overlooked when Barclays turned to outside investors for a fresh injection of capital.

“Barclays considers that it satisfied its disclosure obligations and confirms that it will cooperate fully with the F.S.A.’s investigation,” the bank said in a statement.

Last month, Barclays announced a $450 million settlement with American and British authorities over the manipulation of benchmark rates, including the London interbank offered rate, or Libor. On Friday, Barclays disclosed that it was facing class-action lawsuits in the United States related to such issues. One of the lawsuits also cites unnamed current and former members of the bank’s board as defendants, according to a statement from the bank.

Barclays said it was “not practical” to estimate the costs related to the legal proceedings. Morgan Stanley analysts have said global banks may have to pay more than a combined $20 billion in penalties and fines related to the manipulation of Libor.

“We are sorry for the issues that have emerged over recent weeks and recognize that we have disappointed our customers and shareholders,” Barclays’ chairman, Marcus Agius, who will step down, said in a statement.

As it deals with the fallout, Barclays must also remake its management team. As the rate manipulation scandal unfolded, Robert E. Diamond Jr., the company’s former chief executive, and Jerry del Missier, the former chief operating officer, both resigned. Mr. Agius said in a conference call that the firm would appoint a new chairman before selecting its next chief executive.

The bank is also taking a close look at its actions. Barclays has appointed Anthony Salz, vice chairman of the advisory firm Rothschild, to conduct a review into the British bank’s business practices. Some current and former Barclays employees may still face criminal charges related to the rate-rigging scandal.

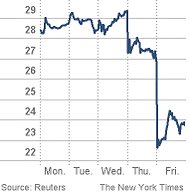

Despite the bad news, investors found a reason to be upbeat. By the close of trading in London, the bank’s shares had jumped nearly 9 percent.

Without the accounting charge and other one-time costs, Barclays’ net profit in the first half of the year rose 9 percent, to £3.07 billion, compared with £2.8 billion a year earlier. The earnings, which beat analysts’ estimates, were driven by an improved performance in the bank’s retail and corporate banking divisions.

Barclays’ investment banking unit, however, continued to get hit by the European debt crisis. Other global rivals, like Morgan Stanley and Goldman Sachs, have faced weakness in their investment banking activity, but analysts said that Barclays had done better than most to maintain its trading income.

The bank reported a £1 billion pretax profit in its investment banking unit in the three months through June 30, a 2.5 percent increase over the previous year. Barclays does not report net income for its separate business units.

“Despite the more recent regulatory assault, this underpins the belief that, in challenging conditions, Barclays Capital should continue to consolidate market share,” Ian Gordon, a banking analyst at Investec in London, said in a note to investors.

The British bank said it had reduced its exposure to the debt of Southern European countries by 22 percent, to £5.6 billion, during the first six months of the year. The bank’s core Tier 1 ratio, a measure of ability to weather financial shocks, fell slightly to 10.9 percent.

“We continue to be cautious about the environment in which we operate and will maintain the group’s strong capital, leverage and liquidity positions,” Mr. Lucas of Barclays said in a statement.

Article source: http://dealbook.nytimes.com/2012/07/27/barclays-profit-falls-amid-rate-rigging-scandal/?partner=rss&emc=rss